The chances of a recession hitting the U.S. economy was the hot topic this time last year, but entering 2025 the issue has almost entirely disappeared. That may sound comforting but it’s also cause for alarm.

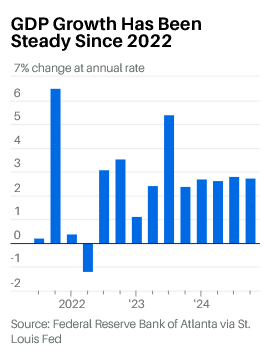

It’s easy to see why recession talk has vanished, as there are very few signs of impending collapse—GDP growth has topped 2% in eight of the last nine quarters. Seasoned investors could see an overwhelming consensus for ever-more growth as a red flag, and if the worst does happen, it means markets may swing more violently because of the unforeseen risk.

If the outlook does change, these are the warnings to watch for:

Jobs Jolt

The textbook first sign of a recession is an increase in unemployment. That leads to weaker consumer spending, which hurts company profits, which then leads to more job losses. Jawad Mian, the founder of Stray Reflections, a macro advisory for institutional investors, sees several factors that could lead to a downturn.

It may not start with high unemployment—while the jobless rate has been rising slowly, it remains historically low. Still, sticky inflation could mean real incomes are soon getting pinched again, Mian told Barron’s. There could also be a negative wealth effect if stocks and property prices stop rising so precipitously, which would hurt consumer confidence. And the labor market might weaken on its own after years of strong job growth—there’s a natural limit to how much the labor market can expand, especially if immigration is pushed down.

Trump Trauma

Which leads to the elephant in the room—President-elect Donald Trump, who has vowed to reduce immigration, slash government spending, cut taxes, and place tariffs on imports. Investors have mostly focused on his promises to reduce regulation and make it easier for U.S. firms to do business.

“The biggest risk right now is a failure to imagine the downsides,” said Mian. “We’ve reached a point of constraint in the economy.”

However, other economists have tried to put numbers on the impact of the net effect of Trump’s proposals. The National Institute of Economic and Social Research (Niesr), a London-based think tank, reckons that expelling immigrants and raising tariffs will knock 1.25% off growth from gross domestic product in the first year. In addition, it will lead to inflation in years to come—especially if Trump is able to increase the president’s influence on the Federal Reserve.

“These negative effects, which hurt consumption, investment and exports, more than offset benefits from supply-side policies, such as easing regulation, even in the medium term,” said Niesr economist Paul Mortimer-Lee. If Trump also radically reduces government spending, the usual cushions against a downturn would be undermined, and “the economy would likely enter recession,” he added.

Market Misery

For investors, one key thing to remember is that the economy and the stock market aren’t the same thing. While they do feed off each other, the stock market can perform well even without strong economic growth. It’s also the case that the economy can keep growing without stocks continuing to do well. Goldman Sachs which sees slim odds of recession, predicts a “lost decade” for stocks with returns after inflation of 3% or less on average.

At the beginning of 2024 there were more than a handful of forecasts for an economic contraction. The year before that, at the end of 2022, respected commentators including Bloomberg Economics and Deutsche BankDBK+2.51% predicted it was almost certain that the U.S., in the near future, would enter recession. Even the Federal Reserve, which was raising interest rates at the fastest pace in a generation, had a recession in its staff forecasts as late as July 2023.

Cursed Curve

The yield curve has always been an important indicator. One of the market’s favorite harbingers of recession—whether it is two quarters of contraction, or a year-over-year drop in output, or just a sustained economic downturn—is when the two-year government note yield is higher than the 10-year yield. It was inverted from mid-2022 through September of last year. But since then, the longer-term rates have pushed substantially higher.

In a FactSet survey of 85 institutions, none of them predicts an economic contraction in 2025. Goldman Sachs reduced the odds of a recession—it now sees the chances at about 15%. The Fed upgraded its forecast for gross domestic product to rise 2.1% next year.

The bottom line is that—perhaps more so than in the past two years when the market has gone from strength to strength—it’s always important to keep your wits about you.

“We are in this strange backdrop where investors believe that there is no recession risk, no risk of earnings disappointments,” said David Rosenberg, founder of Rosenberg Research. “We are in a once-in-a-lifetime situation where the concept of risk has been totally distorted—an investment world where there is no more differentiation between what has traditionally been risky and what is riskless.”

A recession may not be in the cards for 2025. But there is likely more risk out there than most people are mitigating for.

Read the full article HERE.