Pink Floyd’s 1979 song “Comfortably Numb” opens with the following lines, “Hello, hello, hello. Is anybody in there? Just nod if you can hear me. Is there anyone home?” The song was released as part of “The Wall” album and according to music and lifestyle platform Neon Music, it has become “an anthem for emotional detachment and the struggle to maintain a sense of self in an overwhelming world.”[1]

The world of 1979 was volatile as the Iranian Revolution created oil price shock, advanced economies slowed, the U.S. dollar struggled, American hostages were seized in Tehran, The Soviet Union invaded Afghanistan, there was a nuclear disaster at Three-Mile-Island and consumer prices in America skyrocketed.

The U.S. Treasury Department summed up the economic challenges as follows:

“By 1979, inflation had moved up to a double-digit pace and threatened to spiral higher. The economy was showing signs of weakness, and many were predicting recession and rising unemployment. The mood in financial markets was becoming one of deep gloom, as the dollar was sinking and interest rates were soaring.”[2]

Pink Floyd’s lyrics underscore the detachment and dispassion of those trying to navigate a difficult moment in history: “Your lips move but I can’t hear what you’re saying” …. “The dream is gone. I have become comfortably numb.” Indeed, 1979 was social and economic chaos, but today the threats are far more severe.

The Worst Pandemic in 100 Years

It has now been a little more than a year since the official end of the Covid-19 pandemic — which the World Health Organization declared was no longer a public health emergency on May 5th of last year. Now ranked among history’s deadliest plagues, it’s easy to conclude that those of us who survived, have become “numb” to the sheer magnitude of the event.

The impact of SARS-CoV-2 was both deeply psychological and economic — lest we forget the quarantines, mandatory masking, travel restrictions, stay-at-home orders, school closures, and vaccine mandates — along with the very real fear of dying from a virus that killed over 7 million people worldwide. The financial toll of Covid has also been staggering. In April of 2020, an International Monetary Fund Blog entitled, The Great Lockdown: Worst Economic Downturn Since the Great Depression stated that “the magnitude and speed of collapse in activity that has followed is unlike anything experienced in our lifetimes.”[3]

A recent paper published by the National Library of Medicine states that “the COVID-19 pandemic has caused a considerable threat to the economics of patients, health systems, and society.” The authors cite the direct and indirect costs of the virus, healthcare expenditures, preventative measures, absenteeism, and a macroeconomic impact in the trillions of dollars with quarantine costs alone that exceeded 9% of global GDP.[4]

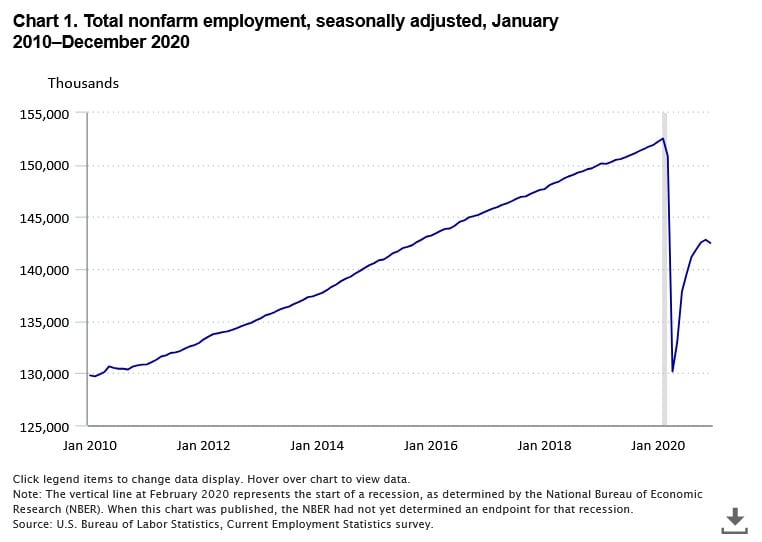

According to data from the Bureau of Labor Statistics (BLS) Current Employment Statistics (CES) survey, non-farm payroll employment in the U.S. declined by 9.4 million in 2020 the largest calendar-year decline in the history of the CES employment series. “As with virtually all economic activity in 2020, this decline was due to the coronavirus disease 2019 (COVID-19) pandemic, including pandemic-driven social and behavioral changes and government restrictions on business activity.”[5]

