“The world is entering an era of protectionism” as the U.S. turns to aggressive tariffs, warns one China expert. How nasty will it get?

The tariffs are coming.

The scope, targets, and even the ultimate objective remain unclear, but President-elect Donald Trump is widely expected to unleash a new front on the trade battle that he started in his first administration.

Trump, who has described tariffs as the “most beautiful word in the dictionary,” has consistently viewed duties as a valuable weapon—a reason that investors are taking seriously the risk of 60% tariffs on goods from China and 10% to 20% universal tariffs on all other imports. They serve another purpose: Revenue, paid by U.S. companies importing goods, could be used to offset the tax bill Trump has promised.

Scenario planning has started in earnest among investors, trading partners, and companies such as cosmetics maker e.l.f. Beauty ELF +0.74% and toolmaker Stanley Black & DeckerSWK+0.10%, which have already warned investors about the prospects of higher prices and curtailed growth in the event of more tariffs. The International Monetary Fund has warned that a tariff battle—one that doesn’t escalate into a full-on trade war— could shave 0.5% off global economic output in 2026.

Investors who remember the trade battle that Trump waged in 2018, and the volatility from the tit-for-tat between the U.S. and China as their relationship fractured, are reviving their old playbooks. One nugget of optimism: Markets were calmed once Trump struck a so-called Phase One trade deal that rolled back some of the tariffs in return for China vowing to make some reforms, as well as committing to buy aircraft engines, soybeans, and services. China didn’t keep the promise.

This time around, investors are grappling with a changed backdrop that could make a trade battle that ignites inflation and dents global growth more complicated. Inflation is much higher, Europe’s growth is anemic, and China’s economy is sputtering.

Upending Global Trade

Trade patterns have also been reshuffled so that beneficiaries the last time around—such as Mexico—could now be in the Trump administration’s crosshairs as countries, including China, reroute trade to circumvent duties. China has revved up its export machine, sending its excess supply of electric vehicles, steel, and chemicals abroad, pushing countries to impose their own tariffs to protect their domestic manufacturers.

“The world is entering an era of protectionism,” warns Eswar Prasad, Cornell University professor and former head of the China division at the IMF. “The U.S. turning aggressively to tariffs—and the second-largest economy in the world desperate to expand its exports—creates the perfect storm.”

How nasty the storm gets depends on a complicated exercise with a host of characters abroad and at home. Part of it depends on who holds sway in the new administration. It is expected to include China hawks like Robert Lighthizer, a protectionist who has pushed for less reliance on China and who crafted trade policy in the first Trump administration, as well as an array of advisers like Tesla TSLA +1.27%’s Elon Musk and Blackstone’s Stephen Schwarzman, who have strong business ties to China.

That variability—with the most extreme scenarios creating the most precarious tariff backdrop since the 1930s—is keeping many strategists cautious about big bets abroad and tilting toward U.S. stocks as they game out potential scenarios.

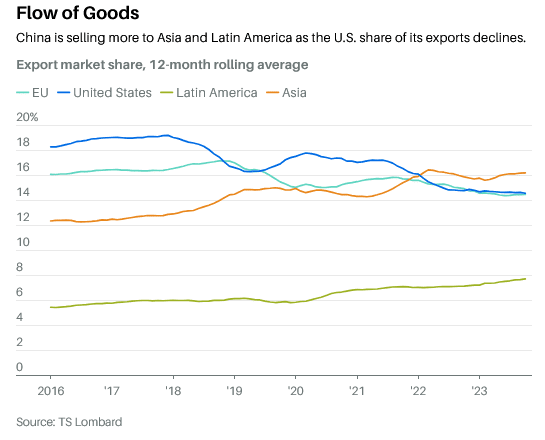

Trump’s long-term focus on trade imbalances puts China in the spotlight. Its trade surplus is approaching $1 trillion as the country leans on exports to help its ailing economy. But while the surplus has grown, China is increasingly selling more to other parts of the world than the U.S. Its goods deficit with the U.S. fell to $279 billion last year from $343 billion in 2019.

Still, China is widely expected to be the first target, offering the cleanest route to imposing tariffs amid bipartisan support for a tougher stance against the People’s Republic. Analysts expect the new administration, as early as the first day, to label China in violation of the Phase One trade deal, setting in motion an enforcement mechanism that could impose tariffs on China within months.

Roughly half of Chinese imports are already subject to tariffs, averaging about 10%, according to the Peterson Institute for International Economics. An escalation would target the remaining half, which includes consumer electronics and staples found at dollar stores, as well as chemicals and other inputs for industrial companies. “It would cause inflationary pressure on those who can’t handle it,” says Veda Partners’ Henrietta Treyz, noting the likely hit on middle-class households.

Oxford Economics estimates that raising tariffs on Chinese goods to 60% could boost the U.S. consumer price index by at most 0.7%, while a blanket 10% tariff could add another 0.3%.

A Phased Approach?

Tariff increases could come in phases. Mary Lovely, senior fellow at the Peterson Institute, expects the new administration to issue pre-exemptions that shield some companies or subsectors, possibly within consumer goods. That could mitigate some of the inflationary pressures.

Most analysts expect the trade battle to unfold in segments, since placing tariffs on China as well as universal tariffs of as much as 20% on the European Union, United Kingdom, and others would increase the risk of an inflationary spike and rattle markets, as companies wouldn’t be able to find a “safe” alternative place to source goods. Tariffs would be everywhere.

The most optimistic scenario calls for an initial salvo of tariffs on China, followed by an attempt at dealmaking. The strength of the U.S. economy and concerns about China as a strategic rival with its own economic challenges could give Trump a strong hand. “We see a lot of governments trying to think about how they will appease him. The U.S. economy will continue to grow, and it’s an important market for everyone,” Lovely says.

