Risk of financial sanctions prompts Beijing to rethink where it parks its massive foreign exchange reserves

Ever since the US dollar cemented its role as the backbone of the global financial system following the second world war, it has been a weapon of choice for American presidents waging economic warfare.

But as the United States’ use of sanctions has proliferated in recent years, concerns have grown in China and elsewhere over whether the US dollar can remain a safe haven currency.

Now, following Donald Trump’s victory in Tuesday’s US presidential election, a fresh wave of uncertainties looms over the US dollar and US dollar-denominated assets.

“We’re still a safe haven – [offering] flight to safety in a messy dangerous world – and that’s a huge benefit,” former US treasury secretary Timothy Geithner told Bloomberg News in July.

He then cautioned that “people in policy have to understand: that position the dollar enjoys, there’s no entitlement to that. It’s not like a guarantee”.

When the governments of the world’s most-advanced economies, led by the US, froze nearly half of the Bank of Russia’s foreign reserves following Russia’s invasion of Ukraine in February 2022, it was a stark reminder to China that its foreign exchange reserves, the world’s largest, could also be affected by US sanctions.

The probability of a worsening financial relationship between China and the US is “high” now that Trump is heading back to the White House, according to Yang Siyao, a researcher at Tsinghua University’s PBC School of Finance.

It will mean bigger risks for China in holding US dollar-denominated assets, Yang said, adding that China should be prepared for the “worst case scenario”.

“For example, the risk of a forced sale or freezing of related [US] assets also needs to be considered,” Yang said.

Trump started a trade war with China in 2018, a year into his first term as US president, and promoted American “decoupling” from the world’s second-largest economy.

At a campaign rally in September, he threatened to slap 100 per cent tariffs on countries that shun the US dollar – a move seen as part of his plans to protect the currency’s dominant role in the global financial system.

The US dollar serves as the primary currency for international trade, central bank reserves and global debt issuance. And bonds, bills and notes issued by the US Treasury – held by central banks and institutions around the globe as marketable securities – have been viewed as a safe haven asset.

China’s foreign exchange reserves started to grow in the 1990s as part of its transition towards a more open economy. The 1997 Asian financial crisis, when Asian currencies were devalued, prompted Beijing to build a financial war chest to protect against external shocks.

Its foreign exchange reserves increased as its international trade and foreign direct investment expanded over the years, with State Administration of Foreign Exchange data showing they totalled US$3.261 trillion last month, down from US$3.316 trillion in September.

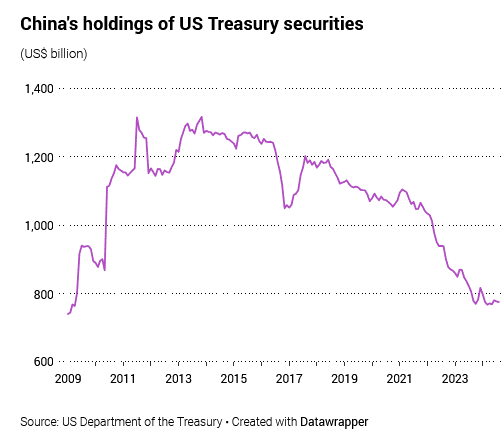

While China does not disclose where it parks its money, a significant proportion is invested in US government debt, according to official US data. As of August, China’s holdings of US treasury securities totalled US$774.6 billion, making it the second-largest foreign holder of US government debt behind Japan’s US$1.13 trillion.

But the rising risk of sanctions means questions have long been asked in China about whether Beijing should continue to invest in US treasuries.

Yu Yongding, a former adviser to China’s central bank, has urged Beijing to curb its investment in them, warning about the growing risks of a US debt crisis and the “weaponisation” of the US dollar in international trade amid geopolitical tensions.

The US’ worsening debt problems could trigger a crisis of confidence in the US government’s creditworthiness, Yu said. The US government sells US treasuries to finance its deficit.

US President Joe Biden’s administration racked up a budget deficit topping US$1.8 trillion in the financial year that ended in September, up more than 8 per cent from the previous year and the third-highest on record, the US Treasury Department said on October 18.