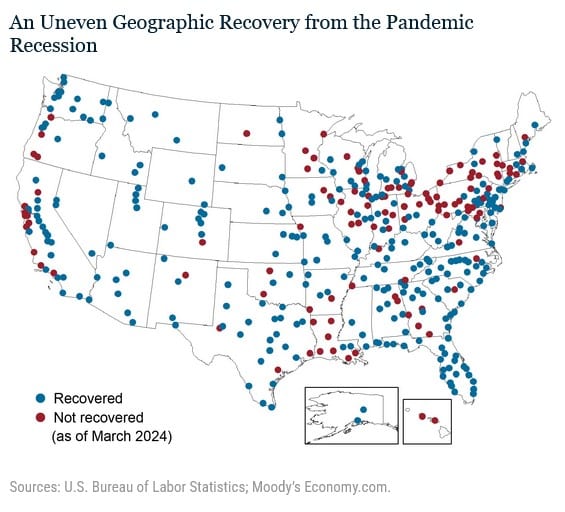

Critical supply chain disruptions during the pandemic coupled with high demand for goods contributed to soaring inflation in 2021 and 2022. This prompted the Fed to hike interest rates at the fastest pace in 40 years resulting in sky-high borrowing costs. And according to Liberty Street Economics and the Federal Reserve Bank of New York, not everyone has recovered.

“The recovery has been uneven and remains incomplete in many places. Indeed, while most metro areas have recouped the jobs that were lost during the recession (shown as blue dots), more than 25 percent still have not (shown as red dots). Most of these areas are concentrated in the Rust Belt along the Great Lakes, though clusters are present in parts of the South—Louisiana in particular—as well as in California, Oregon, and Hawaii. In fact, employment is still more than 5 percent below pre-pandemic levels in New Orleans, and more than 3 percent below in Honolulu and San Francisco. Likewise, sizable job shortfalls remain in Cleveland, Detroit, and Pittsburgh.”

Analysts warn that the economy is still adapting to the dramatic effects of the pandemic and has not yet processed the full impact on commercial real estate, healthcare, global trade, tight credit conditions, slowing economic growth and an underlying sense of altered destiny and grievance that we still don’t quite fully understand.

The First Presidential Candidate Shot in 56 Years

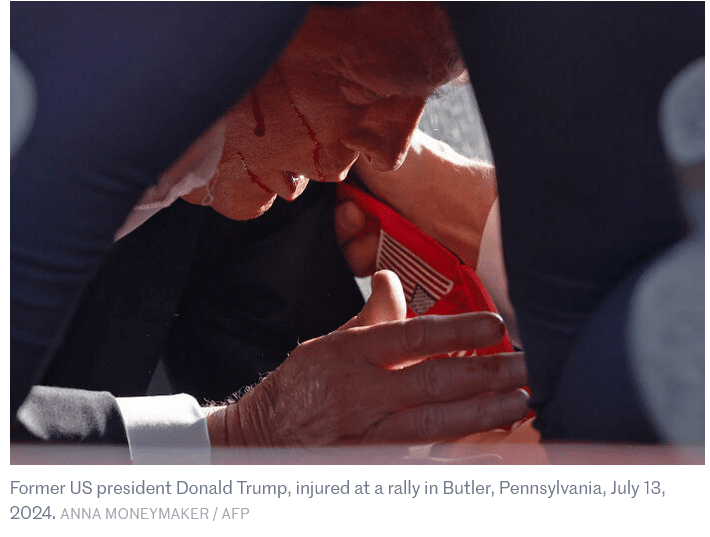

On a sunny, summer afternoon at a recent outdoor campaign event in Western Pennsylvania, a would-be assassin attempted to kill former President Donald Trump, the presumptive nominee of the Republican Party in the upcoming 2024 Presidential election. The gunman fired eight shots from the unsecured rooftop of an adjacent warehouse, hitting Trump in the right ear, killing one man in the crowd, and wounding two others.

It was a surreal moment for the nation and reminiscent of Bobby Kennedy’s assassination in 1968 at the Ambassador Hotel in Los Angeles. Kennedy was one of the leading contenders for the Democratic nomination in the 1968 Presidential Election. After celebrating a victory in the California Primary and addressing supporters in the hotel ballroom, he was shot while exiting through the hotel kitchen. Ironically, the fatal shot hit Kennedy behind his right ear.

