Signs of weakness are showing up in spending on everything from basics to luxuries

Key Points:

-Consumer spending is declining across all income levels due to concerns about tariffs, inflation and a potential recession.

-Retailers are reporting weak demand since the start of the year as consumers become more cautious about their spending.

American consumers have had a lot to fret about so far this year, between never-ending tariff headlines, stubborn inflation and most recently, fresh fears about a recession. These concerns seem to be hitting spending by both rich and poor, across necessities and luxuries, all at once.

Take low-income consumers: At an interview at the Economic Club of Chicago in late February, Walmart Chief Executive Doug McMillon said “budget-pressured” customers are showing stressed behaviors: They are buying smaller pack sizes at the end of the month because their “money runs out before the month is gone.” McDonald’s said in its most recent earnings call that the fast-food industry has had a “sluggish start” to the year, in part because of weak demand from low-income consumers. Across the U.S. fast-food industry, sales to low-income guests were down by a double-digit percentage in the fourth quarter compared with a year earlier, according to McDonald’s.

Dollar General on its earnings call on Thursday said its customers report only having enough money for basic essentials; some are having to sacrifice even on necessities. The company doesn’t expect any improvement in the economic environment this year and is watching potential changes to government entitlement programs. Dollar stores rely more heavily on food-stamp benefits, which could be on the table for budget cuts.

Things don’t look much better on the higher end. American consumers’ spending on the luxury market, which includes high-end department stores and online platforms, fell 9.3% in February from a year earlier, worse than the 5.9% decline in January, according to Citi’s analysis of its credit-card transactions data.

Costco, whose membership-fee-paying customer base skews higher-income, said last week that demand has shifted toward lower-cost proteins such as ground beef and poultry. Its members are still spending but are being “very choiceful” about where they spend, Chief Financial Officer Gary Millerchip said. He said consumers could become even pickier if they see more inflation from tariffs. Dollar General said Thursday that sales to higher-earning households, who are seeking cheaper options, accelerated in the past few weeks.

Department stores are seeing signs of penny-pinching all around, too. On Tuesday, Kohl’s CEO Ashley Buchanan said consumers making less than $50,000 a year are “pretty constrained” on discretionary spending, but added that “it’s also pretty challenging” for those making less than $100,000. The company gave a much weaker sales forecast for the full year than Wall Street expected, causing its share price to plunge 24% on Tuesday. Last week, Macy’s CEO Tony Spring said the “affluent customer that’s shopping [at] Macy’s is just as uncertain and as confused and concerned by what’s transpiring.”

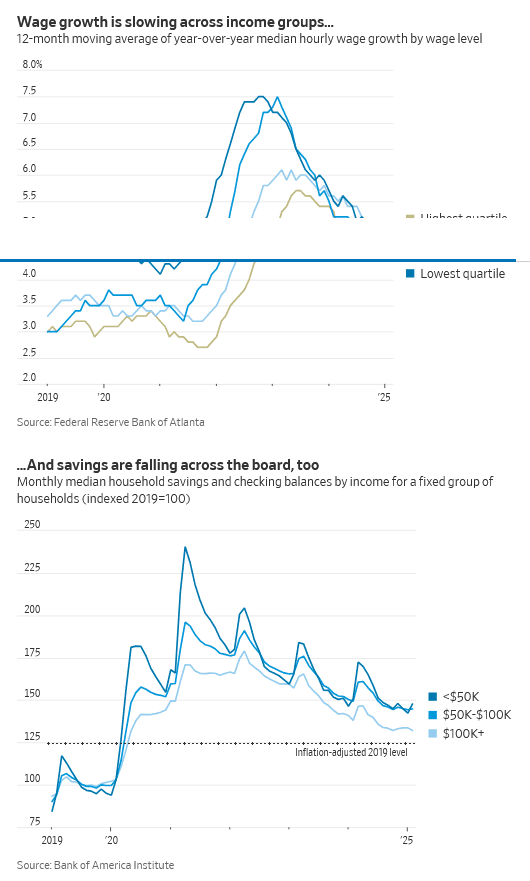

The economy has seen pockets of weakness in recent years, but nothing that suggests such widespread weakness. The period following the pandemic was dubbed by some a “Richcession” because higher earners’ wage growth lagged behind those of in-demand blue-collar workers. But poorer households’ gains have since reversed: Starting in 2023, Covid-era increases to food-stamp benefits were rolled back, and by late 2024, wage growth for the lowest-income Americas started trailing those of richer Americans, according to data from the Federal Reserve Bank of Atlanta. Several years of inflation—particularly on necessities such as groceries, rents and utility bills—have hit poorer Americans hard. But a strong stock market, buoyed by artificial-intelligence hype, kept wealthier folks spending.

Now, everyone seems to be feeling more cautious, and this spending restraint is affecting several categories. There are signs that consumers are pulling back on air travel, for example. Delta Air Lines, American Airlines and JetBlue all cut their first-quarter guidance earlier this week. Delta CEO Ed Bastian said at an industry conference on Tuesday that there was “something going on with economic sentiment, something going on with consumer confidence.”

Citi’s analysis of its U.S. credit-card data shows that spending has fallen across most retail categories. In the retail quarter to date, spending plunged 12% and 22% on apparel and athletic footwear, respectively, compared with a year earlier. But even less-discretionary categories such as food retail, aftermarket auto parts and pet retail are seeing moderate declines.

Retailers including Target, Foot Locker and Lowe’s have all reported seeing weak demand in February. Target CEO Brian Cornell said last week that consumers are thinking about the potential impact of tariffs and what it will mean for them. Foot Locker, which said last week that its consumers were “cautious and sensitive” in February, said its customer base, which skews young, is “thinking about [their] overall cost of living, plus some uncertainty about tariffs.”

This week alone, consumers have had plenty of new developments to digest. President Trump on Sunday declined to rule out a U.S. recession as a result of his economic policies, causing stocks to plummet. This was followed by yet another roller coaster of tariff threats, counter-tariffs and reversals. While Wednesday’s inflation data showed price increases slowing down slightly in February, that is cold comfort because it is too early to reflect the effects of Trump’s tariffs.

But it isn’t all about tariff fears, or even some broader sense of uncertainty. Many also have less cold hard cash on hand. Checking and savings deposit balances across all income levels have declined over the 12-month period through February and are getting closer to inflation-adjusted 2019 levels, according to card data tracked by Bank of America Institute. Wage growth for all income groups has slowed over the past year, per data from the Federal Reserve Bank of Atlanta. Americans’ inflation-adjusted debt balances are starting to surpass prepandemic levels.

What this means is that consumers generally are less able to absorb shocks, just as uncertainty is soaring. It is hard to blame them for turning cautious, even if that means the economy suffers.

Read the full article HERE.