Pound, gold and oil prices in focus: commodity and currency check, 13 June

Gold (GC=F)

Gold prices surged to their highest level in nearly two months on Friday, lifted by heightened geopolitical tensions following Israeli airstrikes on Iran. The escalation in the Middle East conflict spurred demand for traditional safe-haven assets, putting bullion on track for a weekly gain.

Gold futures gained nearly 1% to $3,435.20 per ounce at the time of writing, while the spot gold price advanced 2% to $3,414.79 per ounce.

“The geopolitical escalation adds another layer of uncertainty to already fragile sentiment,” said Charu Chanana, chief investment strategist at Saxo.

The Israeli government declared a state of emergency, warning of imminent missile and drone attacks from Iran. Meanwhile, the US military is reportedly preparing for a range of scenarios, including potential evacuations of American civilians from the region, a US official told Reuters.

“This latest spike in hostilities in the Middle East has taken the focus off trade negotiations for now, with investors making a play towards safe-haven assets in response,” said Tim Waterer, chief market analyst at KCM Trade.

“Gold surged past resistance around $3,400 on news of the airstrikes, and further upside could be in-store should the escalation continue,” he added.

The rally in gold has been further underpinned by growing expectations of monetary policy easing in the US. Recent data showing elevated jobless claims and muted producer price inflation have increased speculation that the Federal Reserve could cut interest rates, making non-yielding assets such as gold more attractive to investors.

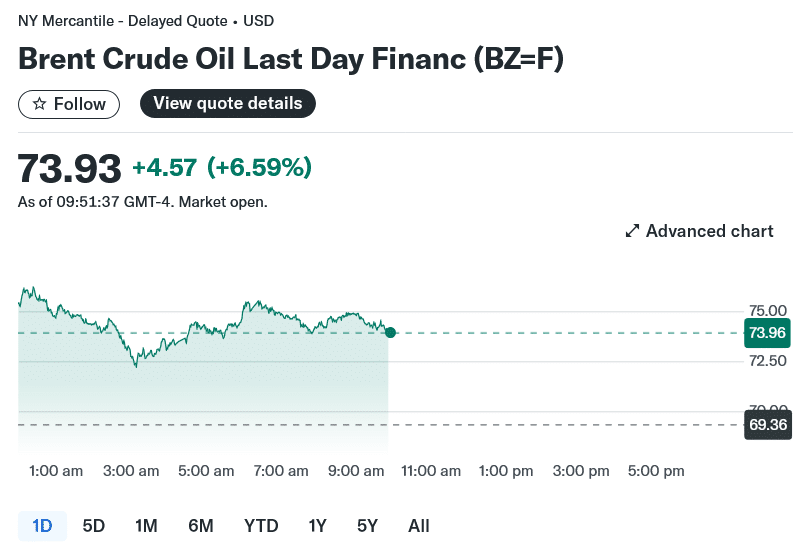

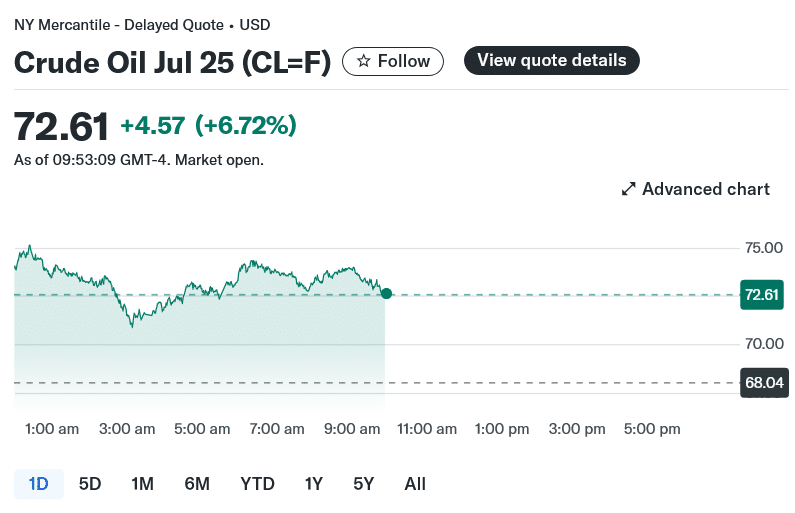

Oil (BZ=F, CL=F)

Oil prices rose at the fastest pace in over three years on Friday amid concerns that Israeli military strikes on Iran could trigger a wider conflict in the Middle East, threatening global energy supplies and stoking inflation.

