New Reasons to Hold Gold

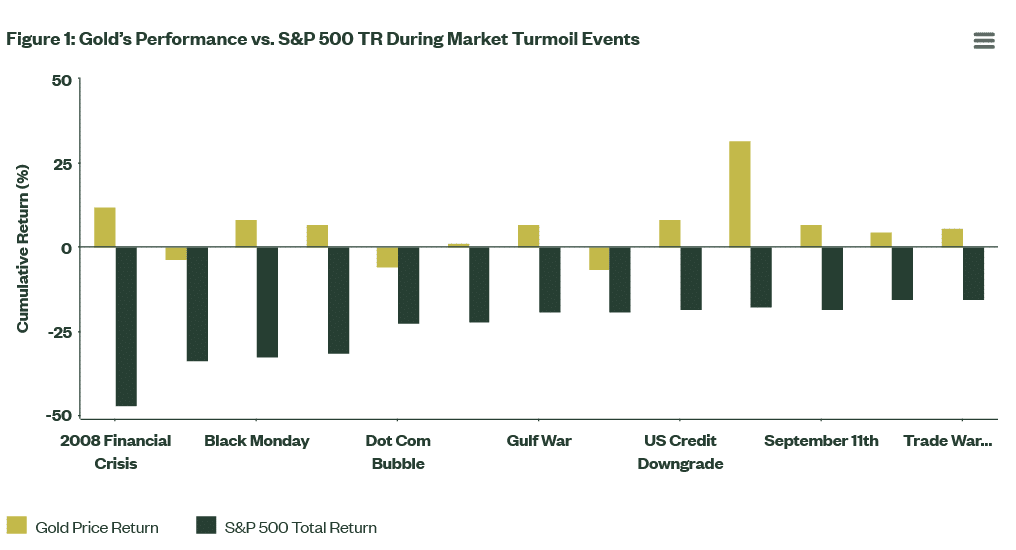

Investors typically turn to gold during times of economic crisis, market volatility, and the fear of an impending recession. Gold’s robust performance during the 2008 subprime crisis, the Dot Com bubble, and the September 11th attacks — is indicative of a reliable safe haven asset. Gold prices also tend to rise in response to a weakening U.S. dollar, lower interest rates, and an unstable labor market.

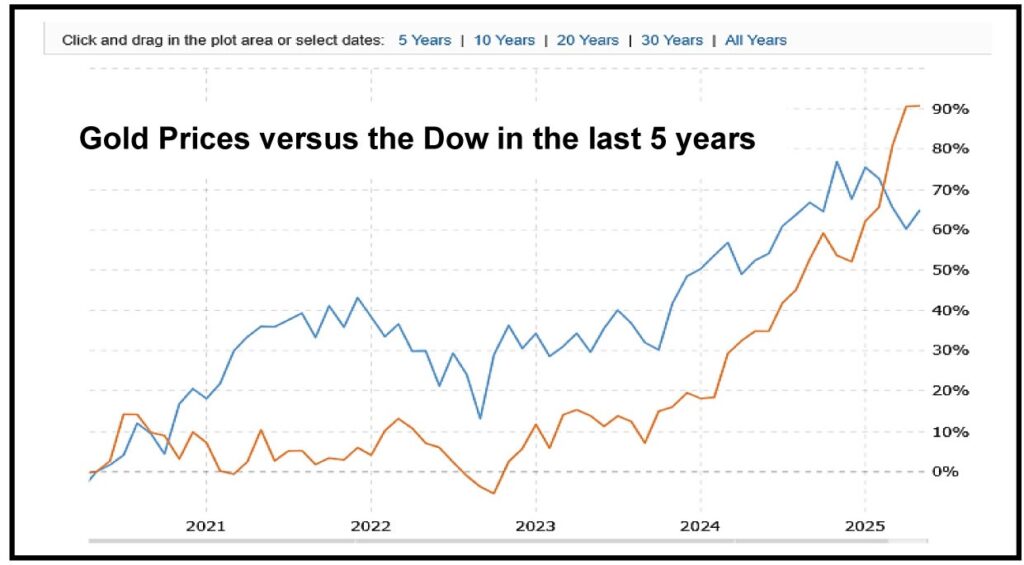

In 2025, however, gold has gained over 23% despite a recovering dollar, an elevated Federal Funds rate, and a relatively healthy job market.

Gold’s steady performance amid traditional headwinds suggests that it is no longer a mere crisis commodity but has become a strategic global asset with long term appeal.

