The investment bank’s models show the average calendar-year return for the S&P 500 could shrink to 5.7%, roughly half the level since World War II.

Millennials and Generation Z might not enjoy the robust returns from U.S. stocks that helped swell the retirement accounts of their parents and grandparents, according to a team of equity analysts at J.P. Morgan Securities.

Over the next decade, the average calendar-year return of the S&P 500

SPX-0.14% could shrink to 5.7%, based on the models maintained by a team of strategists at JPMorgan focused on long-term market performance. That is roughly half the pace of returns seen since the end of World War II.

The basis for their argument was mostly mathematical. Current stock-market valuations are high relative to history, largely due to the performance of a handful of megacap stocks like the members of the Magnificent Seven.

Reams of historical data suggest that, over the long term, valuations should return to the mean, which should translate to lower stock-market returns in the years ahead.

With a current trailing price-to-earnings ratio of 23.7 times, the S&P 500 is about 25% more expensive relative to its 35-year average of 19 times. Robert Shiller’s Cyclically Adjusted PE ratio, another valuation metric used by the team, showed stocks are even more richly valued currently.

But as is often the case in markets, models rarely tell the whole story. So the JPM team theorized some fundamental factors that could weigh on stock-market returns going forward.

The most obvious, according to them, is the pace at which the U.S. population — and indeed, much of the global population — is aging. Older investors tend to shirk stocks in favor of more conservative investments, like bonds.

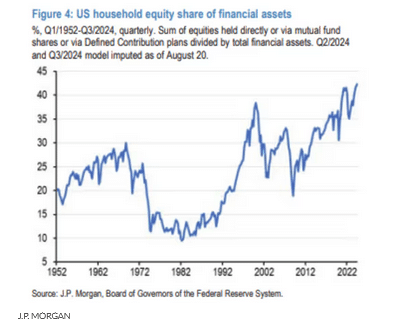

This could help to weigh on the average household allocation to stocks as more baby boomers and older members of Generation X reach retirement age. Currently, that allocation is at record highs, as the chart below shows.

“Multiples could come down because aging induces the growing cohort of elderly baby boomers to lower their equity allocations, currently at record highs, in line with their shrinking investment horizons,” said strategist Jan Loeys and Alexander Wise said in a report.

But there are other issues out there that could weigh on stock-market returns ahead. The team also questioned whether corporations could can continue to expand after reaching record highs during the COVID-19 pandemic.

Globalization and growing market concentration had helped profits grow more quickly than the economy since the early 1990s, as did generous corporate tax cuts. But tax rates could rise as the U.S. scrambles to reduce its budget deficits.

And although there is not a ton of evidence yet that taking on the biggest companies could yield gains for politicians, the team noted that antitrust actions by the U.S. government have picked up over the past few years.

If they progress, antitrust efforts by the government could help shake the dominance of some of the largest Big Tech firms, potentially dimming their already exorbitant (relative to recent history) valuations.

Increasing U.S. political instability and dedollarization could also emerge to diminish equity returns over the long run, the strategists said. Although, so far, neither has had much of a discernible impact on markets.

In fact, U.S. markets have proven remarkably resilient to rising government budget deficits, the team said. But that could change over the next five or 10 years, as foreign investors become less enthusiastic about dollar-denominated assets.

The team concluded their analysis with a caveat: their observations are only useful over the long run. They shouldn’t be applied with the purpose of trying to time the market.

“Valuations…are great at informing us about returns over long holding periods but are quite poor at giving us a clean direction, up or down, over the near term,” the team said.

The S&P 500, Nasdaq Composite COMP0.04% and Dow Jones Industrial Average DJIA-0.15% tallied their worst calendar-year performance since 2008 in 2022, but since then, all three have made a remarkable comeback.

The S&P 500 rose by more than 24% last year, and is up more than 18.5% so far in 2024, according to FactSet data. The index was on the cusp of a fresh record closing high on Tuesday as traders awaited the latest interest-rate decision from the Federal Reserve. And the Dow was poised for another record close of its own.

The Nasdaq was also trading higher on Tuesday, but remained well below its July record high.

Read the full article HERE.