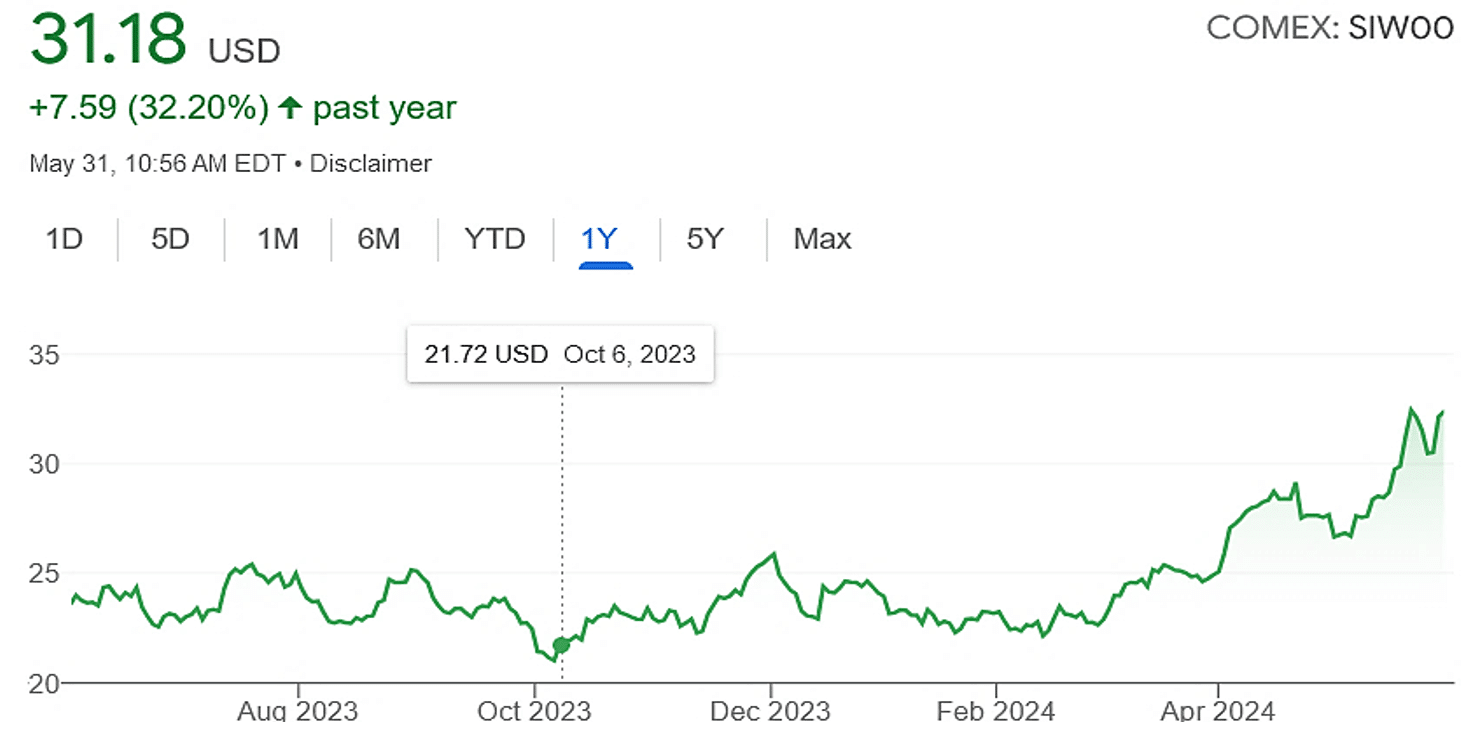

While gold has been grabbing world headlines as it has set repeated price records, silver has quietly rallied to an 11-year high, shattering the $30/oz mark this month. It is one of the year’s best performing commodities and yet in relative terms, silver is cheap. It currently takes about 80 ounces of silver to buy 1 ounce of gold, compared with the 20-year average of 68.1

Silver’s story is steeped in history as the jewelry, food vessels, objets d’art, and coins of the ancients were all made from silver.

But it is also a metal with one foot firmly in modernity as a highly conductive catalyst that plays a critical role in the green revolution and the global transition to clean energy.

According to the U.S. Geological Survey, “of all the metals, pure silver has the whitest color, the highest optical reflectivity, and the highest thermal and electrical conductivity.”2

Could Silver Double or Even Triple?

