Monday’s action is looking positive, but the week could be a tough one for markets as the main event — Friday’s jobs data — looms. That’s as Wall Street has been increasingly scrutinizing the U.S. economy and the new administration’s ability to keep the stock market from coming unglued.

Within that scrutiny is our call of the day from strategists at JPMorgan, who worry investors aren’t giving enough thought to potential economic turbulence this year.

“The risk is of a broadening air pocket in activity, where more aggressive trade, immigration and fiscal consolidation policies could increase uncertainty, and ultimately affect payrolls,” said a team led by Mislav Matejka, head of global and European strategy, in a note to clients.

He and his team rattled off an ever-growing list of economic data they see as starting to wobble – consumer confidence, retail sales, and services purchasing managers surveys. In addition, they also noted a weak performance of cyclical stocks – shares of companies that tend to rise when the economy is booming and vice versa – versus defense stocks, alongside lower bond yields.

At the same time, hottish consumer prices are expected to keep the Fed on the sidelines over interest rates, though that could change, they said.

“Ultimately, the activity air pocket could lead to more forceful Fed support, drive the re-steepening of the yield curve and bullish equity market behavior, likely in the [second half] but not in the first instance,” the strategists said.

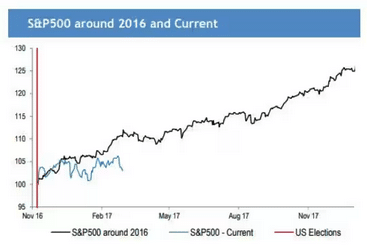

The strategists doubled down on their view that “there are clear differences to the 2017 reflation template,” referring to eight years ago when global stocks rallied on hopes that fiscal stimulus under Trump 1.0 would drive economic growth. The consolidation seen by the S&P 500 this time around has been caused for one, by uncertainty over how policy changes might play out, they said.

“It is premature to believe that tariffs uncertainty has already peaked, and interestingly, even if not much sticks, the adverse impact on sentiment could still be the end result,” JPMorgan strategists warned.

So where to invest right now? They say in the interim, before any Fed support can be seen, defensive stocks should keep performing well.

JPMorgan has a neutral position on U.S. stocks overall, as its strategists continue to worry about a heavily concentrated market with high valuations. At 22 times, they view the U.S. forward price/earnings ratio as looking “very stretched,” though they note valuation discounts seen earlier for China and eurozone equities has largely closed.

“Having said that, we do think U.S. activity will be stronger than the rest, and the U.S. market will likely benefit from animal spirits and deregulation,” said the strategists.

If trade uncertainty does escalate, that will likely be “less of a headwind for the U.S. If markets weaken, the U.S. typically held up better than other regions during risk-off periods.”

One trend likely to continue for U.S. markets, said Matejka and his team, is the rotation out of big U.S. technology and growth companies. Last summer, the bank closed out a bullish position on the growth theme and suggested a rotation from semiconductors to software.

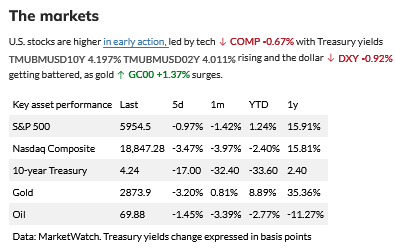

The markets

U.S. stocks are higher in early action, led by tech with Treasury yields rising and the dollar getting battered, as gold surges.

The buzz

European defense stocks like Rheinmetall following a fractious meeting between President Trump and Ukraine President Volodymyr Zelensky. Bitcoin and other cryptos including Ripple’s XRP after a surge in prices on Sunday after Trump gave details of a strategic reserve. Shares of related stocks, MicroStrategy and Coinbase are flying.

Tesla stock is up over 3%. Chief Executive Elon Musk wrote over the weekend on X that he believes a 1,000% profit gain for the EV maker over five years is possible.

Blue Ghost has become the second private spacecraft to ever land on the moon. Space-related stocks like AST SpaceMobile and Rocket Lab are climbing.

The Institute for Supply Management’s manufacturing survey is due at 10 a.m., alongside construction spending.

The Trump administration reportedly is considering exclude government spending from gross GDP reports, which could ultimately distort the picture of the economy’s health.

Read the full article HERE.