U.S. debt is a spending problem, which neither party wants to stop.

Moody’s Ratings service waddled in Friday to state the obvious, which is that the U.S. is on an unsustainable debt trajectory. We’d like to know where Moody’s was when the Biden Administration was spending at record levels, but there’s still a warning here for the Republicans now in charge in Washington.

Moody’s downgraded U.S. debt to a notch below its top rating, citing chronic budget deficits and rising debt-service costs. The rating agency lagged behind S&P Global Ratings and Fitch, which downgraded the U.S. in 2011 and 2023, respectively. Moody’s may have been late because it believes in the Keynesian model that government spending lifts economic growth.

Markets on Monday reacted poorly to the downgrade, as well as comments by Treasury Secretary Scott Bessent that there may be more bad tariff news coming. He said the April 2 “reciprocal” tariffs could return for some countries if they don’t agree to President Trump’s supposedly generous terms. The 30-year Treasury bond yield hit 5% for the first time since autumn 2023, before falling back, and the 10-year appears to be settling near 4.5%.

Moody’s is no oracle, but its downgrade is a moment to explain America’s real deficit and debt issue. The problem is spending, which neither political party wants to restrain. More revenue from faster economic growth would help, but supply-side growth policies have ebbing political support, even in the GOP.

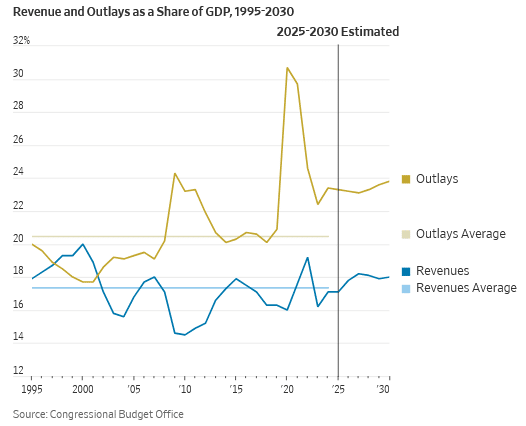

The nearby chart tells the Washington fiscal story as a share of gross domestic product from 1995 through the present and estimated through 2030. Revenues have held within a fairly narrow band not far off from the 17.2% average from 1995 through last year.

Revenues fell with the 2008-2009 recession, and again modestly and for a short time with the Trump tax reform that began in 2018. But they are back to the long-term trend and on current policy will increase over the next decade and beyond.

Spending is a different tale. The average for outlays from 1995-2024 is 21.1%, but they spiked to more than 24% amid the Obama spending blowout after the financial panic. The GOP Congress elected in 2010 shrunk outlays back down to the average, mainly by cutting domestic and defense discretionary spending. Entitlements kept growing.

Then the pandemic hit, and outlays exploded under Presidents Trump and Biden. They’ve declined some in the last two years, but they were still 23.4% of GDP in fiscal 2024.

That left a budget deficit of 6.4% of GDP last year, which is unheard of when the economy is growing and there is no war or emergency. The Congressional Budget Office says spending will keep growing as a share of the economy, as entitlements continue to boom. Spending is the debt driver.

Republicans could do something about this but may not have the votes. DOGE has cut around the edges, but President Trump won’t touch Medicare or Social Security. Too many Republicans won’t even fix Medicaid, which has soared since ObamaCare expanded coverage to able-bodied young men. The current House budget bill doesn’t do much more than sustain the Biden spending path.

Democrats and the press want to blame the tax portion of the House GOP bill, but that mainly keeps the current tax rates. The new Trump tax ideas—expanding social handouts via the tax code and state-and-local tax deductions for wealthy blue-state residents—do nothing for growth.

But its pro-growth tax provisions will at least kick back some revenue to Treasury, unlike more social-welfare spending. And if the bill fails to pass, the economy will be hit with a $4.5 trillion tax increase. Add Mr. Trump’s tariff tax of some $300 billion or so, and the economy might go into recession. Then watch spending and the deficit explode. Extending the lower tax rates and deregulation are crucial to keep the economy growing.

None of this is a fiscal or financial crisis, at least not yet. The dollar’s reserve-currency status gives the U.S. a unique borrowing privilege. There will always be buyers for Treasury bonds, though the question is at what price? Higher interest rates mean net interest on the federal debt is now 3% of GDP and closing in on $900 billion a year.

The Moody’s downgrade joins the list of warnings to Washington that the country needs better economic and fiscal policies. We wish we could see more signs of them.

Read the full article HERE.