The next generation of retirees isn’t feeling so confident about the future

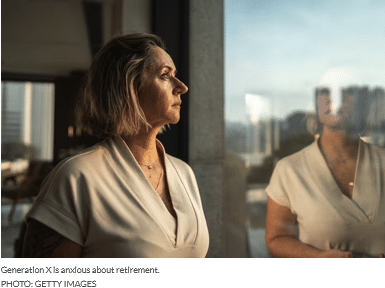

Generation X, a cohort that never got quite as much attention as its baby-boomer elders or its millennial younger siblings, will begin turning 60 this year, and many are worried about their retirements.

One of the biggest reasons for that lack of confidence? They’re juggling too many financial responsibilities, such as mortgages, children’s education, and the rising cost of living, a new report from Fidelity has found. Generation X has almost become synonymous with the “sandwich generation,” taking care of aging parents and children at the same time.

Financial advisers have taken notice of the generation’s worries. “This complex web of financial obligations makes it incredibly difficult to prioritize retirement savings,” said Ashley Folkes, a certified financial planner at Farther Financial. “It’s imperative to understand that, while this stage of life presents unique challenges, it’s not insurmountable. The key is to take a holistic view of your financial situation, clearly define your values and goals, and engage in open discussions about what truly matters.”

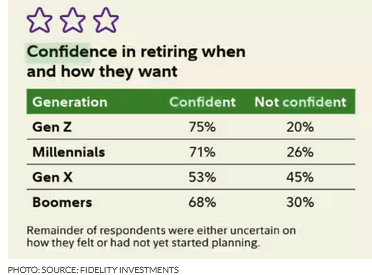

Among all workers, Generation X was the most mixed in characterizing its confidence in retiring on its own terms, according to Fidelity Investments’ latest 2025 State of Retirement Planning report. Almost half, or 45%, of Gen X said they weren’t confident, compared with 30% of baby boomers, 26% of millennials and 20% of Gen Z who said the same.

Overall, 67% of Americans in their “planning years,” as Fidelity put it, said they are confident about their retirement prospects, though that is down seven percentage points from the previous year.

Another factor contributing to retirement insecurity is that Gen X represents a tipping point in retiree reliance on 401(k) plans instead of pensions, said Rita Assaf, vice president of retirement at Fidelity. More than six in 10 respondents in their planning years, or 61%, said their own retirement accounts, including 401(k) plans, IRAs and small-business plans, will be their biggest retirement income streams, compared with about half of current retirees, the report found.

Another 62% of respondents said they’re not sure if those savings will last their lifetimes.

With the bulk of their retirement savings in self-directed investments, near-retirement Gen X–ers will only have anxiety levels heightened by stock-market volatility. The generation has weathered the tech-stock bust and the Great Recession during their working and saving years, in addition to smaller market disruptions, and Fidelity’s report comes as the U.S. stock market has been suffering declines across the board, pressured by worries about a trade war, a possible recession and declining consumer confidence.

Retiring in the midst of a down market can throw careful retirement planning into turmoil. Advisers typically suggest avoiding withdrawals from investment accounts when the market is in a downturn because it could require taking a larger chunk of the portfolio and thus potentially hurting future returns, known as sequence-of-returns risk.

Hope is not lost for Gen X–ers, advisers say. And this generation, importantly, should create a retirement plan if they haven’t already, experts said. “If you’re planning for something, you feel better,” Assaf said. “You don’t have to do it alone, especially with retirement planning. There’s a lot of help.”

A retirement plan involves assessing current finances, determining clear goals for the future and doing the math to attain those goals, Jon Ulin, a certified financial planner and managing principal of Ulin & Co. Wealth Management. “A well-structured, written plan acts as a roadmap with measurable milestones,” he said. “Rule of thumb: Understanding how much you’ll need as a lump sum to fund a multidecade retirement — while accounting for inflation and taxes — is essential for long-term financial security.”

Other tasks include boosting retirement contributions while still able to do so, paying down debts (especially high-interest debts) and planning for healthcare expenses, Ulin said. Engaging a financial adviser can help.

The financial-services industry lately has put a spotlight on annuities, which are investment products that offer guaranteed income. Investors contribute a certain amount of money with the expectation of receiving a stream of income in the future. Annuities have had an imperfect reputation in the past — and investors should scrutinize any product before taking part, regardless of where they heard the recommendation — but having these additional sources of income in retirement can help reduce anxiety.

When looking for an adviser, search for professionals who will look at the full financial picture — as opposed to just recommending investment products — and ask about fees, retirement-planning strategies, their client base and how they will communicate with you as life twists and turns into, and in, your retirement years.

Read the full article HERE.