The S&P 500 could see a setback in the next 12 months as the bull market enters its third year: CFRA Research

U.S. stocks were kicking off their third year in the bull market with the S&P 500 scoring a fresh record on Monday — but history suggests investors need to be prepared for a potential setback in the coming 12 months.

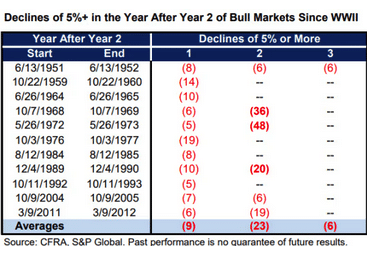

Since 1947, all 11 bull markets that celebrated their second birthday experienced at least one decline of 5% or more in the subsequent 12 months, with some even turning into new bear markets, according to Sam Stovall, chief investment strategist at CFRA Research.

“The average return following the 11 bull markets [since 1947] that celebrated their second birthday was a mere 2%,” Stovall said in a Monday client note. “What’s more, all of them experienced a decline of 5% [in the next 12 months], while five endured selloffs in excess of 10% but less than 20%, and three succumbed to new bear markets.”

The S&P 500 has climbed nearly 64% since Oct. 12, 2022, when the large-cap benchmark index hit a bear-market closing low of 3,577.03. The index surged 0.8% on Monday to finish at 5,859.85, according to FactSet data.

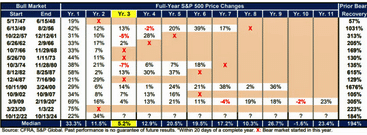

The table below shows the first year of the current bull market saw a 22% advance for the S&P 500, which was the third lowest since 1947. However, the index posted the highest of all second-year increases of 34%, versus the median of 11.5%, according to CFRA Research.

In Stovall’s view, the current high valuation of the U.S. stock market, especially large-cap stocks, is “concerning” as the bull market enters its third year.

The trailing price-to-earnings ratio for the S&P 500 is currently 25 — the highest valuation for the second year of a bull market since World War II. That level is also 48% higher than the median second-year P/E for all bull markets since 1947, according to CFRA Research.

“P/E multiples typically shrank during the third year of the bull market, since earnings-per-share growth tended to accelerate and confirm the optimism implicit in the sharp price advances during the early years of bull markets,” Stovall noted.

To be sure, Wall Street analysts are expecting year-over-year earnings growth rates of 14.2%, 13.9% and 13.1% for the fourth quarter of 2024 and the first and the second quarters of 2025, respectively, according to John Butters, senior earnings analyst at FactSet Research.

Earnings are also expected to grow around 15% in fiscal-year 2025, compared with an expected growth rate of around 10% in 2024, Butters said in a Friday note.

U.S. stocks ended higher on Monday as investors turned their attention to the next batch of corporate earnings. The Dow Jones Industrial Average was up over 200 points, or 0.5%, while the Nasdaq Composite rose 0.9%, according to FactSet data.

Read the full story HERE.