Gold rose as traders weighed the US fiscal outlook following the end of the longest government shutdown in history.

Bullion climbed for a fifth session to trade near $4,230 an ounce, after US President Donald Trump signed legislation to end the longest government shutdown on record. However, the White House has warned that official jobs and inflation data for October are unlikely to be released.

The data void throughout the shutdown has caused investors to fly blind or rely on private statistics for a temperature check on the world’s largest economy. Gold has rallied in that environment, boosted by a string of weak private data releases. The October jobs and consumer price index reports may well never be published, even after the government shutdown.

“This data ‘blackout’ should continue to boost demand for safe haven assets like Treasuries and precious metals,” analysts at BMO Capital Markets wrote in a note.

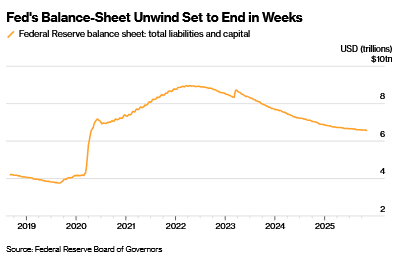

There’s also the prospect of the Federal Reserve injecting further liquidity into the financial system, and a pivot to looser monetary policy that could benefit precious metals. The US central bank “won’t have to wait long” before purchasing assets to sustain desired liquidity levels, the Federal Reserve Bank of New York’s Roberto Perli said on Wednesday.

Last month, Fed officials announced they would stop shrinking their balance sheet — which drains liquidity — starting Dec. 1, amid volatility in short-term funding markets.

Combined with elevated US fiscal deficits, and further spending suggestions from President Donald Trump, that could bolster the so-called “debasement trade” theme — the retreat from sovereign debt and the currencies they are denominated in — over fears their value will be eroded over time.

That concern has helped power gold’s 60% rally this year, as investors and central banks step up purchases to hedge against growing fiscal unease in some of the world’s biggest economies. The precious metal remains on track for its best annual performance since 1979.

Though gold has yet to regain last month’s record above $4,380, several investors are forecasting another advance to $5,000 and beyond next year. China has been a leader among central-bank buyers, supporting its aim of building a world less dependent on US-centric financial markets.

Gold rose 0.8% to $4,227.96 an ounce as of 11:09 a.m. London time. The Bloomberg Dollar Spot Index fell 0.2%. Silver climbed toward a record high, while platinum and palladium also rallied.

Read the full article HERE.