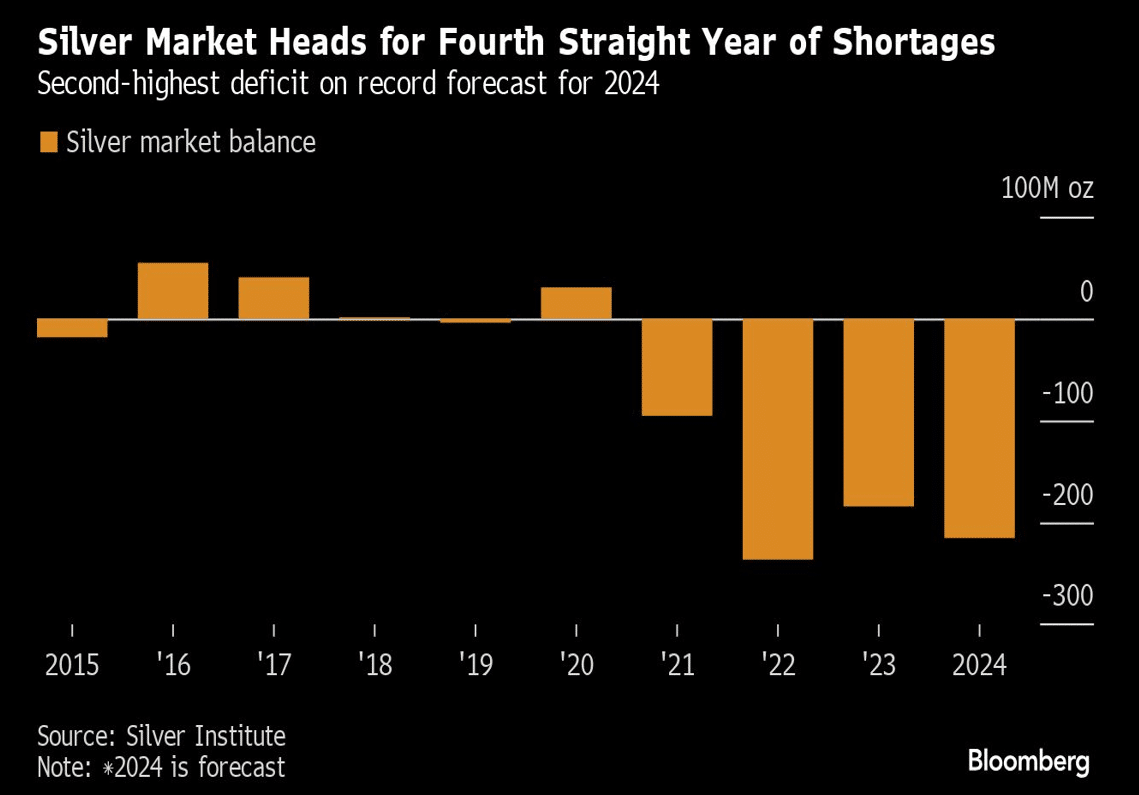

Silver’s latest price forecasts range from $34-$35/oz to as high as $50/oz with some outlier predictions for a price surge of up to $100/oz based on rising industrial demand, growing supply deficits, and limited above ground stock. From 2021 to 2023, the Silver Institute estimates there was a cumulative deficit of 474 million ounces of silver, equivalent to 14,743 tons of the white metal.

According to MarketWatch

“Forecasts pointing to a fourth straight yearly deficit in global supplies and a rise in demand to its second-highest level on record raise the potential for silver prices to rally, and even roughly double before the end of 2024.”3

Supply Challenges Keep Silver Undervalued

Most experts consider silver to be grossly undervalued based upon inherent and uncorrectable supply deficits. As mentioned, silver demand has outpaced supply for the past three years, and according to commodities research group CPM, silver supply is currently in a structural decline that cannot easily be reversed.

“The main issue is the deterioration in mine production, although scrap sources are falling as well. This is important because much of the bullion you and I buy comes from newly-mined silver. Secondary sales (bullion products that have been previously bought and sold) will always have a place in the industry, but to be prepared … mine production will need to be healthy and rising. It is neither of those things.”4

It’s important to remember that silver is rarely found in its pure form and excavating silver from the earth is a complex process of extracting and sifting mineral-rich rock and sediment (ore) via open pits and deep underground mines. Silver-bearing ores like copper, lead and zinc must then be crushed, ground, separated and chemically processed to derive pure silver.

This inherently arduous, expensive, and often inefficient process will only become more taxing since most of the silver that’s easiest to mine has already been reached. So, amid the greatest demand pressure in history, silver reserves are dwindling and that should drive silver prices higher well into the foreseeable future.

Investing News recently summarized the silver supply and demand challenges as follows:

