This has truly been gold’s “amazing year.” The precious metal continues to rally after hitting multiple all-time highs. Central banks and the world’s leading monetary authorities continue to stockpile gold bullion and investors have once again turned to gold’s safe haven properties as wars rage across Eastern Europe and the Middle East. The prospect of rate cuts has added to gold’s allure particularly as inflation wanes. And political uncertainty across the globe including the future of U.S. leadership presents yet another gold price trigger. If you have not yet made a move into gold, here are key reasons to do so before the election in November.

1) Market Concentration Risk

There is no denying that Wall Street’s market gains have been largely concentrated among just a handful of stocks.1

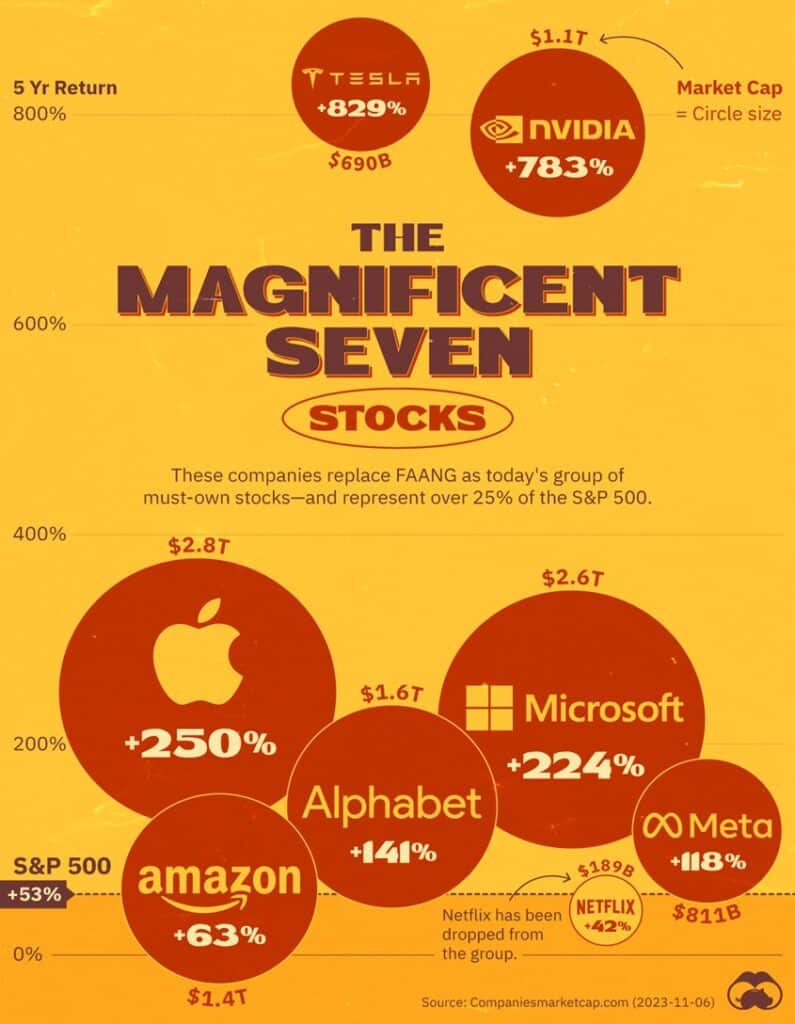

The infamous “Magnificent Seven” — Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla gained 107% in 2023, pushing the S&P 500 up 24%.2 All seven of these companies essentially belong to the same technology sector representing a degree of market concentration that is replete with risk. With fewer companies driving the market, an earnings shift or sector reversal increases the odds of a market correction.

The 10 largest U.S. companies accounted for just 14% of the S&P 500 stock index a decade ago. Today, they account for more than 27%, nearly double. According to Morgan Stanley, the pace of market concentration is the most rapid since 1950, giving just a handful of companies with overlapping business models undue influence on investment portfolios.3

Gold is a Powerful Stock Market Hedge

2) The New Real Estate Crisis

Real Estate in America currently sits at the lowest affordability levels since the 1980s. According to U.S. News & World Report, millions of homeowners are experiencing “golden handcuffs” as they locked in very low, pandemic era fixed-rate mortgages prior to rates skyrocketing giving them little incentive to sell:

“In the past, when mortgage rates rose, home prices would decline to maintain affordability. Today, however, with so many existing homeowners locked into their existing low mortgage rates of 4% to 5% or below, there have not been sufficient incentives to move elsewhere, keeping home inventory low and prices high – for now.”

