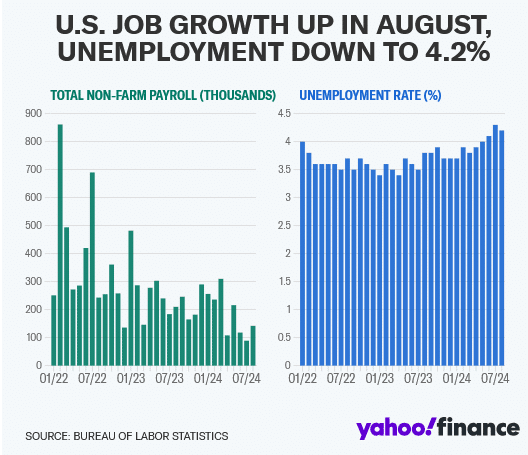

The US economy added fewer jobs than expected in August while the unemployment rate ticked lower.

Data from the Bureau of Labor Statistics released Friday showed the labor market added 142,000 nonfarm payroll jobs in August, fewer additions than the 165,000 expected by economists.

Meanwhile, the unemployment rate fell to 4.2%, from 4.3% in July. August job additions came in higher than the revised 89,000 added in July. Overall, revisions to the June and July labor reports showed the US economy added 86,000 fewer jobs than initially reported in those months.

Wage growth, an important measure for gauging inflation pressures, rose to 3.8% year-over-year, up from a 3.6% annual gain in July. On a monthly basis, wages increased 0.4%, higher than the 0.2% seen the month prior.

Capital Economics chief North America economist wrote in a note to clients that the August jobs report is “still consistent with an economy experiencing a soft landing rather than plummeting into recession.”

Friday’s report comes amid an ongoing debate over how severely the Fed should cut interest rates at its meeting later this month. During a late August speech, Federal Reserve Chair Jerome Powell said the cooling in the labor market has been “unmistakeable” and added that the central bank does not “seek or welcome further cooling in labor market conditions.”

Data released earlier this week indicated further signs of slowing in the job market. ADP’s National Employment Report for August showed private payrolls in the US added 99,000 jobs during the month, well below economists’ estimates for 145,000 and fewer than the 122,000 jobs added in July. The August data marked the fifth straight month payroll additions had slowed from the month prior. Meanwhile, data out Wednesday showed July ended with the lowest amount of job openings in the US labor market since January 2021.

Still, some economists argue that signs of strength within Friday’s jobs report are enough to prompt the Fed to cut interest rates by 25 basis points at its upcoming September meeting rather than making a larger 50 basis point cut.

“The overall solid gain in August payrolls, the retreat in the unemployment rate, and pop in average hourly earnings are not likely enough for Fed officials to start the rate cutting cycle with 50bps reduction on September 18,” Nationwide chief economist Kathy Bostjancic wrote in a note to clients on Friday.

But Bostjancic added that the downward revisions to payroll additions in prior months, as well as current job gains coming from a narrow group of sectors, “underscore that the labor market is losing steam rather quickly.” This, Boistjancic argues, could open the door for the Fed to cut rates by 50 basis points at one of its meetings this year.

The market agrees, with traders pricing in more than 100 basis points of cuts from the Fed this year, per Bloomberg data. As of Friday morning, markets were pricing in a 45% chance the Fed cuts rates by 50 basis points by the end of its September meeting, up from a 30% chance seen a week prior per the CME FedWatch Tool.