Brent crude futures (BZ=F) climbed 5% to $71.92 a barrel, at the time of writing, while West Texas Intermediate futures (CL=F) rose by the same margin to $71.44 a barrel.

The market reaction reflects growing unease that a broader confrontation could disrupt flows through the Strait of Hormuz, a vital maritime chokepoint through which roughly a fifth of global oil supply is transported. While Iran exports around 1.6 million barrels of oil per day, any move to block or restrict traffic through the strait could have far-reaching consequences for global energy markets.

Warren Patterson, an analyst at ING (ING), said: “We are back in an environment of heightened geopolitical uncertainty, leaving the oil market on tenterhooks and requiring it to start pricing in a larger risk premium for any potential supply disruptions.”

Iran, one of the world’s leading oil producers, sells the majority of its crude to China, which consumes approximately 15% of global oil demand.

Priyanka Sachdeva, an analyst at Phillip Nova, said: “Iran has announced an emergency and is preparing to retaliate, which raises the risk of not just disruptions but of contagion in other neighbouring oil producing nations too.

“Although Trump has shown reluctance to participate, US involvement could further raise concerns.”

US secretary of State Marco Rubio on Thursday called Israel’s strikes against Iran a “unilateral action” and said Washington was not involved, while also urging Tehran not to target US interests or personnel in the region.

MST Marquee senior energy analyst Saul Kavonic said the conflict would need to escalate to the point of Iranian retaliation on oil infrastructure in the region before oil supply is materially impacted.

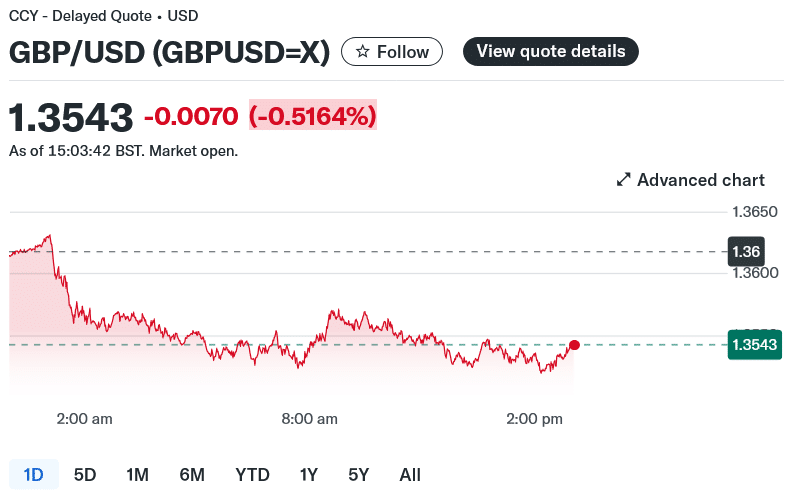

Pound (GBPUSD=X, GBPEUR=X)

The pound was lower against a stronger dollar, slipping 0.4% to $1.3558, amid a global selloff sparked by Israeli strikes on Iran.

The US dollar index (DX-Y.NYB), which measures the greenback against a basket of six currencies, rose 0.3% to $98.19, bolstered by safe-haven demand.

“Full-scale war in the Middle East moves another step closer,” says Tatha Ghose, an analyst at Commerzbank (CBK.DE). “Until the danger of further escalation has passed, safe assets are likely to remain in demand.”

In other currency moves, the pound was muted against the euro (GBPEUR=X), trading at €1.1744 at the time of writing.

More broadly, the FTSE 100 (^FTSE) was down, losing 0.6% to 8,834 points at the time writing. For more details, check our live coverage here.

Read the full article HERE