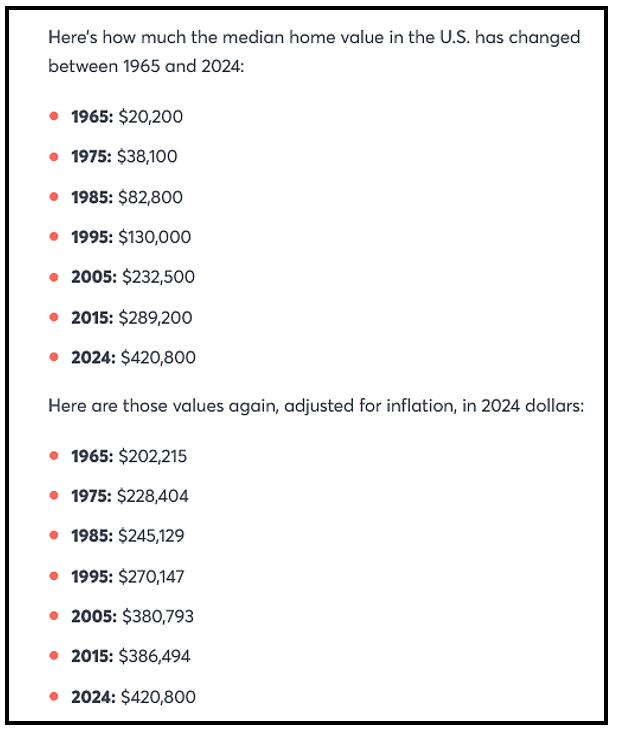

According to US Census Data, homebuyers are spending more than double to buy a home in 2024 as opposed to back in 1965 when a home cost about $202,000 — less than half of the over $420,000 it costs today when adjusted for inflation.4

Long-time investment strategist, Chris Vermeulen of The Technical Traders, believes the property market is due for a significant correction and both commercial and residential properties could plunge as much as 30%.

“People are going to have to start to sell their homes. What we’re starting to see is people starting to realize they can’t afford their mortgages, or they need to downgrade. A lot of people are struggling financially, and this is really the tip of the iceberg. Give it another two or three years — that’s when the realestate market gets hit the most.” 5

Gold Hit Record Highs During the 2008 Subprime Real Estate Crisis

3) The Trump Tariffs

If he prevails in the 2024 Presidential Election, Donald Trump has made no secret of his intention to take a tougher stance on America’s trading partners. He has proposed an acrossthe-board 10% tariff on all imported goods and floated a 60% tariff on all Chinese imports.

“I’m a big believer in tariffs,” the former President proclaimed in March. “I fully believe in them economically when you’re being taken advantage of by other countries. Beyond the economics, it gives you power in dealing with other countries.” 6

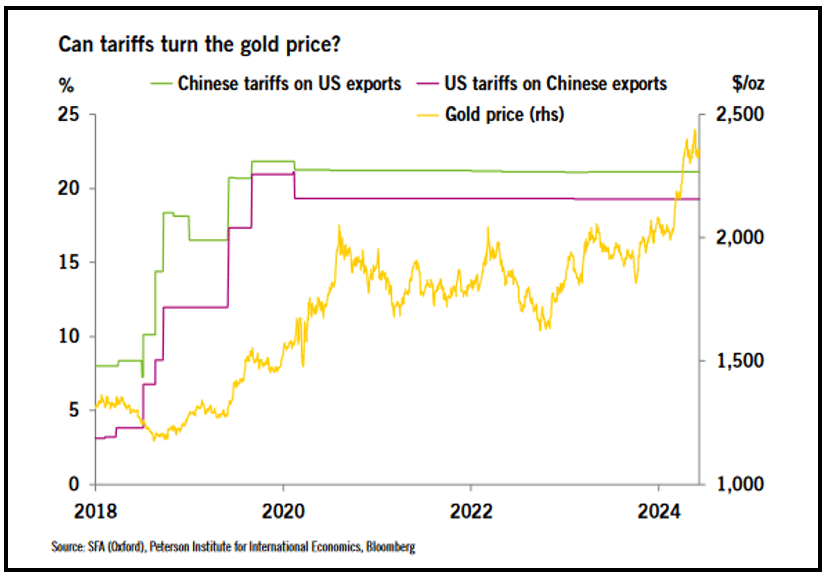

Some experts worry, however, that the Trump Tariffs could prove economically disruptive and even inflationary. German technology group Heraeus, one of the world’s largest refiners of precious metals points out that Trump last trade war with China from 2018-2020, coincided with dramatically rising gold prices.