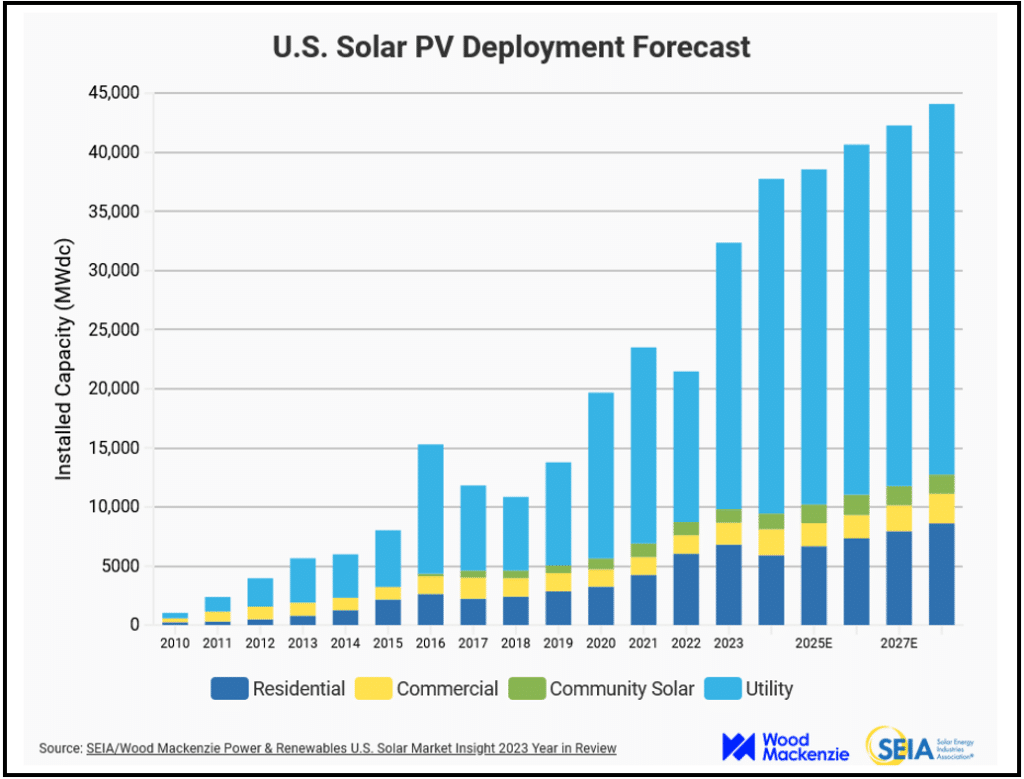

“The thinning inventories that contributed to silver’s price gains through Q1 have been driven by the white metal’s increasing demand from industrial sectors. The biggest contributing sectors have come from the energy transition, particularly the production of photovoltaics and electric vehicles.”5

The Unstoppable Solar Army

So where does silver go from here? In terms of green energy needs, demand looks elevated well into the end of the decade. Solar energy continues to boom, particularly in the U.S. The Solar Energy Industries Association predicts nothing but silver rooftops and sunshine ahead.

“The total US solar fleet is expected to quadruple over the next decade to 673 GW, as the Inflation Reduction Act provides key tax incentives and long-term certainty that will spark demand for solar and storage and accelerate the transition to renewable energy.”6

Breaking Price Barriers and Resistance Levels

Andrew Addison of Barron’s who has been charting silver’s price barriers, resistance levels and upsides for years, believes silver is ready for a dramatic breakout. “Once silver has a monthly close above $31, then my work would confirm upside projections to $45-$55.”7

He’s not alone. FX Empire recently stated that, “historically speaking, once we get above the $30 level, it [silver] is a market that tends to just take off to the upside.” And Forbes Advisor Benjamin Curry offers this advice, “It makes sense to invest in silver under certain market conditions. When supply and demand are out of balance is the right time to invest in silver.”

And with silver supply critically constrained and silver demand being inexhaustibly driven by expanding 5G networks, photovoltaics, and consumer electronics — the right time to buy appears to be right now.

AI Demand and Beyond

Global silver demand is expected to reach 1.2 billion ounces this year, the second highest level in recorded history, and there seems no end in sight for silver’s role in industry, manufacturing, renewable energy and beyond.

According to the Silver Institute’s April 2024 Newsletter, “Silver has many exciting new demand opportunities beyond its traditional applications and expanding role in the energy transition. For example, silver will become an indispensable material as artificial intelligence (AI) rises. End uses expected to incorporate silver in AI include transportation, nanotechnology, biotechnology, healthcare, consumer wearables, computing, and energy in data centers.”8

Contact Thor Metals Group at 844-944-THOR for information on Investment-Grade Silver

- https://www.mining.com/web/hot-commodity-silver-sets-pace-as-demand-and-deficit-drive-rally ↩︎

- https://www.usgs.gov/centers/national-minerals-information-center/silver-statistics-and-information ↩︎

- https://www.marketwatch.com/story/it-may-be-silvers-turn-to-shine-after-the-gold-rush-to-record-high-prices-e119b3ec ↩︎

- https://cpmgroup.com/update-new-silver-supply-is-drying-up-faster-than-death-valley ↩︎

- https://investingnews.com/daily/resource-investing/precious-metals-investing/silver-investing/silver-forecast ↩︎

- https://www.seia.org/solar-industry-research-data ↩︎

- https://www.barrons.com/articles/silver-breakout-what-to-watch-cf9872ac ↩︎

- https://www.silverinstitute.org/wp-content/uploads/2024/05/SNApr2024.pdf ↩︎