The recent Trump shooting has raised serious questions about Secret Service protocols, site preparation, and overall competency. The Associated Press reported on some of the pressing questions surrounding the tragedy:

“The U.S. Secret Service is investigating how a gunman armed with an AR-style rifle was able to get close enough to shoot and injure former President Donald Trump at a rally Saturday in Pennsylvania, in a devastating failure of one of the agency’s core duties … The gunman, who officials said was killed by Secret Service personnel, fired multiple shots at the stage from an ‘elevated position outside of the rally venue,’ the agency said.”[6]

The entire nation witnessed countless viral video clips of rally goers yelling that there was “a man on roof with a gun.” There were other clips of the shooter suspiciously walking the grounds behind attendees, and additional reports that local police had seen and even encountered the suspect up to an hour before the shooting started.

According to Spotlight PA an independent Pennsylvania news service:

“The Trump rally shooting that day, which killed one man and injured three others, including the former president, has been called the largest security failure in 40 years. It has led to the resignation of the Secret Service director, a congressional investigation, and questions from lawmakers about how such a lapse could have occurred.”[7]

The shooting is symbolic of the dangerous uptick in political rhetoric, violence, and polarization in America. Trump has been the target of multiple impeachments, investigations, prosecutions, and a name-calling campaign i.e. fascist, racist, Hitler — that has dehumanized him to the point that a deranged individual might very well have climbed a roof with an AR-15 seeking to remove the “threat to democracy” that he believed Trump represents.

Regardless of the motivation, the attempt on Trump’s life elicits memories of other difficult ‘American moments’ as the French publication Le Monde outlined:

“The attack immediately joined the country’s collective consciousness, especially since it was filmed live. Although the former president escaped safely, the white roof on which the gunman stood is likely to be long remembered, like Dealey Plaza, in Dallas, Texas, where President John F. Kennedy was killed on November 22, 1963, by a gunman ambushed from the top floor of the school book depository. Similarly, there is the balcony of the Lorraine Motel in Memphis, Tennessee, where Martin Luther King was shot dead on April 4, 1968, by a right-wing extremist. Or the kitchen of the Ambassador Hotel in Los Angeles, through which Robert F. Kennedy was walking on June 5, 1968, after a victory speech in the California Democratic primary, where a Palestinian-Jordanian man opened fire. Or the Hilton Hotel in Washington, where Ronald Reagan was shot and seriously injured on March 30, 1981, 90 days after his inauguration.”[8]

July 13, 2024 is another dark chapter in American political history and reflects a country clearly on edge and gripped by radical dissent and ideological extremes.

The Largest Housing Bubble since 2007

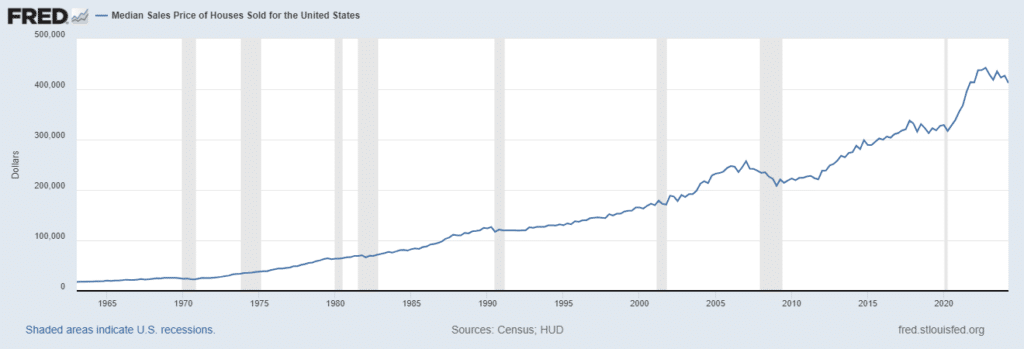

On top of our post-Covid economic angst and rising political uncertainty is another pain point that strikes at the heart of the American Dream — home prices and home affordability. The United States is sitting in a massive housing bubble. Home prices have risen an astonishing 47.1% since the start of 2020.

According to Fox Business … “Home price growth so far this decade is on the verge of surpassing all the growth seen in the 2000s. During that time period, housing prices skyrocketed 47.3%, including an 80% spike before the 2007 housing market crash.”[9]

Prices are being driven by a variety of factors including low inventory, high mortgage rates, an undersupply of new homes, a spike in the cost of building materials, and the powerful “locked in effect” of the many homeowners who “locked in” historically low interest rates during the pandemic creating a disincentive to sell, move, downgrade or upgrade.

