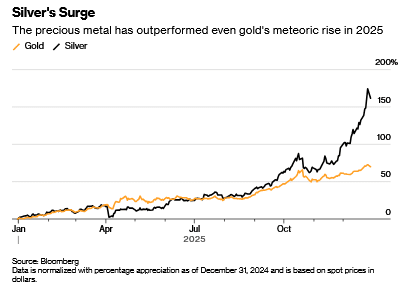

Gold staged a dramatic rally in 2025 as the US Trump administration’s unorthodox economic policies sent investors and central banks reaching for safe-haven assets. Right now, however, it’s silver that’s stealing the spotlight.

Surging investor demand collided with limited availability to catapult the price of silver above $80 a troy ounce at the end of December, almost triple its value a year earlier and enough to dwarf even gold’s meteoric rise of more than 70%.

Both precious metals have been experiencing a surge in demand from investors seeking to hedge against political turbulence, inflation and currency weakness. But unlike gold, silver has many properties that also make it a valuable ingredient in a range of industrial applications. Sustained high prices could erode the profitability of manufacturers that use it and spur efforts to substitute silver components for other metals.

Who needs silver?

Silver is an excellent electrical conductor that’s used in circuit boards and switches, electric vehicles and batteries. Silver paste is a critical ingredient in solar panels, and the metal is also used in coatings for medical devices.

Like gold, silver is still a popular ingredient for making jewelry and coins. China and India remain the top buyers of silver thanks to their vast industrial bases, large populations and the important role that silver jewelry continues to play as a store of value passed down the generations.

Governments and mints also consume large amounts of silver to produce bullion coins and other products. As a tradable asset, it’s much cheaper than gold per ounce, making it more accessible to retail investors, and its price tends to move more sharply during precious metal rallies.

What makes the silver market unique?

Silver’s varied uses mean its market price is influenced by a wide array of events including shifts in manufacturing cycles and interest rates and even renewable energy policy. When the global economy accelerates, industrial demand tends to push silver higher. When recessions loom, investors can step in as alternative buyers.

The market is thinner than that of gold. Daily turnover is smaller, inventories are tighter and liquidity can evaporate quickly. The silver stored in London is worth about $65 billion, while the gold is worth almost $1.3 trillion, though much of both are not available to borrow or buy for investors. For gold, the London market is underpinned by around $700 billion of bullion held mostly by the world’s central banks in vaults of the Bank of England. This can be lent out when a liquidity squeeze hits, effectively making the central banks lenders of last resort. No such reserve exists for silver.

Why did silver rally so much in 2025?

Silver often moves in tandem with gold, but with more violent price moves. A surge in gold in the early months of the year stretched the valuation gap between the two metals to the point where an ounce of gold could buy more than 100 times the same amount of silver. Some investors saw a potentially lucrative opportunity and piled in.

Heavy debt loads in major economies such as the US and France and a lack of political will to solve them also encouraged some investors to stock up on silver and other alternative assets, in a wider retreat from government bonds and currencies dubbed the debasement trade.

Meanwhile, global silver output has been constrained by declining ore grades and limited new project development. Mines in Mexico, Peru, and China — the top three producers — have all faced setbacks ranging from regulatory hurdles to environmental restrictions. Most of the world’s silver is extracted as a by-product from the mining of other metals.

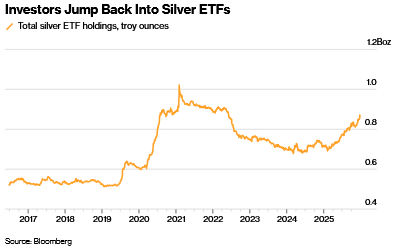

Global demand for silver has outpaced the output from mines for five years in a row, while silver-backed exchange-traded funds have drawn in new investment.

What was there a silver squeeze in 2025?

Speculation early in the year that the US would levy tariffs on silver led to a flood of metal heading into vaults linked to the Comex commodities exchange in New York, as traders sought to take advantage of premium prices in that market.

This contributed to a dwindling of available silver stocks in London, the dominant spot trading hub. Those were further eroded as more than 100 million ounces flowed into ETFs backed by physical bullion.

With a spike in demand during the Indian festive season in October, the market suddenly seized up. The cost of borrowing silver surged to a record, while prices jumped.

London prices rose above other international benchmarks, eventually drawing more silver into the market and helping to ease the supply squeeze.

Traders were still monitoring for any potential US tariff on silver after the precious metal was added to the US Geological Survey’s list of critical minerals in November. The market remained febrile into December, with speculation of any new development triggering sharp price moves.

The metal broke above $80 on Dec. 26 amid concerns around Chinese silver export restrictions that were announced in late October, even though these were effectively a rollover of previous policies. The rally was fueled partly by billionaire entrepreneur Elon Musk, who responded to comments about the Chinese policy on social media platform X with his own post: “This is not good. Silver is needed in many industrial processes.”

Read the full story HERE.