Chinese officials have been visiting Washington, D.C., for months to gauge what type of deal could be appealing, says Derek Scissors, a fellow at the American Enterprise Institute who recently served as a commissioner on the U.S.-China Economic and Security Commission, which advises Congress on China-related issues. The Trump administration’s lesson from the first deal, where China didn’t honor its commitments to buy an additional $200 billion in exports, probably means that the administration first places tariffs, probably 50%, before entertaining any deals.

China’s economic troubles could coax its officials to come to the table sooner—possibly with bigger commitments to buy U.S. agricultural products and energy, as well as possible investments in production in the U.S. that could create jobs. While more-hawkish prospective members of the administration have advocated curtailing Chinese investment in the U.S., Scissors thinks there could be some sectors that aren’t off-limits where Trump would welcome investment.

Critical to any sort of deal is assessing what the new administration’s objective is—and what the Chinese think it is, says Logan Wright, who leads Rhodium Group’s China Markets Research. If the Chinese view the tariffs as a stick to get them to invest more in the U.S., Wright expects a more modest tariff increase—and possibly a temporary one.

China’s Response

But if China sees the battle as a way to punish its economy or accelerate decoupling, a deal is less likely. And retaliation could be sharper, possibly with measures to disrupt the revival of U.S. manufacturing through critical mineral restrictions or their own tariffs on inputs to intermediate goods that raise prices. Even in a more benign scenario, China is likely to retaliate to a tariff increase, albeit in ways that may not hurt as much at first. U.S. agricultural products are a likely target.

Economists expect a trade battle to potentially shave two percentage points off Chinese economic growth—far from ideal for a country already trying to stabilize its growth.

To cope, China will probably redouble efforts to reduce reliance on the West. And it will probably step up fiscal stimulus, possibly with subsidies for exporters hit by tariffs to ensure the pain doesn’t lead to job cuts. Beijing could also devalue the renminbi to offset some of the hit, but this comes with some dangers.

While China could handle a 3% to 5% depreciation, a 10% to 15% weakening could trigger a wave of devaluations among emerging markets looking to maintain their competitive position—and that could risk capital outflows and financial instability, Prasad says.

If no deal looks likely within a month or two of the U.S. imposing tariffs, markets will get jittery as the risk of escalation by the U.S. increases. Beyond raising tariffs even further, Scissors says the U.S. could look to levy duties on Chinese companies operating elsewhere, like in Mexico, to circumvent tariffs or find ways to restrict U.S. companies’ investments in China.

Other market spoilers persist too. Congress is expected to introduce a bill to revoke China’s permanent normal trade relations status, which was granted in 2000—a move Lighthizer has advocated for years. If passed, it would ratchet tariffs higher and bring tensions to a new high by putting China in the same camp as North Korea and Russia. “This is a far-reaching, potentially permanent, and quite dramatic change to the U.S. trade landscape,” says Treyz, who sees 40% odds of such a bill passing.

That would rattle markets, with the Peterson Institute estimating the move and resulting retaliation could increase the U.S. consumer price index by 0.6% and lower U.S. gross domestic product by almost $160 billion between 2025 to 2028.

Universal Tariffs

The other channel for a trade battle is blanket tariffs of up to 20% on goods from the rest of the world. If the administration imposes these tariffs at the same time it goes after China, strategists expect a much bigger selloff in markets—and a larger inflation hit.

For now, many expect Trump to tap the International Emergency Economic Powers Act to start with a 10% duty later in the year. The U.S. doesn’t export that much to Europe, limiting the potential retaliation to a handful of goods like Harley-Davidson HOG -1.01% motorcycles or whiskey. In this scenario, the economic hit to the region could be limited.

Andrew Kenningham, chief Europe economist at Capital Economics, estimates a 0.2% hit to the region’s GDP if Trump levies a blanket 10% tariff.

Germany’s auto sector could face a harder time. Trump has complained about Germany’s large trade surplus and specifically its auto sector, which tends to design and make cars at home but sends them to the U.S. for final assembly. Though the sector could ride out a 10% tariff, Kenningham says German auto makers would have a harder time absorbing a 20% tariff. They would probably have to raise car prices, which could dent their sales to the U.S. by 50%., resulting in an additional 0.2% hit to Germany’s GDP.

Hitting Europe with tariffs would probably rattle markets, Treyz says. For now, Pantheon Macroeconomics economist Claus Vistesen expects the European Central Bank to cut interest rates less than expected as it waits to see the scope of Trump’s tariff battle.

The situation with Mexico is even trickier. While Trump has proposed 200% tariffs on cars made in Mexico, analysts say placing tariffs on Mexico would put the U.S. in violation of the U.S.-Mexico Canada Trade Agreement that was one of the hallmarks of the first Trump term.

Also problematic: U.S. companies have invested aggressively in Mexico to diversify production. That could create a loud lobbying pushback against the tariffs. Analysts expect the administration to use saber-ratting about a tariff to push President Claudia Sheinbaum to impose new immigration rules at the border—helping Trump make progress on another priority, Treyz says.

Mexico’s economy could be in for a tough period, with potential deportations driving up unemployment and the Chinese investment powering Mexico’s growth potentially coming under increased scrutiny. The iShares MSCI Mexico EWW +0.28% exchange-traded fund (ticker: EWW) is down 25% this year.

Nuveen Chief Investment Officer Saira Malik favors U.S. stocks, especially more domestically focused companies that are better insulated from tariffs, and is wary of making any foreign bets.

Others are also cautious. “Sometimes you just have to wait,” said Ian Shepherdson, chief economist at Pantheon Macro, in a briefing. “The potential policy changes are quite gigantic—or it could be a huge bluff.”

Read the full article HERE.