Key Points

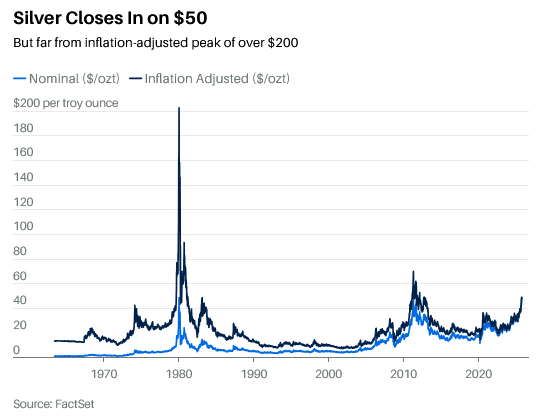

- Silver reached a record high of $48.994, exceeding $49 intraday, and has gained 67.55% this year, outpacing gold’s 54.13% rise.

- The increase in silver prices is driven by booming industrial demand for applications in solar panels and artificial intelligence semiconductors.

- A smaller market size compared to gold means dollar fluctuations have a larger percentage impact on silver, potentially boosting prices if the dollar falls.

Silver is right at the cusp of touching $50 a troy ounce for the first time since 2011. It has risen in the shadow of gold’s GC00-1.98% rally—but at a faster pace.

Most active silver settled at a record high of $48.994 on Wednesday after officially exceeding $49 during intraday trading, a level last surpassed 14 years ago. The price of silver is paltry when compared with gold’s price of $4,070.50, but the white metal has risen by 67.55% this year so far, or 13.42% more than gold’s 54.13% gain.

Such an outperformance hasn’t been seen in 15 years, according to Dow Jones Market Data team. It’s the biggest year-to-date increase for silver since 1979.

Most other major metals, besides platinum, can’t beat silver’s gain this year. Its rise is rooted in booming industrial demand. Silver is used in everything from solar panels to semiconductors linked to artificial intelligence. There is also a trickle-down of safe-haven money: Investors who see the gold trade as too crowded are looking into silver.

“The bull market in gold has now spread to silver, platinum and palladium, and it even seems to be leaking into copper,” wrote Louis-Vincent Gave, founding partner and CEO of Gavekal Research, in a report last week. “Once a bull market in precious metals gets under way, it usually takes a hawkish Federal Reserve, a hawkish People’s Bank of China, or a sharp rise in the US dollar for the bull market to stop. Right now, none of these developments seems to be in the cards.”

Finding drivers that can pull silver prices down is difficult because the world seems increasingly fragmented. Metals like silver, unlike stocks and bonds, are offering investors a sense of safety and promise to protect cash from inflation erosion.

Silver could go further up if the dollar falls further in value since it spurs more international buying. Silver is globally priced and traded in dollars. The market for silver is significantly smaller than the over $25 trillion gold market, which means a move in the dollar has a bigger impact on silver on a percentage basis than gold. Rising inflation can also support demand for real assets like silver.

“In our view, for the silver price to keep rising, there would need to be severe demand destruction in lower economic value-added end uses for silver, like photography and silverware. Meanwhile, there would need to be a growing demand for higher economic end uses, such as electrical and electronic demand from AI-related spending, photovoltaics and other technology-related demand,” wrote Paul Wong, market strategist at Sprott Asset Management.

To be sure, gold prices are getting support from global central banks buying the metal for their reserves, while no sovereign entity views silver as a neutral reserve asset.

But if silver still manages to trade above $50 sustainably, “it could be a sign that silver’s economic worth and store of value function was being re-evaluated, or it could be a mark-to-market reality repricing of the metal,” Wong writes.

HSBC, in a note this week, said it expects prices to go as far as $53 this year and as high as $55 next year, but decline in the back half of 2026.

Part of the rise will come from gold, which often exerts a “strong gravitational pull on silver” possibly as a result of buying by “investors who have not taken full advantage of the gold rally,” wrote James Steel, HSBC’s chief precious metals analyst.

Read the full article HERE.