The banking system is another concern for China when it comes to relying on the US dollar, following repeated threats from Washington that it will kick Chinese banks out of the Society for Worldwide Interbank Financial Telecommunication – the formal name for the Swift messaging system that facilitates rapid cross-border payments – if they deal with Russian entities that have been subjected to sanctions.

US Treasury Department data shows that China began cutting its holdings of US government bonds around 2014, after they peaked at over US$1.3 trillion in 2013. In 2022, China’s holdings of US treasuries fell below US$1 trillion for the first time since 2010.

Brad Setser, former US Treasury Department economist and a senior fellow at the Council on Foreign Relations, said China could also be holding US treasuries through the use of custodians outside the US, which would not be listed as Chinese holdings in the department’s data.

“But in the last couple of months of data, China’s reported US holdings have been steady or increased just a bit – so there isn’t even a fall in the headline numbers right now in any meaningful sense,” Setser said.

In addition to its reported foreign reserves, China has maintained a substantial exposure to US dollar denominated assets through its large state commercial banks, the state policy banks, and its sovereign wealth fund, China Investment Corporation (CIC).

China launched CIC in 2007 to better manage its ballooning reserves and diversify investments beyond US dollar holdings, targeting higher-yielding opportunities abroad .

CIC said its total assets were valued at US$1.33 trillion at the end of last year, up 7.46 per cent year on year, with nearly 50 per cent of its overseas portfolio invested in alternative assets such as hedge funds and property, and a third invested in stocks – 60.29 per cent of them US-listed, up from 59.18 per cent in 2022.

Robert Greene, a vice-president at financial services consultancy Patomak Global Partners, said China is likely to maintain “very large holdings” of US dollar assets in the near term.

“China’s monetary policy approach and trade imbalances inherently bring about Chinese demand for foreign currency assets,” said Greene, who is also a non-resident scholar at the Carnegie Endowment for International Peace.

“Moreover, China’s foreign exchange reserves are so sizeable that there are structural impediments to meaningfully reducing the dollar’s share of these reserves while holding the level of reserves relatively constant.”

The Official Monetary and Financial Institutions Forum (OMFIF), a London-based finance think tank, has predicted that the US dollar’s share in world currency reserves could decline to 40 to 45 per cent by 2050 from around 60 per cent at present. It said emerging economies could become more aggressive in promoting the use of non-dollar currencies amid questions over the US’ persistent budget and current account deficits and their impact on the sustainability of US debt.

According to the US Treasury Department, America’s national debt stood at US$35.46 trillion at the end of September, giving it a debt to gross domestic product ratio of 124 per cent.

Vitor Gaspar, director of the International Monetary Fund’s fiscal affairs department, told a news conference on October 23 that while the US’ debt has grown steadily, it is still sustainable.

“We do believe that the situation in the United States is sustainable because the policymakers in the United States have access to many combinations of policy instruments that enable them to put the path of public debt under control,” Gaspar said.

For China, there are other things to consider when it comes to US treasuries, apart from their role as safe haven assets, Wu Guoding, an associate researcher at Chinese Academy of Social Sciences, wrote in an article in Shijie Zhishi, a semi-official foreign affairs magazine, in September.

“In addition to the economic significance, holding a certain amount of US debt also has certain political significance for China,” Wu wrote.

“Given the importance of US debt to the US, China can maintain its influence on the US capital market and even on US politics by holding US debt, making the US cautious in dealing with China-US relations.”

Zerlina Zeng, head of Asia strategy at CreditSights, which conducts research on credit markets, said China was likely to promote the use of the yuan – also known as renminbi – globally to reduce its reliance on the US dollar.

She said it is already promoting the use of the Chinese currency in trade and financial transaction settlement to further its internationalisation.

“In the offshore debt market, Chinese state-owned enterprises and the Chinese government are increasingly using offshore yuan, non-dollar G3 [the euro and Japanese yen], or even emerging currencies for refinancing and new debt,” Zeng said.

“We expect these trends to continue post the US election.”

Read the full article HERE