Gold — typically a safe-haven in times of turmoil — is soaring at the same time the stock market is hitting new highs, an unusual dynamic that is troubling some market insiders.

Why it matters: The rally in gold reflects investors’ desire to diversify away from dollar-denominated assets as trust in the U.S. slowly erodes, they say.

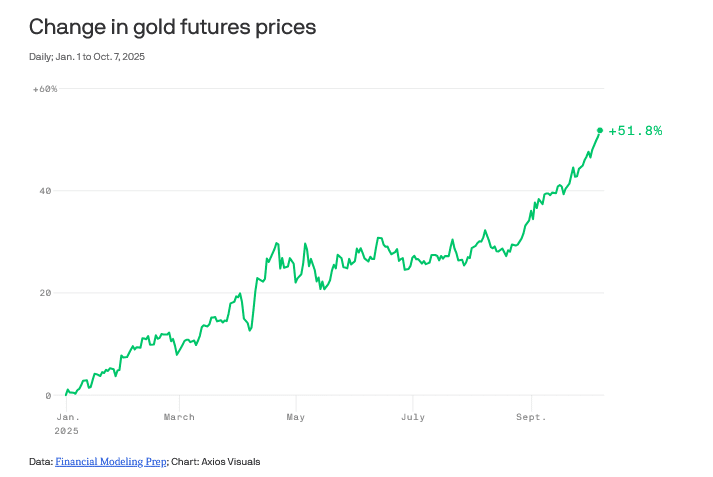

Driving the news: Gold futures on Tuesday topped a record high of over $4,000 an ounce for the first time, putting the precious metal on track for its best year since 1979 — a year of double-digit inflation, a Mideast oil crisis and the Soviet invasion of Afghanistan. So far this year, the price of gold is up 51%.

What they’re saying: “People are willing to go long U.S. enterprise, and they want to short the mess,” Mohamed El-Erian, the former CEO of the asset manager Pimco and current president of Queen’s College, Cambridge, tells Axios.

- “People are starting to lose trust in institutions,” says Ryan McIntrye, a senior managing partner at Sprott, which focuses on precious metals, adding that gold’s rally comes as people are “reassessing what they view as safe.”

- Gold’s rally comes amid President Trump’s trade war and, now, a government shutdown.

- “For the rest of the world, we’re weaponizing the tools of economic policy,” El-Erian says. The concern is that slowly, over time, the rally in gold starts to indicate an eroding belief in “what makes the U.S. special,” he adds.

Between the lines: While gold and U.S. stocks are surging, the U.S. dollar is down over 9% against a basket of other currencies so far this year.

- That indicates that investors want exposure to corporate America’s resilience, but they don’t want what Citadel CEO Ken Griffin called “sovereign risk” in an interview with Bloomberg.

- That flight to gold to try to “de-dollarize” is concerning, Griffin said, given what it says about sentiment around the the U.S. dollar, the world’s global reserve currency.

Follow the money: What else is powering the gold rally?

- Central banks: Other countries’ central banks are looking to diversify their reserves after overallocating to the U.S. dollar. These banks “have enormous buying ability,” El-Erian notes.

- Speculation: As central banks buy gold, pushing up the price, speculators come in, adding fuel to the rally.

- Weak competition: Once, there was no alternative to U.S. Treasuries for investors seeking safety, Now, “there’s no alternative to gold,” McIntyre says.

- Uncertainty: Concerns about a possible resurgence in inflation, the debt load of the U.S., and economic and policy uncertainty are all risks that are driving people to look “outside the financial system” for assets like bitcoin and gold, which aren’t tied to fiat currencies like the dollar.

Yes, but: “I wouldn’t call it strict de-dollarization,” Jay Barry, managing director and global rates strategist at JPMorgan, tells Axios.

- Barry notes continued high demand from foreign banks for U.S. Treasuries, which would not indicate any unease about the dollar.

What we’re watching: Whether the Trump administration starts to consider the rally in gold amid the decline of the dollar as a potential risk.

Read the full article HERE.