Precious metals hold a unique place in the investment universe. Gold, silver, platinum and palladium combine aspects of financial instruments with characteristics of raw materials used in manufacturing.

Investors often hold relatively small amounts of precious metals when they’re worried about currency devaluation amid government spending or high inflation during economic boom times. Precious metals, especially gold, also have an allure as a place to park cash during times of heightened global economic or political worries.

“The timeless element of precious metals has led investors to perceive them as safe havens, inflation hedges and wealth diversifiers,” said Rohan Reddy, director of research with investment management firm Global X. “Historically, this has made them useful hedging instruments during market downturns as well as times of geopolitical uncertainty.”

Understanding investing in precious metals

The first thing to understand about precious metals is that they’re not all created equal.

While these metals can serve as portfolio diversifiers or hedges against inflation or weakness in the US dollar, they all have different demand dynamics.

“Investors should seek to understand the driving factors behind each precious metal, as each can behave differently under a variety of circumstances,” Reddy said.

Types of precious metals

The main precious metals for the investment community are gold, silver, platinum and palladium.

1. Gold

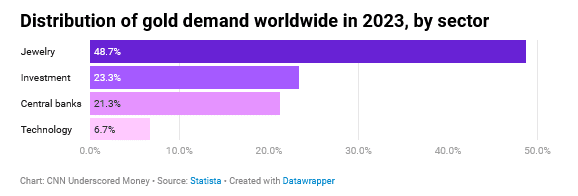

Of the four main precious metals, gold is the most popular for pure investment considerations, but the biggest source of its demand is for the jewelry market, especially in India and China.

“Gold is the preferred hedge against geopolitical tensions around the world, inflation and economic uncertainty,” said Alex Ebkarian, chief operating officer of physical precious metals dealer Allegiance Gold. “While it has periods of volatility, it has clearly proven to be a great long-term investment and will continue to be so for the foreseeable future. Overall, gold tends to carry less risk than the other three metals.”

That’s in part due to gold having a much larger market than silver, platinum or palladium, meaning investment in the “yellow metal” may be more liquid — easier to buy and sell — than metals with smaller markets.

2. Silver

Silver is often called “the poor man’s gold” because it is much cheaper than the yellow metal and often moves along with gold based on similar investment considerations.

But silver has long been more widely used as an industrial metal in electronics, automobiles and appliances, and the demand outlook amid the energy transition is bright because of its heavy use in solar panels.

That industrial demand also makes silver a hedge against inflation. When the economy is gaining ground, or expected to, silver prices might rise, giving investors a cushion against rising consumer prices for goods and services.

3. Platinum

Platinum is rarer than gold and has a smaller market, and the limited supply makes the metal subject to volatile price swings, Reddy said. With most global platinum coming from South Africa, problems in the mining industry there — such as struggles with electricity — can exacerbate the volatility.

Demand for platinum is largely dominated by jewelers and industrial buyers, especially the auto industry, which uses the metal in catalytic converters.

4. Palladium

Palladium is also a key ingredient for catalytic converters, making demand for it highly influenced by the automotive sector.

Due to its rarity, palladium is often extracted along with other metals, which can make it difficult to get pure-play palladium exposure from mining companies, Reddy said.

Benefits and drawbacks of investing in precious metals

Volatility

Like other commodities, precious metals prices are often volatile.

Diversification

But George Cheveley, metals and mining specialist with investment manager Ninety One, pointed out that precious metals also often perform well when equities are falling, providing portfolio diversification.

Robert Johnson, a finance professor at Creighton University, agreed that precious metals are good portfolio diversifiers. He studied the relationship between precious metals, equities and fixed-income investments for a book he co-authored called “Invest with the Fed: Maximizing Portfolio Performance by Following Federal Reserve Policy.”

“What we found is that the correlation between the returns to precious metals and stock and bond indices was near zero,” Johnson said. “So, while the returns to precious metals historically have been lower than those of stock market indices, the low correlation between stocks and precious metals makes them ideal diversifiers in a portfolio context.”

Economic sensitivity

A key risk to the diversification aspects of silver, platinum and palladium, however, is their increased links to economic cycles because of their industrial uses. That could mean these metals underperform gold in an economic downturn as investors flock to the perceived safety of the yellow metal.

Options for investing in precious metals

Investing vehicles for precious metals have proliferated in recent years, but retail investors just dipping their toes in the water will probably want to consider three relatively straightforward methods — buying bars or coins, shares in mining companies or funds that invest in mining companies or that are backed by physical metals.

