U.S. stocks are extending their scorching spring rally into the close of the second quarter, with the S&P 500 probing record levels as investors ride bets on Federal Reserve rate cuts, fading tariff risks, and stimulative tax and spending plans from Capitol Hill.

Now, the question is whether companies’ performances justify that second-quarter surge. With corporate earnings reports starting on July 15 with an update from JPMorgan Chase, some investors are worried that expensive stock valuations and subdued levels of market risk could suggest markets are pricing in more profit growth and a better economic performance than is likely over the coming year.

“The U.S. market remains the clear global leader, buoyed by strong earnings momentum, macro resilience, and AI-driven enthusiasm (and) reignited conversations about whether the “Buy America’ trade is making a comeback,” said Charu Chanana, chief investment strategist at Saxo Bank.

“However, with stretched valuations, this earnings season needs to confirm the second-half rebound story—or risk a market rethink.”

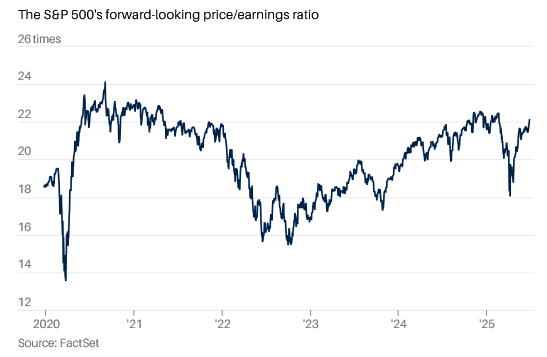

The S&P 500SPX-0.13%, which closed at a record high of 6201 points on Monday, is now trading at 22.8 times the collective earnings its constituents are expected to generate over the next 12 months.

That is not only historically expensive, according to data from Goldman Sachs Global Investment Research, but it also means the benchmark is more highly valued than the Nasdaq 100 and the Russell 2000RUT-0.18%.

“There’s clearly a bit of pull forward of earnings expectations,” said Louis Navellier of Navellier Calculated Investing. “There’s also a desire to get in front of the Fed beginning to cut rates.”

“Clearly, the geopolitical risks are being discounted as having little impact on growth prospects, as are the prospects of tariffs either having little impact on inflation or never actually becoming real,” he said. “As always, there are many fewer questions about bull markets than bear markets.”

Collective second-quarter earnings for the index are forecast to rise 5.9% from last year to around $529 billion, according to LSEG data, but that growth rate is only around half of the 10% gain the benchmark has recorded since the end of March.

Nearly half of the benchmark’s 11 subsectors, meanwhile, aren’t expected to see any earnings growth at all. Of the six sectors that will generate higher profits, around 82% of the increase will come from just two: communications services and information technology.

LSEG data point to earnings growth of 8.5% for the year. That implies that stocks are valued at 23.4 times earnings, compared with their current 22.8 times, even though that 8.5% is well below the 14% increase in profits expected at the start of the year.

And investors don’t seem to be demanding much extra return regardless of the risk implied by those high valuations. Calculations from WisdomTree indicate the so-called equity risk premium—the extra return investors can get by being in stocks rather than safe Treasury debt—is just 2.4 percentage points, the lowest since the early 2000s.

Measures of volatility are near the lowest levels of the year. The Cboe Group’s VIX index, priced at 16.62, suggests traders expect daily swings of around 65 points for the S&P 500 over July. That compares to a peak of around 105 points in early April.

Though Clark Bellin, president and chief investment officer at Bellwether Wealth in Lincoln, Neb., isn’t sure that the market can remain this complacent, he doesn’t see it as a worry.

“While stocks trading at record highs naturally leads many to believe that a pullback is imminent, that’s actually not usually the case, as new highs often beget new highs,” he said. “The positive momentum can continue for some time,” though volatility is always possible.

“The big conundrum facing investors for the second half of 2025 is how to deploy new cash, especially for investors who did not put new money to work during the April market pullback.”

Read the full article HERE.