President Donald Trump loves gold. He uses it to adorn his properties. So it is perhaps fitting that gold is experiencing a tremendous bull run during his second term.

The SPDR Gold Shares exchange-traded fund (ticker: GLD) is up about 28% this year, compared with a 0.15% decline for the S&P 500 indexSPX-0.08%. A day seldom passes without bullish gold news for the precious metal.

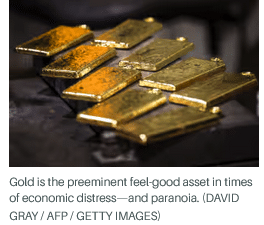

Unfortunately, gold is popular for reasons that likely annoy the president. As the preeminent feel-good asset in times of economic distress—and paranoia—its allure is stronger now as investors struggle to understand Trump’s master plan for remaking the U.S. and global economy.

Gold’s extraordinary price performance suggests that investors are undecided about Trump’s bold idea to use tariffs against trading partners to enrich the U.S. and liberate Americans from income taxes.

Much remains unsettled. Trump’s “big, beautiful bill” passed the House and now awaits the Senate. If approved, it would increase the deficit to about 125% of the economy’s output, which would, according to traditional thinking, hobble America with economic problems and financial risks if the tariff plan fails to produce.

To a real estate tycoon like Trump, who has often used debt as a tool to unlock asset values, deficits probably aren’t as concerning as to those who consider massive government debt to be the economic equivalent of the Covid virus.

If the president is right, the world will pay to access American consumers—perhaps the world’s greatest purchasing force—and the deficit and income taxes will cease to be problematic.

Trump’s approach is revolutionary, and potentially catastrophic, which should support gold’s continued advance. Goldman Sachs has told clients that it sees gold rising to $3,700 a troy ounce by the end of 2025, up from $3,326 on May 23.

All of this enriches investors who own gold, while creating challenges for those who have enviously watched the rally. Few canny investors like chasing hot stocks, as the risk of a price reversal is high.

In this case, gold’s price momentum can be harnessed with a so-called bull spread using call options, which limits money at risk while still allowing for potentially astronomical returns.

Aggressive investors who are intrigued could buy the gold ETF’s September $310 call and sell the September $330 call. This spread cost about $6.35 when GLD was at $304.50. One hundred shares of the ETF would cost about $30,450, much more than the options that control the same number of shares.

The spread’s maximum profit is $13.65 if GLD is at $330 at expiration. During the past 52 weeks, the ETF has ranged from $211.54 to $317.63.

We selected a September expiration for a recent stock market hedge, and are suggesting it again in deference to the challenges that define the rest of 2025.

An extraordinary number of economic reports will challenge stock and bond prices, and options volatility, as investors try evaluating the impact of tariffs—and the outcome of three Federal Reserve rate-setting meetings.

The Fed is expected to lower interest rates in September. Until then, any hint of economic weakness should prompt more investors to buy gold and flee stocks—and maybe even bonds.

Though gold’s preeminence in chaotic times is assured, recent trading activity reveals increasingly volatile intraday price swings. This suggests investors are actively arguing about the sustainability of gold’s price.

If there were more agreement, there would be less price volatility and intraday moves would be narrower. The disagreements reinforce the merit of managing risk while positioning for further gains.

Read the full article HERE.