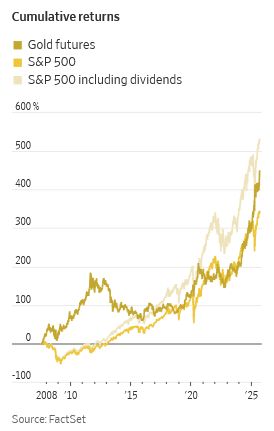

A 39% price jump this year outpaces Covid-19 pandemic, 2007-09 recession

Kenneth Pack invested in gold for the first time in April to shield himself from what he saw as the disorder of the new Trump administration. The chaos trade was just heating up.

Even after the stock market recovered from Trump’s “Liberation Day” confusion and rose even higher, investors such as Pack have kept plowing money into the precious metal. The Nevada retiree plans to keep holding precious metals and stocks linked to them, which comprise 17% of his portfolio.

His reasons include the stop-and-start policy rollouts that have at times included several tariff changes in a day.

“Strangeness seems to be the new norm,” Pack said.

A modern-day gold rush is stretching from Costco store aisles to underground vaults in London to the flickering screens of Wall Street. Old jewelry now glimmers with potential dollar signs.

Gold’s value has ballooned by 39% this year, putting it on track for a greater annual price jump than during the depths of the Covid-19 pandemic or 2007-09 recession, according to Dow Jones Market Data. Futures for the precious metal haven’t surged so much in a year since 1979, when a global energy crisis fueled an inflationary shock that thrashed the world’s economy.

These days, it isn’t a financial meltdown that is drawing people to one of the original market refuges. The recent run-up to record prices—reaching $3,649.40 a troy ounce on Friday—instead stems in part from the White House, with investors big and small rushing to shield themselves from an uncertain outlook for the U.S. economy and its role in the world.

President Trump’s attempt to reorder global trade has buoyed inflation and scrambled economic forecasts. A White House pressure campaign against the Federal Reserve is threatening the independence of one of the financial system’s bulwarks. The U.S. dollar by one measure had its weakest first half of the year in more than five decades.

On top of it all, the president has made little progress in ending wars in Ukraine and elsewhere that have periodically upset markets.

“With Trump in the U.S. and [Vladimir] Putin in Russia, a lot of people think: Is this going to get worse?” said Sean Hoey, managing director of IBV International Vaults London.

Operating from a Victorian mansion just steps from Hyde Park, the company has recently seen a surge of wealthy customers hoping to stuff gold into the hundreds of safe-deposit boxes in its subterranean, steel-encased vault. IBV’s in-house trading arm buys gold from the Royal Mint and other certified sources, Hoey said, allowing clients to hold and sell the metal without it ever leaving the building.

“The majority of people right now are buying and thinking it’s going to go up more, rather than selling,” he said. IBV next year plans to roughly double the number of boxes it offers to keep up.

Gold’s run-up began almost three years ago, fueled by central banks and Chinese investors loading up on bullion.

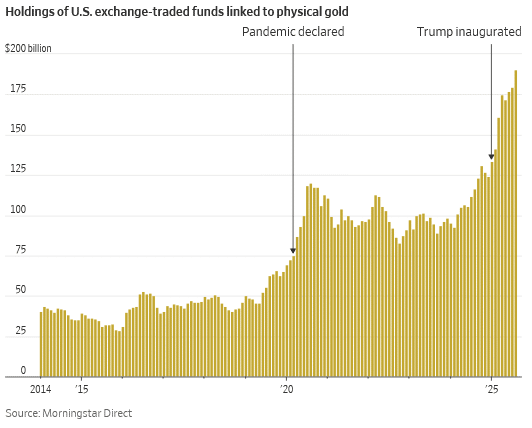

But Westerners have helped drive the rally this year in part by piling into exchange-traded funds. The net assets in U.S. ETFs linked to physical gold have ballooned 43% since January, according to Morningstar Direct, with March and April seeing two of the three-biggest monthly inflows since at least 2014.

Gold prices took another turn higher in August after Federal Reserve Chair Jerome Powell signaled the central bank would begin cutting interest rates at its meeting this week. Speculators piled in. In the short term, lower rates could make gold, which pays no interest, more appealing relative to safe government bonds.

Saxo Bank’s head of commodity strategy, Ole Hansen, said hedge funds by early September had parked 47% of their net commodity holdings in gold.

Lower rates could propel the precious metal in another way. Analysts warn that cutting rates in an economy with low unemployment and above-target inflation may also lead to longer-term price pressures that would erode profits and boost borrowing costs.

Investors’ ultimate fear is a mixture of high inflation and slow growth similar to what fueled gold prices’ meteoric 1979 rise.

“The risk of the s-word—stagflation—has increased,” said Aakash Doshi, head of gold strategy at State Street Investment Management. “That is a perfect environment for gold.”

Renewed confidence in U.S. growth and the dollar’s role as a reserve currency could tarnish the rally. But given trade tensions and America’s retrenchment from the world, Doshi said, “that seems very tenuous.”

Investors haven’t lost their appetite for risk in that new world—the AI-crazed stock market is at records—but instead are hedging their bets with investments not denominated in weakening dollars.

“Trump has been positive for gold,” he added.

On Main Street, where surveys show consumers are increasingly downbeat, more Americans are now handing over their gold to jewelry stores or repair shops to be melted down and sold.

“The value is not in the artistry,” said Lark E. Mason Jr., an appraiser based in Texas and New York. “It’s in the material.”

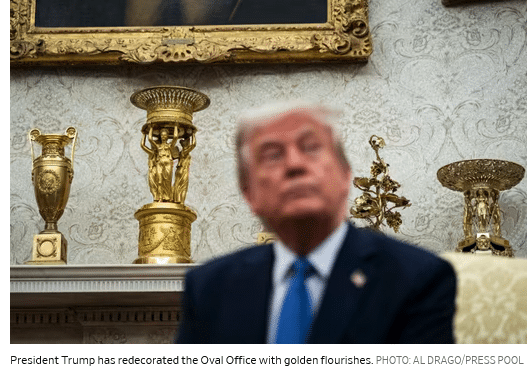

Even the Trump family has gotten in on the action. Donald Trump Jr., whose father has redecorated the Oval Office with golden flourishes, has in recent months appeared in online ads for a company that helps customers convert retirement accounts into gold.

Advising viewers to reach out for a free consultation, he said in an ad shared on Instagram, “What do you have to lose?”

Read the full article HERE.