A market insight from Blackrock back in February stated the following:

“Gold’s continued advance has occurred despite both the dollar and U.S. interest rates spiking higher. Since late September the dollar (DXY Index) has risen by nearly 10%, while long-term rates have climbed by almost a full percentage point. The fact that neither trend has disrupted gold’s performance speaks to the changing rationale for holding the metal, with central bank demand and U.S. deficits serving as support.”[1]

This sentiment has been echoed by both traditional and alternative asset experts who see gold evolving into a tactical investment that not only serves as a safe haven but can outperform stocks, bonds, cryptos, cash and even real estate with respect to liquidity. Investors are no longer buying gold just for portfolio diversification, they are also acquiring it as a profit asset capable of delivering significant returns in an increasingly dollar adverse world.

FTSE Russell recently declared that “gold is reasserting its role as a strategic asset in a fragmented, multipolar world — favoured by central banks seeking alternatives to the US dollar amid geopolitical and monetary shifts.”[2]

The ‘Incurable Defects’ Propelling Gold Prices

An ‘incurable defect’ is most commonly associated with real estate. It is used to describe a property with an inherent problem that cannot be reasonably remedied. A piece of land, for instance, that is close to an airport, near a busy intersection, or in the vicinity of a hazardous waste site is considered inherently flawed since it cannot be physically moved or improved upon with respect to its location.

Similarly, there are incurable defects within the financial landscape that have been driving gold prices to record levels, and they have no easy or apparent remedy.

The Waning U.S. Dollar

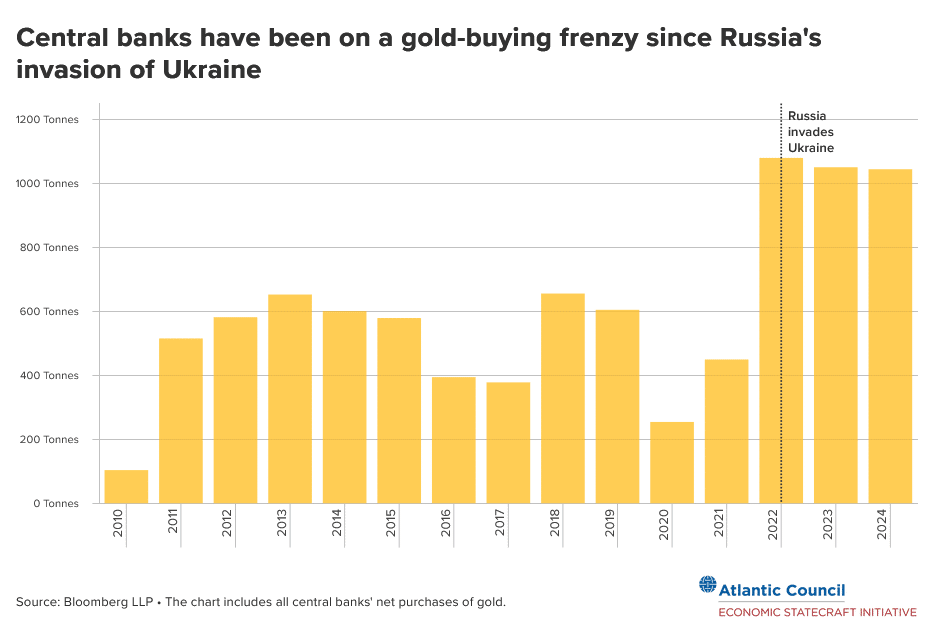

The world’s central banks have dramatically increased their gold purchases since 2019. While a host of factors are driving gold demand, a desire to reduce reliance on the dollar is among the leading triggers. Central banks are acquiring gold to diversify away from the buck in an effort to mitigate the risk of holding a single currency, particularly a declining U.S. Dollar.

According to London Investment management firm, The Man Group:

“As the geopolitical landscape fractures, central banks are ramping up bullion purchases to diversify reserves, driven by growing concerns over reliance on the US dollar … The US dollar served as the foundation of an open global trading system, backed by the economic and military strength of the US government. This framework allowed the US to sustain both fiscal and current account deficits for decades. However, the impartiality of the US dollar has been eroding in recent years. While US president Donald Trump’s recent trade policies have drawn significant attention, the weaponisation of the US dollar has been a bipartisan strategy, pursued across multiple presidential administrations.”[3]

Central Banks perceive the dollar as increasingly unstable. With U.S. debt and deficits on a record-breaking trajectory, concerns about America’s ability to pay its bills are growing. And as confidence in the greenback continues to erode, the world’s monetary authorities will continue to boost their gold reserves to protect their economies from financial risk.

