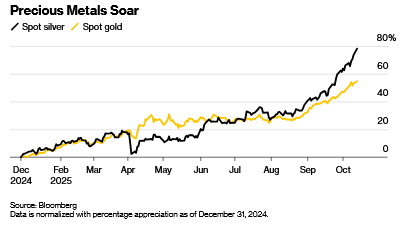

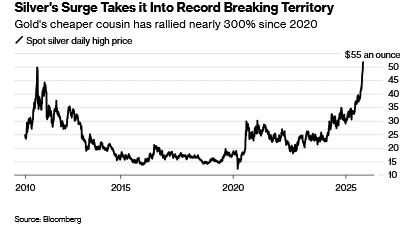

Gold has staged a dramatic rally this year as Russia’s war in Ukraine and the US Trump administration’s unorthodox economic policies sent investors and central banks reaching for safe-haven assets. Right now, however, it’s silver that’s stealing the spotlight.

A squeeze in supply of the precious metal has catapulted it to a 70% gain on the London market this year, compared with a 55% increase for gold as of mid-October. Both have been experiencing a surge in demand from investors, who value their price stability through periods of political turbulence, inflation and currency weakness.

Unlike gold, silver isn’t just scarce and beautiful: It also has useful real-world properties that make it a valuable component in a range of products. With inventories at their lowest in years and investors still scrambling for more, there’s a risk of supply shortages that could impact multiple industries.

Who needs silver?

Political and fiscal uncertainty this year in major economies including the US, France and Japan is putting pressure on their currencies, and investors have been hedging their exposure to US dollars, euros and yen by acquiring assets like gold and silver in what’s been termed the “debasement trade.”

Silver is an excellent electrical conductor that’s used in circuit boards and switches, electric vehicles, batteries and solar panels. It’s also used in coatings for medical devices. And like gold, it’s still a popular ingredient for making jewelry and coins. As a tradable asset, it’s cheaper than gold per ounce, making it more accessible to retail investors, and its price tends to move more sharply during precious metal rallies.

China and India remain the top buyers of silver, thanks to their vast industrial bases, large populations and the important role that silver jewelry continues to play as a store of value passed down the generations.

Governments and mints also consume large quantities of silver to produce bullion coins and other products.

What makes the silver market unique?

Silver’s varied uses mean its market price is influenced by a wide array of events including shifts in manufacturing cycles and interest rates and even renewable energy policy. When the global economy accelerates, industrial demand tends to push silver higher. When recessions loom, investors often step in as alternative buyers.

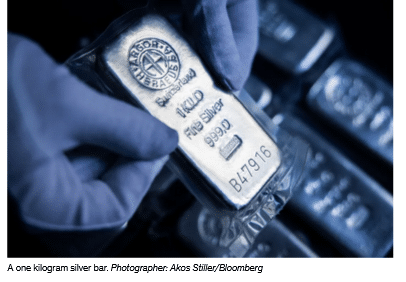

The market is thinner than with gold. Daily turnover is smaller, inventories are tighter and liquidity can evaporate quickly. That isn’t because there is less silver than gold available for trading. In fact, it’s the opposite: There are about 790 million ounces of silver in vaults overseen by the London Bullion Market Association, compared with 284 million ounces of gold. But silver is far less valuable per weight. The silver stored in London is worth about $40 billion, while the gold is worth $1.1 trillion.

What drove the latest silver squeeze?

LBMA data show silver inventories in London — the backbone of the global trade — have dropped by roughly a third since mid-2021, leaving less metal available for lending or delivery. Global demand for silver has outpaced the output from mines for four consecutive years, eroding the supply buffer once held in London. Meanwhile, silver-backed exchange-traded funds have drawn in new investment, forcing custodians to secure physical bars just as available supply was dwindling.

A proposed US tariff on certain imported metals earlier this year added fuel to the fire, spurring speculative buying and depleting inventories even further. Spot prices in London are trading at multi-year premiums to futures in New York.

The result has been strained liquidity and a scramble to secure silver bars.

Why all the demand from India?

The country’s festive season, culminating in Diwali on Oct. 20, is traditionally a peak period for precious metal buying. Silver imports have nearly doubled from last year as jewelers rushed to restock amid soaring bullion prices.

Indian buyers are now paying premiums of 10% or more over global benchmark prices, underscoring how tight physical supply has become. That demand has siphoned off even more metal from Western vaults, worsening the squeeze.

What does this mean for industries that rely on silver?

Some traders have been booking space on transatlantic cargo flights for bulky silver bars — an expensive transport method typically reserved for gold — to capture price differentials between London and New York.

For sectors like solar panel manufacturing, in which silver paste is a critical ingredient, sustained high prices could begin to erode profitability and spur efforts to substitute silver components for other metals.

Where could new supply come from?

Global mine production has been constrained by declining ore grades and limited new project development. Mexico, Peru, and China — the top three producers — have all faced setbacks ranging from regulatory hurdles to environmental restrictions. Reshuffling inventory from New York to London might solve the immediate crisis, but it won’t fix persistent supply deficits.

Whether the market finds a balance — or faces another bout of panic buying — will depend on how quickly new supply can reach the vaults.

Read the full article HERE.