US consumers hit the brakes in April while goods imports plummeted by a record as companies adjusted to higher tariffs.

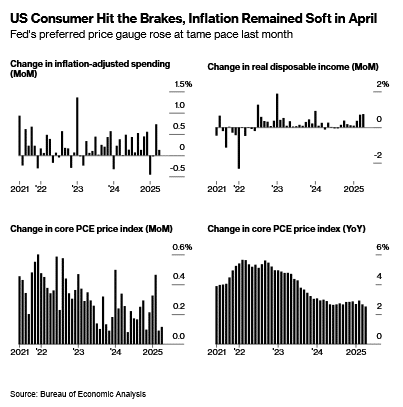

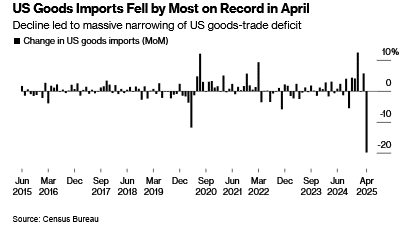

Inflation-adjusted personal spending rose 0.1% after rising 0.7% a month earlier, Bureau of Economic Analysis data showed Friday. Separate data showed an almost 20% slump in imports, leading to a massive narrowing in the US merchandise-trade deficit in April.

Meanwhile, the Federal Reserve’s preferred price gauge remained tame. The personal consumption expenditures price index, excluding food and energy, increased 0.1% from a month earlier. Compared with a year earlier, the so-called core inflation gauge rose 2.5% from April 2024 — the smallest annual advance in more than four years.

The data offer a snapshot of the economy during a month when the Trump administration raised tariffs on China goods to 145%, roiling stock markets and prompting companies to halt orders for imported goods. The figures reflect an undercurrent of anxiety among many American consumers about the economy after the weakest quarter for spending in nearly two years. Higher duties on imports had yet to show up more broadly in higher goods prices, as sentiment slumped and the outlook for personal finances stood at a record low.

Levies have since come down after the US and China agreed to a temporary drop in tariffs on their respective goods while the two countries negotiate a deal. It may have led some importers to resume shipments in May, but the constant state of flux in trade policy has since fueled further uncertainty. This week a US court issued a ruling that blocks many of the import taxes, and on Friday President Donald Trump accused China of violating an agreement with the US to ease tariffs, ratcheting up tensions between the world’s two largest economies.

Meanwhile, Fed policymakers will likely keep interest rates unchanged for the foreseeable future until they get more clarity on the impact of tariffs not only on prices but also on other pillars of the economy like the labor market and consumer spending.

The modest rise in April spending reflected an increase in services that more than offset a decline in durable goods outlays.

Economists are paying close attention to the degree to which companies are passing through higher import duties to consumers. A measure of goods inflation that excludes food and energy climbed 0.3%.

While many companies have so far been absorbing or offsetting much of the hit from tariffs, retailers including Walmart Inc. and Macy’s Inc. have indicated Americans will start seeing price hikes soon.

Services Costs

Core services prices — a closely watched category that strips out housing and energy — were little changed. That was the tamest in five years.

According to minutes of the Fed’s May meeting, released earlier this week, central bank staffers marked down their expectations for economic growth in 2025 and 2026, reflecting the announced trade policies.

And while job growth has shifted into a lower gear since last year, the labor market remains the main engine fueling consumer spending. Real disposable income increased 0.7% for a second month, fueled by government transfer payments, according to the BEA.

Excluding government transfers, personal income still advanced at a healthy pace. Nominal wages and salaries rose 0.5% for a third straight month. The saving rate increased to 4.9%, the highest in nearly a year.

Read the full article HERE.