- Gold and silver advanced as investors weighed heightened geopolitical risks following the US capture of Venezuelan leader Nicolás Maduro.

- The US plans to “run” Venezuela after ousting Maduro, leaving the future governance of the South American nation uncertain, according to President Donald Trump.

- Gold often rallies in the short term as geopolitical tensions spike, although the effect is often short-lived, and some analysts believe the impact of the Venezuelan event on gold prices will be limited over time.

Gold and silver advanced, with investors weighing heightened geopolitical risks following the US capture of Venezuelan leader Nicolás Maduro.

Spot gold rose as much as 2.5% on Monday, climbing above $4,430 an ounce, while silver gained almost 5%. President Donald Trump said the US plans to “run” Venezuela after ousting Maduro over the weekend, leaving the future governance of the South American nation uncertain. He said Washington required “total access” to the country, including its oil reserves.

The episode “reinforced a backdrop of geopolitical uncertainty,” said Christopher Wong, an analyst at Oversea-Chinese Banking Corp. in Singapore. However, immediate risks are limited as “developments in Venezuela point to a relatively quick closure, rather than a prolonged military conflict,” he added.

Gold often rallies in the short term as geopolitical tensions spike, although the effect is often short-lived.

An analysis of the long term impact of geopolitical events “shows a far more limited price impact in time on gold prices than, for instance, oil,” Bernard Dahdah, an analyst at Natixis, said in a note. “Our view is that if there are no further repercussions or a domino effect in the capturing of Maduro, then this event will cease to have an impact on the price of gold.”

In addition to events in Venezuela, Trump also used the weekend to restate his ambitions for Greenland, part of NATO-ally Denmark’s territory.

Trump told reporters in Washington that “Greenland is covered with Russian and Chinese ships all over the place. We need Greenland, from the standpoint of national security, and Denmark is not going to be able to do it, I can tell you.”

Denmark’s prime minister denounced the notion, saying the US “has no right to annex” any of its territory.

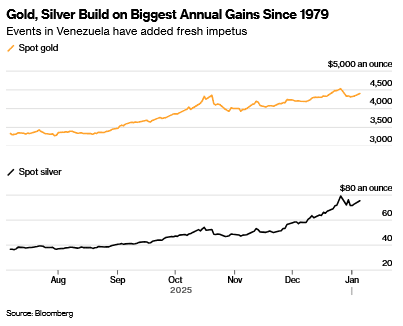

Gold is fresh from posting its best annual performance since 1979, hitting a series of records throughout last year with support from central-bank buying and inflows to bullion-backed exchange-traded funds. Three successive rate cuts by the US Federal Reserve were also a tailwind for precious metals, which don’t pay interest.

Some leading banks forecast further gains in gold this year, especially with the Fed expected to deliver additional interest-rate reductions and Trump reshaping the US central bank’s leadership. Goldman Sachs Group Inc. said last month that its base case was for a rally to $4,900 an ounce, with risks to the upside.

Adding further support, the US economy is facing long-term risks posed by mounting federal debt, according to a panel of economic luminaries speaking Sunday. Former Treasury Secretary Janet Yellen said preconditions are strengthening for fiscal dominance, whereby the size of debt prompts the central bank to keep rates low to minimize servicing costs.

Silver rallied even more than gold last year, blowing through levels that until recently seemed unthinkable to all but the most enthusiastic of market watchers. In addition to the factors that aided gold, the white metal has also benefited from sustained concerns that the US administration could eventually impose import tariffs on the refined metal.

The fear of tariffs have drawn much of the world’s readily available silver to the US, leaving other markets substantially tighter. Silver contracts on the Shanghai Gold Exchange traded more than $5 an ounce above spot prices in London on Monday, while the London prices continued to trade at a premium to futures on the Comex exchange in New York. That’s an unusual reversal of what is normally a discount.

Gold rose 1.7% to $4,407.02 an ounce as of 12:40 p.m. in London. Silver climbed 2.7% to $74.75. Platinum and palladium also advanced. The Bloomberg Dollar Spot Index, a key gauge of the US currency’s strength, was up 0.2%.

Read the full article HERE.