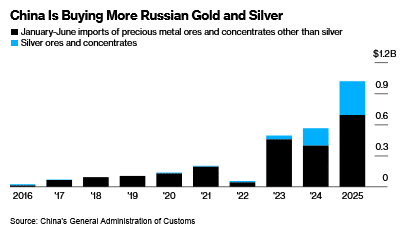

Russian precious metals exports to China almost doubled in the first half of the year, as record gold prices boost revenue.

Chinese imports of Russian precious metal ores and concentrates, including gold and silver, jumped 80% to $1 billion from the same period a year earlier, according to data from Trade Data Monitor, which sources information from China’s customs office. Bullion prices have climbed about 28% this year, boosted by heightened geopolitical risks and trade tensions, alongside buying by central banks and exchange-traded funds.

Russia, the world’s second-largest gold producer with annual output of more than 300 tons, has been shut out of Western trading hubs like London and New York since its full-scale invasion of Ukraine in 2022. The Bank of Russia, formerly the world’s largest central bank gold buyer, has not resumed large-scale purchases, leaving China as one of the country’s few remaining major markets.

Gold miners in Russia have also been buoyed by growing domestic retail demand, which reached a record high in 2024 as Russians turned to precious metals to safeguard their savings.

Russia’s MMC Norilsk Nickel PJSC, one of the world’s top producers of palladium and platinum, has ramped up exports to China this year. Prices for the two metals jumped 38% and 59%, respectively, this year.

Read the full article HERE.