1. Buying bars or coins

Investors can buy all four of the aforementioned precious metals in the form of bars or coins, also known as bullion.

While bullion provides the most tangible way to invest in precious metals, there are downsides. Storage, transportation and insurance costs all dampen price appreciation, which is the only way to make money with bars and coins because they don’t pay interest or dividends.

Investors will also pay a premium over the value of the physical weight of the metal in bullion form.

2. Buying shares in mining companies

Buying stocks of mining companies in a brokerage account is as easy as buying shares in any other type of company.

You’ll want to pay attention to whether the miner is a smaller company that’s exploring or developing a mine, known as a junior miner, versus a larger enterprise that already has a mine or multiple mines in operation.

The former provides huge returns but comes with more risk, while the latter offers more stability, cash flow and the potential for dividends.

Miners that produce precious metals can outperform when prices rise because their costs are relatively fixed, and higher prices increase their profit margin. They can also sometimes ramp up production to take advantage of higher prices.

However, mining is a risky business, even for established companies. There can be accidents or cost overruns, poor management decisions or the risk that a mine might be closed for political reasons or nationalized.

3. Buying funds for precious metals investment

Exchange-traded funds (ETFs) have become a popular way to own multiple mining companies under a single ticker symbol, making for instant diversification to ward off some of the company-specific risks of investing in mining.

Other ETFs are backed by physical metals held in vaults, with each share representing a certain amount. These have become popular ways to invest in physical metal without having to store it yourself.

Outlook for precious metals investment

Generally speaking, Reddy said his outlook for precious metals is constructive because of falling inflation, a generally stable macroeconomic environment and demand growth from emerging markets and emerging technologies.

Gold

For gold, he sees the combination of possible dollar weakening and continued federal funds rate cuts as supportive. When interest rates fall, non-interest-bearing assets like gold can become more attractive.

Emerging market central banks may also be a source of gold demand, and geopolitical uncertainties might buoy the safe-haven metal, he said.

Silver

“Silver toes the middle ground as both a haven asset and an industrial input, which may position it optimally should economic conditions remain resilient and global demands rise,” Reddy said. “Additionally, the structural growth trends in the solar energy sector may represent a viable source of long-term demand for silver.”

Platinum and palladium

Meanwhile, limited mine production and persistent global deficits may act as short-term floors for platinum pricing.

“The outlook for both platinum and palladium will likely depend on global automotive production, as industrial buyers continue to work through existing inventories of precious metals,” he said. “Prospects for a soft landing within the United States, as well as hopes for a recovery in Chinese demand, offer possible tailwinds for the sector. We believe that there are also long-term structural demand growth opportunities for these metals, as renewable investments ramp up.

What to know before investing in precious metals

Before investing in precious metals, Ebkarian said investors should determine whether they are looking for long-term wealth preservation, capital appreciation or portfolio diversification. They should also determine an exit strategy when thinking about what metal to invest in and whether to do that through stocks, physical metal or other options. Considering liquidity is an important part of that, as some metals and investment vehicles are more easily sold than others.

Gold is the best option for long-term investments, while silver might be better for short- to mid-term objectives, he said. Platinum might be better for portfolio diversification, exposure to industrial demand and potential for price appreciation, while palladium could be better suited for those who want to capitalize on strong automotive demand, supply constraints and potential price growth, he added.

“Consider diversifying your wealth into two or three metals versus choosing one over the other,” he said. “This allows you to minimize risk.”

Frequently asked questions (FAQs)

Which precious metal is the best investment option for beginners?

Reddy said gold and silver might be best for beginner investors given their large trading markets and high liquidity.

“Gold is the more easily understood of the two, given its primary use as a store of value,” he said. “By contrast, silver’s lower price point may make it an accessible investment for new precious metal investors.”

How much should you invest in precious metals?

Cheveley said institutional investors often allocate 5% to 10% of their portfolios to precious metals, while retail investor allocations vary based on their portfolio and risk requirements.

Reddy reiterated that 5% to 10% figure would be an appropriate part of a diversified portfolio as an upper bound for precious metals.

“Generally, we think that precious metals should make up a limited part of investor portfolios, given their lack of corresponding cash flows and cyclical behavior,” Reddy said. “It’s important that any allocation to precious metals be accompanied by a broadly diversified portfolio of stocks and bonds to avoid negatively impacting long-term performance.”

Read the full article HERE.