Key Points

- The Federal Open Market Committee lowered interest rates by a quarter of a percentage point, setting the target range between 4% and 4.25%.

- Federal Reserve officials hold differing views on economic direction, with some prioritizing labor market weakness and others inflation risks.

- August saw only 22,000 nonfarm positions added and unemployment rose to 4.3%, with 13,000 jobs lost in June.

There may have only been one official dissent vote at the Federal Reserve’s policy meeting last week, but recent comments from policymakers show there are wide and differing viewpoints on where the economy is heading and what potential pitfalls need to be prioritized.

The Federal Open Market Committee opted to lower interest rates by a quarter of a percentage point on Sept. 17, pushing the target fed funds range down to between 4% and 4.25%. Only newly minted Federal Reserve governor Stephen Miran dissented, contending that a half percentage point cut was warranted. On Monday, he noted that monetary policy was “very restrictive” and keeping it elevated risked “unnecessary layoffs and higher unemployment.”

But while Fed officials were more in step with their vote than perhaps expected, there’s little consensus around what lies ahead at this point and which part of the Fed’s dual mandate of maximum employment and price stability needs more attention right now.

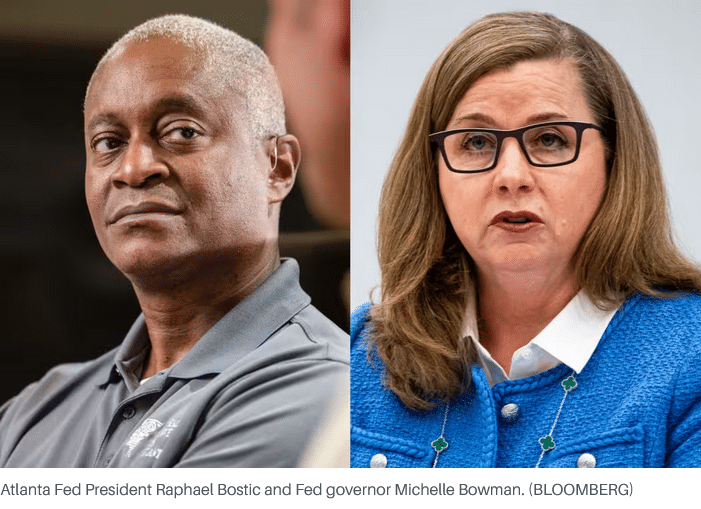

Some, like Fed governor Michelle Bowman, continue to warn that materially weaker labor conditions call for a more neutral stance on rates. But others, including Atlanta Fed President Raphael Bostic, are concerned about the risks of higher inflation and call for a more cautious approach to lowering rates lest it spur more price growth.

Bowman, who dissented at the July meeting in favor of a rate cut, said in a speech Tuesday that recent data have revealed a “materially more fragile labor market.” Yet when it came to inflation, she was less worried, noting that price growth continued to hover not far above the Fed’s 2% target.

“I am also more confident that, as trade policy has become more certain, tariffs will have only a small and short-lived effect on inflation going forward,” Bowman said, adding that she was pleased Fed officials have finally begun lowering rates given this shift in labor market conditions.

In August, employers only added about 22,000 nonfarm positions and unemployment ticked up to 4.3%. Additionally, updated estimates of previous monthly payrolls revealed that the economy lost 13,000 jobs in June.

She added that it was “appropriate to begin the process of moving policy toward a more neutral stance” at the September meeting, and that it was important policymakers signaled that additional adjustments were in the offing. In the Fed’s latest summary of economic projections, the median forecast for rates signaled there would be two additional quarter-point cuts this year.

“If the statement had not included a reference to additional cuts, it would have signaled to markets that the committee would not be responsive to weakening labor market conditions,” Bowman said.

But while labor conditions have softened, not all committee members are convinced that these conditions call for significant cuts. The Atlanta Fed’s Bostic said Tuesday that the central bank hasn’t been at target for inflation for four and a half years, so that remains something “we definitely need to be concerned about.”

Policymakers expect the personal consumption expenditures index will top out at 3% this year, not returning to the 2% target until 2028, according to their latest economic projections. Economists surveyed by FactSet are forecasting that the latest PCE inflation reading—due out on Friday—will show prices rose 2.9% in August from a year earlier.

“There’s been a lot of discussion and debate about whether one would expect that tariffs would have an impact on inflation initially and to date, it’s been much more muted, I think, than many expected,” Bostic acknowledged.

But he says it’s still up in the air on whether the changes in tariff policy will ultimately result in a one time shifts or structural changes. Bostic noted that business leaders are telling the Atlanta Fed they are feeling the cost pressures from higher tariffs, and it is becoming increasingly difficult to prevent those from flowing into prices that are faced by consumers.

“I actually think there’s still more to come,” Bostic said. “I’m still worried about it…I don’t think we’re at target today, and given that the forces and the pressures are likely to move us away from that in the short and medium term, I really think we need to pay very close attention to the consumer psyche and to what businesses plan based on what they’re expecting the future to have.”

He added that he has been worried from the “very beginning” that once people have an experience with high inflation they’ll expect that moving forward.

Employment conditions are important as well, Bostic said, though he noted that labor supply and demand are both softer and that could help provide some balance. He also noted that he’s still hearing from businesses that while they’re not hiring, they’re also reluctant to fire anyone.

Keeping the options open and remaining flexible to respond to the changing economic landscape, however, are things policymakers can agree on. “If something happens, we will be responsive and as forcefully as possible,” Bostic added.

Read the full article HERE.