According to the non-profit civic group Strong Towns, home prices have also been manipulated as “decades of housing subsidies, down payment assistance, artificially low interest rates, money printing and endless bank support have turned the American home into a financial product first and a place of shelter second.”[10]

The question on everyone’s mind is will there be a price crash that crushes the economy and triggers the next Great Recession? The answer depends on who you ask. Bank of America maintains that home prices will remain high into 2026 but housing experts warn that if demand suddenly drops and there’s a rapid oversupply of homes — the housing market could nosedive. A large percentage of Americans now believe that is possible and according to Lending Tree, some are even hoping for it … “44% of Americans believe that the housing market could crash this year, and more than one third say they want the market to crash, believing it’s their only way to be able to afford a home.”[11]

We must be careful what we wish for. The subprime mortgage crisis of 2007-2009 triggered a punishing global financial crisis that resulted in the worst economic disaster since the Great Depression as U.S. GDP collapsed by 4.3%, home prices sank by 30%, and unemployment doubled.[12] And according to one prominent economist, that is precisely where we’re headed right now. Chris Vermeulen, the founder of The Technical Traders believes that both the US residential and commercial real estate markets are on the cusp of collapse and will see price drops of as much as 30%.

“A lot of people are struggling financially, and this is really the tip of the iceberg. Give it another two or three years — that’s when the real-estate market gets hit the most. People are starting to get laid off as unemployment rises. People have burned through their savings, and inflation is crazy higher. Eventually, people aren’t going to be able to pay their mortgages … [and] are going to have to start to sell their homes.”[13]

Hello. Hello. Hello.

Is anybody in there? Just nod if you can hear me. Is there anyone home? So much has gone on over the past few years socially, economically, and politically that experts fear we’ve erected a metaphysical wall to collectively coddle ourselves. These once-in-a-generation events have left us desensitized and nonreactive — and that’s not only dangerous for our psyche, but it could be disastrous for our finances.

In his book, “The Fourth Industrial Revolution” Klaus Schwab, Executive Chairman of the World Economic Forum, addresses the increasingly blurred lines between the physical and the digital, the fusion of humans and machines, the high connectivity, and the dangerous detachment of living in this place and time. “The changes are so profound that, from the perspective of human history, there has never been a time of greater promise or potential peril.”

The “peril” is apparent in a news cycle dominated by geopolitical conflicts, protests, inflation, interest rates, market volatility, Fed policy, debt, layoffs, and political warfare — making the notion of being “comfortably numb” as tempting now as it was in 1979. And just like 45 years ago, it’s critical to have a plan to protect our savings and preserve our wealth from the volatility of a dramatically changing and far more unpredictable world.

This essay is brought to you by Thor Metals Group. For more information about preserving wealth with precious metals call 1-844-944-THOR.

[1] https://neonmusic.co.uk/unravelling-the-mystery-the-profound-meaning-behind-pink-floyds-comfortably-numb/

[2] https://home.treasury.gov/news/press-releases/js2001

[3] https://www.imf.org/en/Blogs/Articles/2020/04/14/blog-weo-the-great-lockdown-worst-economic-downturn-since-the-great-depression

[4] https://pubmed.ncbi.nlm.nih.gov/38365735/

[5] https://www.bls.gov/opub/mlr/2021/article/covid-19-ends-longest-employment-expansion-in-ces-history.htm

[6] https://apnews.com/article/secret-service-trump-rally-4e3415b1461f5acefbc8e1fadad0375b

[7] https://www.spotlightpa.org/news/2024/08/trump-assassination-attempt-secret-service-flaws-failures/

[8] https://www.lemonde.fr/en/international/article/2024/07/15/trump-assassination-attempt-political-violence-an-american-plague_6684742_4.html

[9] https://www.foxbusiness.com/economy/us-home-prices-have-surged-47-since-start-2020

[10] https://www.strongtowns.org/journal/2024/8/19/the-housing-market-is-a-bubble-full-of-fraud-and-its-going-to-pop

[11] https://www.businessinsider.com/personal-finance/mortgages/when-will-the-housing-market-crash

[12] https://www.forbes.com/advisor/investing/great-recession/

[13] https://www.dailymail.co.uk/yourmoney/article-13608961/economist-stark-warning-united-states-property-market.html