“The US-China trade war between 2018 and 2020 coincided with a rising gold price. Gold surged during this period as the prolonged negotiations, coupled with tariff and geopolitical escalations, drove investors to seek gold as a safehaven asset despite a rate-hiking environment until mid-2019. Gold’s appreciation closely correlated with the tariff increases which served as a meaningful indicator of US China tensions.” 7

Trump’s Return to the White House Could Drive Investors to Gold

4) Fed Rate Cuts

The latest Consumer Price Index for June, indicates that inflation fell 0.1% from May, marking the first monthly decline in prices since May of 2020. Prior to this reading, Fed Chair Jerome Powell had already indicated that inflation doesn’t need to be below 2% for the Fed to cut rates.

“You don’t want to wait until inflation gets all the way down to 2%. If you waited that long you probably waited too long because inflation will be moving downward and would go well below 2%, which we don’t want.”8

According to the Wall Street Journal, Powell made an even more important shift toward lower rates when he expressed concern about the US labor market during his Senate Banking Committee testimony on June 9th.

“Elevated inflation is not the only risk we face. We’ve seen that the labor market has cooled really significantly across so many measures.” 9

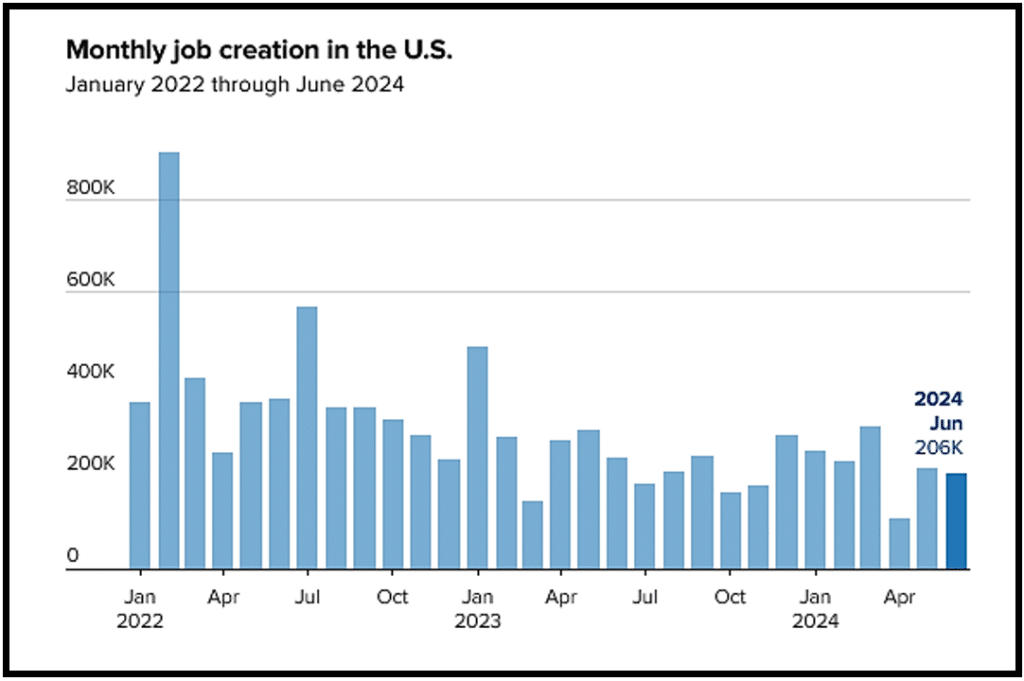

The June jobs report showed employers adding 206,000 jobs, down from 218,000 in May. In addition, the unemployment rate tick up to 4.1%, the highest level since late 2021. The latest inflation readings and soft jobs data have significantly raised the odds that the Fed will start cutting rates in September and continue to do so in subsequent meetings.

Gold has Historically Delivered Positive Returns during Rate Cut Cycles

5) An Imminent Economic Downturn

There are a host of financial experts now expressing concern about a looming economic crisis driven by a number of factors including a cooling labor market, rising unemployment, slowing GDP growth, geopolitical fragility, skyrocketing consumer debt, decreased consumer spending, a real estate crash and a sharp downturn in U.S. business investment.