The World Will Always be Risky

Among the top geopolitical risks of 2025 are the regional conflicts in the Middle East and Eastern Europe. The death toll in Gaza has now topped 50,000 while Russian and Ukrainian casualties are purported to be well into the hundreds of thousands. There are also ongoing tensions between the U.S. and China, the West and Iran, India and Pakistan — and conflicts raging in Africa particularly in Sudan and Myanmar.

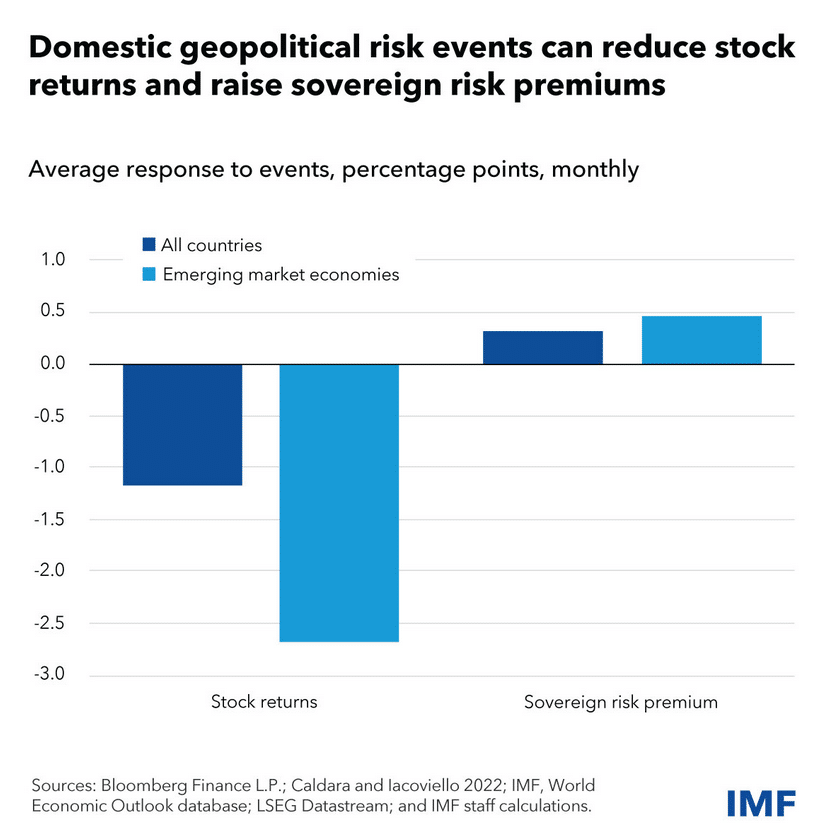

According to the International Monetary Fund these types of territorial disputes heighten financial risk:

“Global geopolitical risks remain elevated, raising concerns about their potential impact on economic and financial stability. Shocks such as wars, diplomatic tensions, or terrorism can disrupt cross-border trade and investment. This can hurt asset prices, affect financial institutions, and curtail lending to the private sector, weighing on economic activity and posing a threat to financial stability. Such risks are challenging for investors to price due to their unique nature, rare occurrence, and uncertain duration and scope. This can lead to sharp market reactions when geopolitical shocks materialize.”[4]

In 2025, there are the added threats posed by cyber-attacks, the rise of AI, an aging population, and falling birth rates. But border incursions, global discord, and existential threats are not exclusive to our era — these types of risks are the bane of every generation.

Back in the 1970’s investors grappled with the Oil Crisis, the collapse of Bretton Woods, and rampant stagflation. The Cold War, the rise of Islam, and the emerging threat of nuclear war confronted Ronald Reagan and the economy of the 1980’s. The 1990’s saw the Soviet Union collapse, China emerge as an economic power, and global terrorism go mainstream with the rise of international extremist groups.

The reality is, the world will always be dangerous and investors will continue to look to gold as a reliable safe haven and store of value.

Finite Supply amid Chinese and Indian Demand

Gold has long been a symbol of wealth, prosperity and status — but perhaps to no greater extent than in China and India. Both countries revere gold as a financial asset and a commodity of societal importance.

