The rapid acceleration in investors’ use of margin debt in trading calls to mind the meme stock frenzy and dot-com bubble.

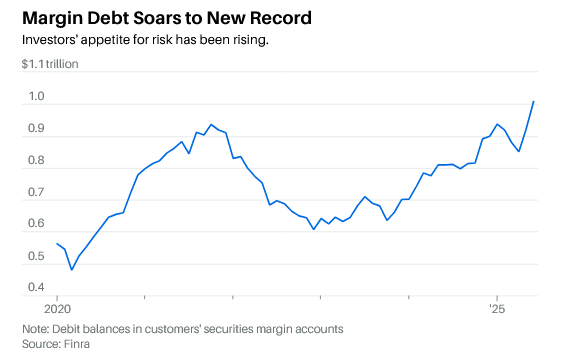

Investors are trading on margin like it’s 1999. Debt balances in investors’ margin accounts topped $1 trillion in June, a new record, according to data from Finra the brokerage industry’s self-regulatory organization.

The figure surpasses the previous high of $937 billion in February and is a sign that investors’ appetite for risk dramatically increased in May and June following a sharp selloff in U.S. stocks in April when President Donald Trump unveiled sweeping tariffs.

Margin trading can amplify returns and losses because investors borrow funds from their broker to buy shares. Investors’ use of margin tends to parallel moves in stock markets, and the S&P 500 and Nasdaq have risen considerably since April.

Investors’ use of margin has surpassed the level seen during the pandemic (before this year the record was in October 2021) when many first-time investors downloaded commission-free apps, such as Robinhood, to buy GameStop and other so-called meme stocks.

Risk signal. Use of margin signals increased investor appetite for risk and can be a sign that a bubble is building. Strategists at Deutsche Bank warn that we may be entering worrisome territory, noting that the 18% increase in margin usage is among the fastest increases since the tech bubble of the late 1990s. The fastest two-month increase in margin debt—24.6%—was recorded in December 1999, according to Deutsche Bank. The second fastest—20.3%—was notched in May 2007.

“We care about margin debt, as it is a useful gauge of when market sentiment is on the verge of going from ‘red-hot’ to ‘white-hot’,” credit strategists led by Steve Caprio write in a July 24 research note. “We have tracked this indicator for years now, but only have written on it today, given that the rate of increase is starting to flag as ‘too hot” by our metrics. And while there is still room for market euphoria to potentially grow, we are ultimately getting closer to that point where market euphoria is becoming too hot to handle.”

Caprio and colleagues, who focus on investment-grade and high-yield corporate bonds, say that the current run-rate of margin debt growth is consistent with U.S. high-yield credit spreads widening between 80 to 120 basis points over the next 12 months. A basis point is one one-hundredth of a percentage point and credit spreads widening is another way of saying high yield bonds fall in value relative to Treasuries. High-yield bonds falling in price can correlate with risk-off behavior among investors more broadly.

How long investor euphoria—and appetite for risk—lasts is hard to say, and Caprio acknowledges that unexpected market catalysts could emerge, such as tariff rate reductions or a dovish Fed. “But in all scenarios, we would not lose sight of the broader theme; namely that the level and pace of margin debt growth today suggests market sentiment is starting to run too hot.”

Read the full article HERE.