Strategist Jim Paulsen sees lots of economic hurdles ahead

The end of 2024 is nigh, and can’t come soon enough for investors seeing anything but a Santa Rally lately.

Some may blame the Federal Reserve’s rollback of expectations for interest rate cuts, as it worries strong U.S. growth may reignite inflation. Our call of the day from Jim Paulsen, chief investment strategist of The Leuthold Group, sees things differently.

“Although policy officials and investors appear increasingly anxious about the potential for overheated economic growth, I think the more likely outcome for 2025 is an unexpected economic slowdown,” Paulsen says in his Paulsen Perspective blog, where he cautions such a surprise could ultimately lead to a pullback in the stock market of at least 10%.

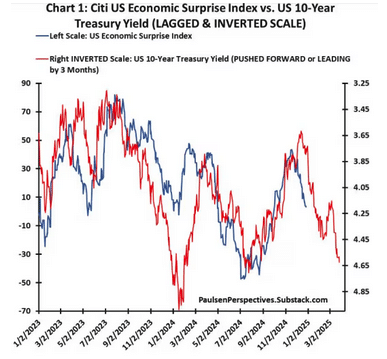

He offers up several examples of weakening growth, such as the Citi Economic Surprise Index—a rise means economic reports have come in stronger than expected, and declines mean economic momentum is trending below expectations. Paulsen’s chart compares that index with the 10-year Treasury yield lagged behind or pushed forward by three months:

Based on history going back to 2003, movements in bond yields have often led to economic surprises, and declining yields have meant an improving economy three months out, and vice versa, he notes. But bond yields, hovering near 4.6%—they hit 4.63% last week—suggest to him the economic surprise index will slow to -35 in the first quarter, slowing GDP as well.

While Paulsen says healthy business and household sectors will likely keep a recession at bay next year, if real GDP slows from a current 2.7% pace to 2% or less, recession fears will dominate financial discussions, drive down profit forecasts and feed through to stocks.

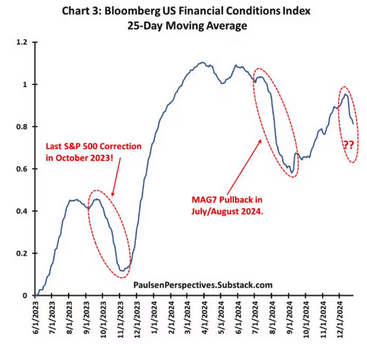

He also looked at the U.S. Financial Conditions Index, which has been worsening since early December. “As illustrated, two other times during the last 18 months, even modest declines in this index led to significant stock market events,” he said, pointing to stock pullbacks of October 2023 and last summer’s rare “Magnificent 7” slump.

“The most recent decline in financial conditions is not yet nearly as pronounced as the last two but it wouldn’t be surprising if financial conditions continue worsening somewhat as economic growth slows further in the new year,” he said.

Paulsen rattled off a number of concerning issues where stocks are concerned, such as deteriorating breadth, where the number of U.S.-listed stocks climbing relative to the number falling has dropping since early October. His read from that is investors are increasingly cautious, noting also underperformance by cyclical and more aggressive stocks since mid-November.

“Since most currently believe the economy is healthy, if not too strong, any meaningful slowdown will come as a surprise. And a ‘surprising slowdown’ which heightens fears could pause the stock market run if not possibly produce a 10% to 15% correction,” cautions Paulsen.

But given corrections are tough to call, he says “most should stay invested since the bull market seems likely to continue during 2025 even if it experiences a bump or two along the way.” That said, a small shift away from cyclical and other “traditionally aggressive investments” toward more defensive ones, may make sense, he says.

The likelihood of a correction and how deep it goes depends much on how technology sector favorites perform in 2025, says Paulsen. If that strength continues, a correction can be avoided, with any slowdown for those stocks a risk. In the below chart he overlays the relative performance of the S&P 500 tech sector with the U.S. financial conditions index:

The last four years have seen obvious close correlation, and in the past a worsening of financial conditions has led to tech underperformance that infects the entire market, Paulsen notes. “So, the primary question for investors in 2025 may be how much will financial conditions deteriorate as the economy slows next year, and how much will this impact technology stocks?”

Read the full article HERE.