As we head into 2025, the gold market is witnessing a remarkable sequence of ‘events.’

There is no gold bull market without participation of gold miners.

Admittedly, gold miners have been lagging, tremendously in fact. But that’s changing ‘as we speak’ because gold miners are now staging epic secular breakouts.

In this article, we repeat the fundamental drivers underpinning this gold bull market. We also look at gold miners which are coming to life and will amplify the gold bull market.

Dominant Gold Price Drivers

Rising inflation expectations

Inflation expectations have proven to be a dominant market dynamic driving gold prices higher in this new gold bull market.

As inflation is stabilizing, globally, inflation expectations are on a steady path higher. Investors are increasingly turning to gold as a hedge against normalizing inflation.

Essentially, what happened in 2022 is that aggressive disinflationary policies introduced by policy makers pushed the real inflation rate lower. This, in turn, affected the gold price.

Historical data reveals that gold performs exceptionally well when inflation expectations are on the rise, as explained in great detail in Gold Price Drivers Remain Very Bullish Ahead Of 2025.

This trend is particularly relevant today, as inflationary pressures are pushing gold to new levels. The current economic environment, characterized by dominant dynamics around inflation and geopolitical tensions, is setting the stage for a continued rise in gold prices.

As we approach 2025, the rise in inflation expectations is expected to maintain momentum. This trend highlights the strength of gold as an investment asset, emphasizing its role as a key asset for smart and diversified investors.

Central bank purchasing: A supportive yet secondary dynamic

While central bank purchases of gold have certainly contributed to the bullish trend, they are secondary to the primary driver of rising inflation expectations. Central banks have been actively increasing their gold reserves, providing a supportive backdrop for gold prices.

Recent data from July 2024 indicates a substantial increase in central bank gold purchases, reaching 37 tons. This represents a notable rise in demand and helps support gold prices. However, it is important to recognize that the main catalyst for gold’s current bullish trend remains the growing concerns about inflation.

Central bank buying is an important component of the overall gold market dynamics. Primary and secondary price influencers for price of gold are nicely explained in this well researched gold price prediction.

Gold Miners: From Lagging to Leading

Gold mining stocks have faced a challenging period over the past 18 months. If anything, they have been lagging significantly behind the performance of bullion prices. This underperformance has been a divergence from the strong gains in gold itself.

However, the tide is turning for gold miners. Moreover, it has happening NOW.

One key factor driving the recent turnaround in gold mining stocks is the decline in crude oil prices. Lower oil prices reduce operational costs for mining companies, which is a significant advantage in an industry where energy expenses are a major component of overall costs.

Additionally, the surge in bullion prices is providing a strong incentive for mining companies to push their production up, affecting their revenue and profit margins.

These positive changes in market conditions are creating a perfect storm for gold miners, setting the stage for a potential breakout.

What makes this breakout so exceptional is that it’s occurring on a secular timeframe, marking a significant shift in the long-term trend. This is a major milestone in the gold mining sector. Surprisingly, this pivotal development has largely gone unnoticed by mainstream financial media. However, JPost.com is spotlighting this decisive evolution and is eager to share this important news with its readers.

Gold Miners’ secular breakouts happening now

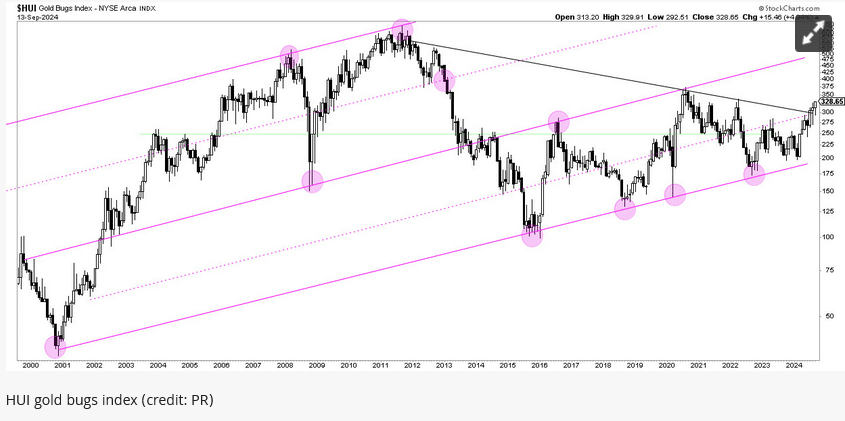

The HUI Gold Bug Index, a leading benchmark for gold mining stocks, is showing a dramatic bullish breakout.

This chart breakout is particularly noteworthy given the index’s previous period of underperformance.

The recent uptrend suggests that gold mining stocks are set for a significant recovery and could experience substantial gains (in the quarters and years to come) for as long as gold prices continue to rise.

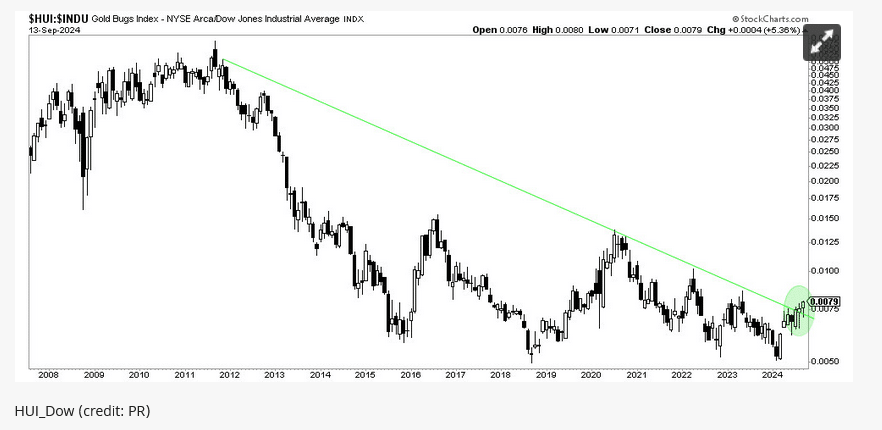

Furthermore, we look at a ratio chart. What’s interesting and insightful about ratio charts is that they express the value of a market segment expressed in another leading segment.

In particular, we like the HUI/Dow ratio a lot. It compares gold mining stocks to the defensive segment of the market represented by the Dow Jones Index.

As seen below, the HUI/Dow ratio has a chart pattern that exhibits a breakout out from a 12-year downtrend. This indicates that gold miners are gaining relative strength and suggests a promising outlook for the sector.

Opportunities and Considerations

The bullish development in the gold mining space represents a compelling investment opportunity. With gold prices driven by rising inflation expectations and favorable market conditions, gold mining stocks are likely to see considerable upside.

More importantly, gold miners are likely to fuel the gold bull market by improving even more bullish sentiment.

However, it is essential to remain mindful of potential risks. Gold miners are traditionally very volatile, and individual stocks come with individual risks. For investors seeking some safety, it is safe to consider either the leading gold mining ETFs and/or the large cap gold miners.

Conclusion

The gold market is entering a new phase as we head into 2025. This environment which is very favorable for gold is now having an impact on gold miners. They are finally emerging from a period of underperformance.

With favorable conditions, including high bullion prices and declining crude oil costs, gold mining stocks are set for a rebalancing act.

Read full article HERE.