Key Points:

- Goldman Sachs forecasts gold prices to reach $4,900 by the end of 2026, a 21% gain from Tuesday’s price.

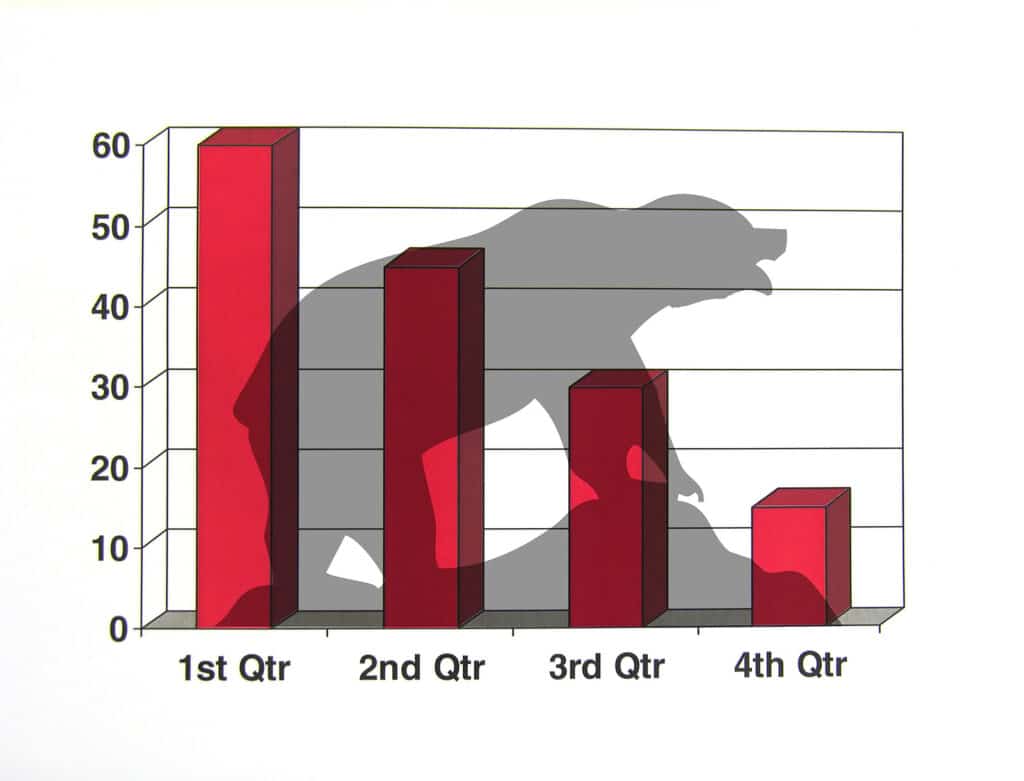

- Gold has fallen approximately 6% to $4,062 an ounce since reaching an all-time high of $4,336 on October 30.

- The U.S. dollar’s strengthening and a decreased likelihood of a December interest-rate cut have impacted gold prices.

Gold is having a bad month. The struggles will likely turn out to be a blip rather than the start of a sustained downturn, Goldman Sachs says.

All in all it has been a great year for gold, with the precious metal up nearly 75%. Starting about a month ago, however, investors began to show some doubts. Gold reached a record high of $4,336 an ounce on Oct. 30. Since then, it’s tumbled about 6% to $4,062 on Tuesday.

One culprit has been a strengthening U.S. dollar. Since gold is priced in dollars, a stronger dollar makes gold more expensive for global buyers who need to swap out of local currencies to acquire the metal.

A separate, but related, factor is the outlook for U.S. interest rates. A month ago, markets were all but certain the Federal Reserve would issue another interest-rate cut in December. In the past few weeks, those odds have fallen below 50%. Higher U.S. interest rates help strengthen the dollar and make gold, which doesn’t pay any interest, comparatively less attractive than Treasuries.

The question weighing on gold investors: Is this just a bull market gut check, or the start of a bigger selloff?

Put Goldman Sachs clearly in the blip camp.

On Monday, the investment bank forecast gold prices would hit $4,900 by the end of 2026, representing a gain of about 21% on Tuesday’s price. The metal could go even higher, according to Goldman analyst Lina Thomas. She sees “significant upside if the private investors diversification theme were to gain more traction”—a reference to more U.S. and international investors buying gold to complement their stock-and-bond portfolios.

What’s behind all the bullishness? The current gold rally has been driven by heavy buying from two key sources—central banks and private investors, such as retirement savers, investment funds and more. Goldman doesn’t see either one changing their behavior.

Central banks began buying gold to move away from dollar-denominated assets in 2022, after the U.S. froze Russian assets in response to the country’s invasion of Ukraine. That rationale hasn’t changed, notes Goldman, which says central banks’ purchases appear to have ticked up in September, the latest month for which it has data.

Gold buying by investors, such as Main Street retirement savers, also appears to be on the rise. So far this year, investors have poured more than $41 billion into SPDR Gold Shares and other exchange-traded funds. While ETF investors have pulled some money out in the past month, the turnaround hasn’t been dramatic, with the funds seeing outflows of only around $1.2 billion. Thomas expects ETF investors, alongside ultrahigh net worth individuals who buy physical gold, to continue accumulating the metal.

Goldman isn’t the only one that remains bullish despite the pullback. Last week, strategists at UBS predicted gold could hit $5,000 in 2026 or 2027.

Read the full article HERE.