Economist David Rosenberg believes there is an 85% chance that the U.S. economy will enter a recession this year based on models from the National Bureau of Economic Research including financial conditions indexes, the debtservice ratio, foreign term spreads, and the level of the yield curve. Rosenberg says the recession model is displaying the highest probability since the financial crisis of 2008. 10

Peter Berezin, chief global strategist at BCA Research, recently predicted that a recession will hit the US economy later this year or in early 2025 accompanied by a 32% stock crash. 11

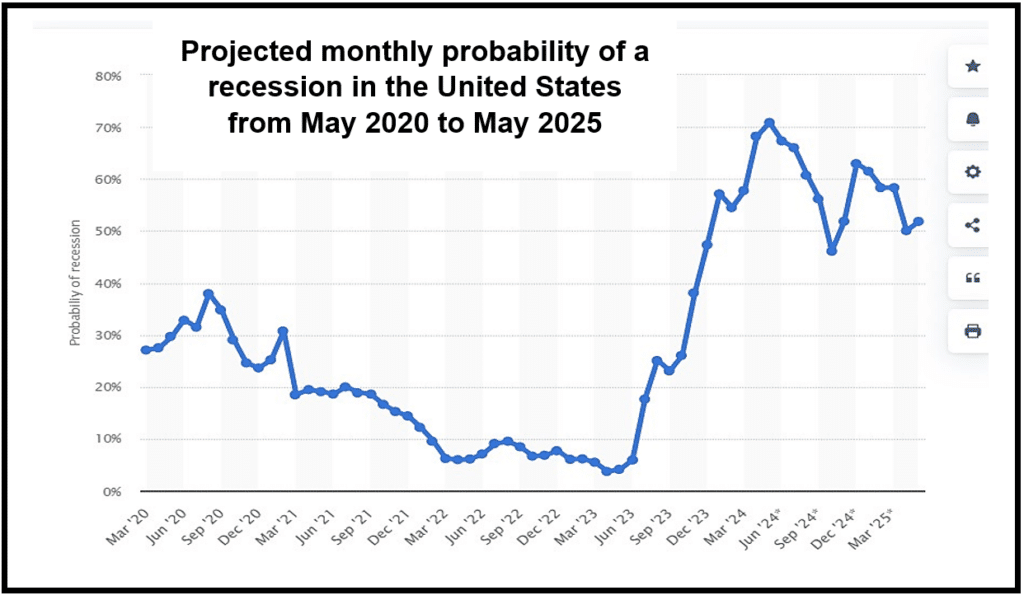

Data platform Statista is projecting an almost 52% probability that the U.S. will fall into an economic recession in less than a year or by May of 2025. 12

And top economist and founder of the Economic Cycle Research Institute, Lakshman Achuthan, also believe the US economy is flashing a recession warning based on a model that has only shown a false positive once in the last century. The ECRI’s Cyclical Labor Conditions index has plunged nearly 50%. That steep decline mirrors falls seen prior to the 2001, 2008, and pandemic-era recession. 13

Gold has Proven to be a Reliable Safe Haven during Economic Crisis

This report is courtesy of Thor Metals Group. 1-844-944-THOR www.ThorMetalsGroup.com

- https://www.visualcapitalist.com/magnificent-seven-stocks/ ↩︎

- https://www.forbes.com/sites/danirvine/2024/03/20/magnificent-7-momentum-is-slowing-signals-caution/ ↩︎

- https://www.cnbc.com/2024/07/01/how-magnificent-7-affects-sp-500-stock-market-concentration.html ↩︎

- https://www.cnbc.com/2024/05/13/how-much-more-expensive-homes-are-since-1965.html ↩︎

- https://www.businessinsider.com/real-estate-crash-home-prices-correction-foreclosures-mortgage-defaults-2024-7 ↩︎

- https://www.cnbc.com/2024/03/11/trump-pledges-to-get-tough-with-tariffs-again-if-elected.html ↩︎

- https://www.heraeus.com/media/media/hpm/doc_hpm/precious_metal_update/en_6/Appraisal_20240701.pdf ↩︎

- https://www.marketwatch.com/livecoverage/powell-testimony-day-two-house-hearing-will-give-fed-chief-more-scope-to-talk-about-rates ↩︎

- https://www.wsj.com/economy/central-banking/jerome-powell-senate-testimony-july-b7805d54 ↩︎

- https://finance.yahoo.com/news/us-now-85-chance-recession-022705048.html ↩︎

- https://markets.businessinsider.com/news/stocks/stock-market-crash-prediction-2025-decline-fed-fails-avoid-recession-2024-7 ↩︎

- https://www.statista.com/statistics/1239080/us-monthly-projected-recession-probability/ ↩︎

- https://www.statista.com/statistics/1239080/us-monthly-projected-recession-probability/ ↩︎