Utilities, healthcare and consumer staples are leading the S&P 500 this month

Wall Street is starting to get a little defensive.

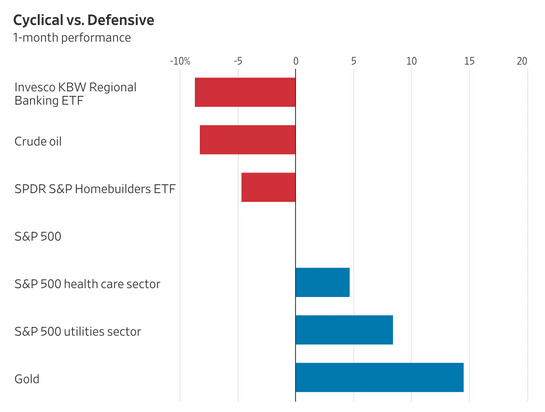

In the midst of the market’s most unsettling stretch since August, investors have turned to utilities, healthcare stocks and consumer staples—industries that reliably churn out profits no matter the economic conditions. Electricity, drugs and groceries are always in demand, even when consumers buy fewer cars, phones and streaming services. Those three defensive sectors are on track to lead the S&P 500 index this month for the first time since June 2022.

Investors have also sheltered in bonds. The 10-year Treasury yield, which falls when bond prices rise, has dropped close to half a percentage point over the last three months to close below 4% for the first time in a year on Thursday. And gold hit another series of new records this past week.

“We’ve been living in a disconnected environment for the last six months where the market just chugs higher and the news just gets worse,” said Alex Chaloff, chief investment officer at Bernstein Private Wealth Management.

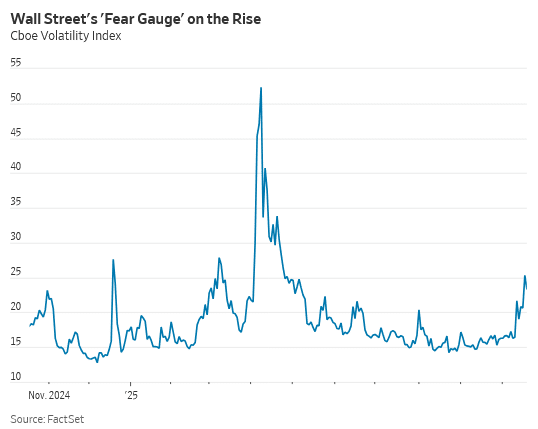

Volatility returned to the market on Oct. 10, when stocks tumbled after President Trump and Chinese leader Xi Jinping revived their trade-war rhetoric. The major stock indexes quickly regained their footing, and the S&P 500 is now within 1.4% of its Oct. 8 record.

Below the surface, though, investors are pulling back from holdings more sensitive to a slowing economy.

Regional bank, retailer, home-builder and airline stocks have all tumbled over the past month. These industries tend to flourish during periods of economic growth. Meanwhile, the surprise bankruptcies of auto-parts supplier First Brands and auto lender Tricolor have raised concerns that the market’s rally has masked pockets of weakness and potential fraud—particularly in the more opaque corners of the debt markets.

“When you see one cockroach, there are probably more,” JPMorgan Chase Chief Executive Jamie Dimon said Tuesday after his bank reported a $170 million charge-off related to Tricolor.

Shares of the investment bank Jefferies Financial Group, a key lender to First Brands, are down 27% over the past month, though they blunted some of the losses on Friday after Jefferies executives addressed First Brands during the firm’s investor meeting. Major private credit players such as KKR and Apollo Global Management have also sold off.

The credit scrutiny has spilled into the nation’s regional banks. Zions Bancorp reported a $50 million charge-off Wednesday to cover two loans taken out by borrowers facing legal actions. Western Alliance said Thursday that it had filed a lawsuit accusing one of its borrowers of fraud. The KBW Regional Banking Index fell sharply afterward.

Zions is scheduled to report quarterly earnings this week, along with heavyweights Tesla, Netflix, Intel and Procter & Gamble. On Friday, investors will get a key reading on monthly consumer inflation.

The extra yield investors demand to invest in junk-rated corporate bonds over Treasurys recently climbed to its highest level since June, according to the ICE BofA U.S. High Yield Index.

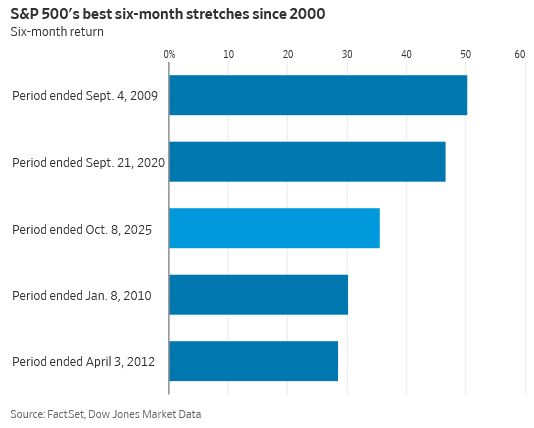

These flare-ups have arrived just as the S&P 500 has capped one of its hottest six-month runs on record. Powered by the biggest tech stocks and enthusiasm for the AI boom, the market ripped through dozens of record highs.

Bullish investors note that corporate earnings have been very strong in aggregate. Analysts expect 16% earnings growth for S&P 500 companies over the next year, the best growth rate since the 2021 Covid recovery. Rate-cut expectations are also helping out stock valuations, though analysts say that effect has been fully priced in.

“Underneath it all, I think the fundamentals are still intact,” said Jurrien Timmer, director of global macro at Fidelity Investments. “I see quite a few reasons out there to still be bullish even if some areas might look overextended.”

The recent spate of disconcerting news has felt sudden—and jarring.

“The strength in megacap tech has obfuscated what appears to be increasing signs of weakness through much of the real economy,” said Bob Elliott, chief executive at Unlimited Funds. “And the pricing of that weakness has accelerated in recent weeks.”

Bernstein’s Chaloff doesn’t think a recession is imminent, but he’s concerned about the effect of a still-sluggish labor market on consumer spending.

“The low-end consumer is hurting,” he said. “Those increases in discretionary spending we saw post-Covid have been tempered, and that’s starting to show up in results and stock prices.”

Part of this year’s market exuberance has been based on the idea that tax cuts and falling interest rates will heat up the economy, fueling a new burst of growth. So far, investors are still waiting.

While the federal government shutdown has turned the lights off at the Bureau of Labor Statistics, a host of alternative data from Wall Street is pointing in the same direction: The U.S. labor market is still losing steam.

Of course, so-called real economy companies are playing a smaller role than ever in the 2025 AI-fueled bull market. And the companies and investors spending hundreds of billions on AI-related infrastructure are helping boost the economy: The government’s most recent GDP report showed AI spending propelled economic growth while consumer spending stagnated.

Read the full article HERE.