Strategists at Citi are keen on China tech instead

Just when investors thought it couldn’t get worse, Monday’s brutal selloff was a hold-their-beer day.

And while Tuesday is looking a bit better, speculation on whether stocks have bottomed should probably wait until a CPI update on Wednesday. Softer-than-forecast data could relay the message that there’s room for the Fed to ease, bringing some relief to stocks, but higher inflation might do the opposite, and send stocks sinking again.

Wall Street strategists, who headed into 2025 armed with bullish forecasts are getting cautious. Citigroup has now joined that camp, as it has just downgraded U.S. equities to neutral from an overweight, or bullish, stance since Oct. 2023.

In our call of the day, a team of Citi strategists led by Dirk Willer said it’s now clear that “U.S. exceptionalism is at least pausing.” Alongside that shift, they upgraded China stocks to overweight, which in balance, now leaves their overall global equity view at neutral.

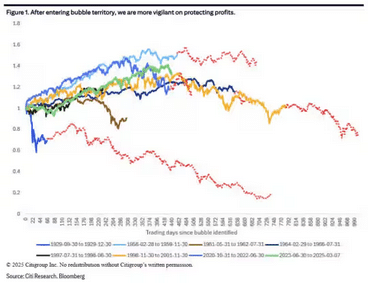

Willer and the team explained that two of their bearish signals have now been triggered for U.S. stocks. One was the S&P 500 breaking its 200-day moving average “at a time when the market is/has been extended.”

The second signal was triggered by five-straight soft sessions for four of the seven so-called “generals,” referring to the major technology stocks that have been leading the market higher for the past two years.

Already mired in a tough year, the “Magnificent Seven” grouping of large technology stocks collectively lost $759 billion in market cap on Monday, the biggest one-day loss of market cap on record.

Last week, the Citi strategists felt some of those bearish signals were close to triggering, but they were reluctant to move forward until after Friday’s payrolls data, which could have changed the market’s trajectory. However, the data not only failed to do so, but Citi’s economists believe it was likely the last strong jobs report before DOGE cuts—government reductions executed by the Department of Government Efficiency—along with voluntary resignations and a weaker economy take hold.

Willer and his team emphasized that their neutral stance on U.S. stocks is short-term, based on a three- to six-month outlook. “In the bigger picture, we doubt that the AI bubble is already fully played out, and we would expect for the U.S. to remain one of the leaders, maybe jointly with China, while the AI theme is intact,” they said.

“But for reasons mentioned above, we believe this is unlikely to be the right view for today, as we expect more negative U.S. data prints.”

As for China stocks, the strategists said those assets have been screening as attractive for some time, but they’ve been wary up to now due to tariff risks. The strategists flagged two big reasons to love China: 1) DeepSeek has “proved that China tech is at the Western technological frontier (or beyond) despite export controls and 2)President Xi Jinping has embraced the tech sector, albeit belatedly. The sector is still relatively cheap versus other global AI assets, even after a big rally.

Citi strategists prefer the Hang Seng China Enterprises Index which is up 20% year-to-date, as they said the index outperformed the Shanghai Composite during the 2018 tariff wars. The Hang Seng Tech index has climbed 33% so far this year, versus a nearly 10% drop for the Nasdaq Composite. The U.S.-listed KraneShares CSI China Internet ETF has shot up 21% this year.

The Citi strategists argued that there might be some dovish signs on the horizon, such as a report that President Trump may visit Xi in China as soon as next month. Tariffs on China, said Willer and his team, have already risen by 20% and “have had a limited impact on the market,” and in their view, the U.S. will likely be in “deal-making mode.”

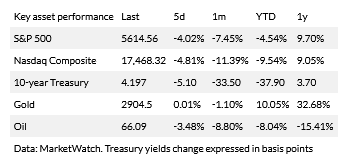

The markets

After the worst day for the S&P 500 since December, U.S. stocks. Treasury yields are steady and the dollar is dropping.

The chart

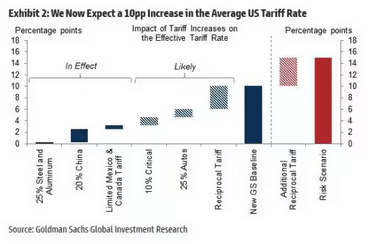

The chart from Goldman Sachs maps out where the bank sees U.S. tariffs hitting on different sectors on countries and sectors. Goldman cut its U.S. growth forecasts on Monday, not for data, but because of a more negative view on those duties.

“We now see the average U.S. tariff rate rising by 10pp [percentage points] this year, twice our previous forecast and about five times the increase seen in the first Trump administration,” said chief economist Jan Hatzius.

Read the full article HERE.