The Chinese have as strong connection with gold and the reasons are inherently economic as well as deeply cultural according to the Smithsonian:

“In Chinese culture, gold is associated with power, wealth, longevity, and happiness. It is considered the most valuable and significant gift one can give, and is included in many celebrations, such as weddings, the birth of a child, the New Year, and other important occasions. Historically, gold’s importance made it a valuable ingredient in the ‘elixir of immortality.’ It was also important in rituals and ceremonies associated with unsolvable problems or unexplainable natural phenomena.”[5]

Gold also has deep cultural and religious significance in India. It is similarly tied to ceremonies, festivals, and gift giving but Indians are also renowned for their use of gold in adornment and for their iconic gold jewelry.

According to Vummidi Bangaru jewelers in Tamil Nadu, Southern India:

“Indian jewellery has always been renowned for its intricate designs, craftsmanship, and the cultural stories it tells. From the Mughal courts to the temples of South India, Indian jewellery is a blend of history, tradition, and artistry … The evolution of Indian jewellery is a story that spans thousands of years, reflecting the changes in human society, culture, and technology. From the earliest shell beads worn by our ancestors to the elaborate gold and diamond creations of today, jewellery has always been a way for us to express our identity, status, and beliefs.”[6]

Aside from heavy gold purchases by the central banks of China and India, gold sits at the very heart of the heritage and traditions of both countries. Its role in their customs dates back thousands of years. And its rarity and limited supply will continue to prop up gold prices amid steady demand from both nations — which are among the world’s fastest growing economies.

The Bullish Gold Outlook for 2025-2026

Most experts expect gold prices to continue to rise throughout this year and into next. Goldman Sachs cites central bank buying as well as renewed interest from investors as propelling gold to new record highs:

“Since March, investors have been increasing their holdings of gold, driven by concerns about the health of the economy and market volatility. Longer term, Goldman Sachs Research expects prices to be propelled by multi-year demand from central banks. Our analysts’ gold price prediction is for these two factors to push the metal to new record highs.”[7]

Meanwhile, JP Morgan sees gold prices surpassing $4000/oz by Q2 2026 and asset management firm Incrementum has a “forecast corridor” of $4,800 to $8,900 declaring that the role of gold has changed into is a portfolio outperformer:

“The growing gap between gold and the S&P 500 since the beginning of the year points to fundamental changes. Capital is increasingly flowing from US markets into the safe haven of gold – but also increasingly into Europe and selected emerging markets. If this trend is confirmed, it would be a clear signal of a sectoral and geographical rotation with far-reaching consequences … In other words, we are witnessing capital outflows from a once immensely popular and widely held sector into performance gold, an asset that has lingered in the shadows for nearly a decade.”[8]

We are indeed witnessing a fundamental shift both in the perception of gold, its sources of physical demand, and its performance expectations versus other assets. This is a turning point for a rare commodity once deemed outdated and which John Maynard Keynes referred to in 1924 as a “barbarous relic.” Just four years after his declaration, America would witness the greatest stock collapse in its history with the Dow Jones losing almost 90% of its value.

We are, as President Trump has declared, living in the new “golden age” — and we’re reminded that it is not necessarily a new awareness of the world’s most valuable precious metal — but more of a strategic reawakening.

This article was brought to you by Thor Metals Group. Our representatives are standing by to discuss adding gold to your portfolio. We’re currently offering a percentage of free metals matched to every dollar of gold you purchase.

Call 844-944-THOR (8467) to speak to an expert right now. Or fill out our online form, and we’ll reach back out to you.

[1] https://www.blackrock.com/us/individual/insights/stay-long-gold

[2] https://www.lseg.com/en/ftse-russell/research/gold-in-a-fragmented-world-safe-haven-and-strategic-asset

[3] https://www.man.com/insights/views-from-the-floor-2025-april-29

[4] https://www.imf.org/en/Blogs/Articles/2025/04/14/how-rising-geopolitical-risks-weigh-on-asset-prices

[5] https://library.si.edu/es/donate/adopt-a-book/ancient-chinese-gold

[6] https://www.vummidi.com/blog/history-of-indian-jewellery/

[7] https://www.goldmansachs.com/insights/articles/why-gold-prices-are-forecast-to-rise-to-new-record-highs

[8] https://ingoldwetrust.report/wp-content/uploads/2025/05/In-Gold-We-Trust-Report-2025-Compact-Version-english.pdf