Analysts at Bank of America see gold prices reaching $4,000 an ounce — an 18% jump above current levels — within the next year due to a ballooning US fiscal debt.

Gold — traditionally viewed as a safe haven during times of uncertainty — has risen by nearly 30% this year, driven by high global trade tensions and rising geopolitical risks.

In April, the yellow metal soared to an all-time high of $3,500 as an unprecedented tariff war ignited by the US rocked the global markets. A dragged-out US-Ukraine deal also did little to assuage investor concerns.

Contrary to popular opinion, another potential rally to $4,000 may have less to do with these factors, but more to do with US debt, BofA analysts say.

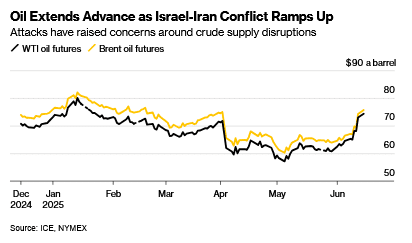

In a note published Friday, the analysts explained that wars and geopolitical conflicts typically “aren’t long-term growth drivers” for gold prices, pointing to the 2% dip in the metal’s prices since Israel began its airstrikes on Iran a week ago.

According to the bank’s analysts, the Israel-Iran conflict has drawn attention away from US President Donald Trump’s sprawling tax-and-spending bill that’s making its way through Congress. If passed, the bill is expected to add trillions of dollars in deficits in the coming years, raising concerns about the sustainability of US debts and the future status of the dollar.

“While the war between Israel and Iran can always escalate, conflicts are not usually a sustained bullish price driver,” they wrote. “As such, the trajectory of the US budget negotiations will be critical, and if fiscal shortfalls don’t decline, the fallout from that plus market volatility may end up attracting more buyers.”

De-dollarization

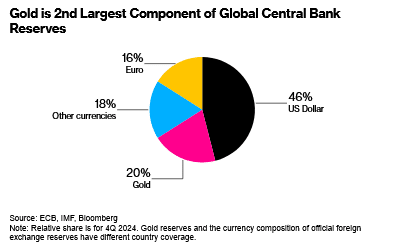

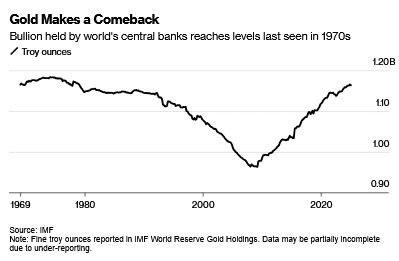

The BofA analysts also pointed to the growing trend of global central banks shifting away from US assets (Treasuries and dollar) in their reserves and holding more gold. They estimate that central banks’ gold holdings represent about 18% of the outstanding US public debt, up from 13% a decade ago.

“That tally should be a warning for US policymakers. Ongoing apprehension over trade and US fiscal deficits may well divert more central bank purchases away from US Treasuries to gold,” they warned.

A study by the European Central Bank revealed that bullion has risen up the ranks of official reserve assets, surpassing the euro and only behind the dollar. By the end of 2024, it is estimated that gold accounted for 20% of the world’s total reserve holdings. The dollar, while maintaining a lead at 46%, continued to decline.

Similarly, a recent survey by the World Gold Council showed that most central banks are expecting to accumulate more gold and less dollar over the next 12 months.

Read the full article HERE.

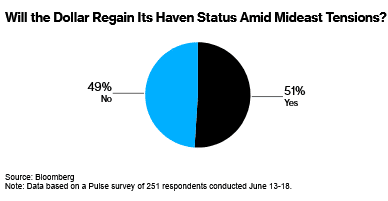

- The escalating Middle East conflict is likely to help the dollar hold on to its haven role, with a little more than half of respondents thinking the US currency will regain its status as a safe asset.

- Despite this, the Bloomberg Dollar Spot Index is expected to fall over the next month, and sentiment toward the US currency remains overwhelmingly bearish, with the dollar having lost over 11% against the euro and 8% against the Japanese yen this year.

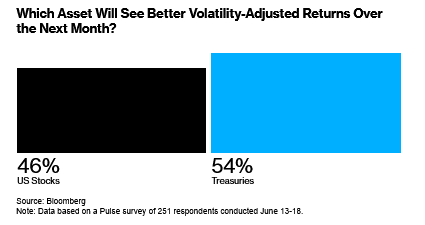

- The appeal of Treasuries in times of turmoil is clear, with 54% of respondents favoring bonds over US stocks for better volatility-adjusted returns over the next month.

The escalating Middle East conflict is likely to help the dollar hold on to its haven role — but only just, the latest Bloomberg Pulse survey shows.

A little more than half of 251 respondents think the US currency will regain its status as a safe asset as Iran and Israel continue to carry out attacks on each other. Yet participants also see the Bloomberg Dollar Spot Index falling over the next month, according to the poll conducted June 13-18.

“While we expect further dollar weakness, investors now perceive more two-way risks,” Goldman Sachs Group Inc. strategists including Christian Mueller-Glissmann and Michael Cahill wrote in a note to clients. “Some argue the depreciation may be overdone, especially given resilient US asset returns.”

The divergence underscores a shift in perceptions of the greenback, as global investors grow more averse to President Donald Trump’s policies. While geopolitical tensions in the past week have limited its decline, sentiment toward the US currency remains overwhelmingly bearish.

The share of respondents expecting Bloomberg’s dollar gauge to fall over the next month is the smallest since February, according to Pulse survey data. The index was set for its first weekly gain since May.

Beyond the revival of haven demand, the greenback also received support from a Federal Reserve policy decision on Wednesday, where Chair Jerome Powell warned of the inflationary impact of tariffs and said policymakers don’t have great conviction in their outlook for lower rates.

All the same, this week’s advance barely dents the greenback’s battering this year. It has lost more than 11% against the euro and about 8% against the Japanese yen so far this year.

A weaker dollar is here to stay, according to Invesco Ltd. Senior Portfolio Manager Kristina Campmany. Recent shakeups in US policy mean that there’s now a premium for holding the currency, Campmany said earlier this month at Bloomberg’s Money & Macro: An Evening with Markets Live event in New York.

As for Treasuries, higher oil prices resulting from the Middle East conflict will add to price pressures that will temper the bond rally — that’s according to 49% of survey respondents. About a third said the crude spike will have no effect on US debt.

The appeal of Treasuries in times of turmoil was clear. When asked which asset will deliver better volatility-adjusted returns over the next month, 54% of respondents favored bonds over US stocks.

Read the full article HERE.

The Federal Reserve left interest rates unchanged at its June policy meeting on Wednesday and maintained its forecast for two rate cuts in 2025. But Chair Jerome Powell was adamant about one point: Tariffs will likely push inflation higher in the months ahead.

Powell, speaking at a press conference following the Federal Open Market Committee’s rate decision, emphasized the high level of uncertainty facing the economy but was much more certain about this specific inflation risk.

“Everyone that I know is forecasting a meaningful increase in inflation in coming months from tariffs,” he said, citing early signs of price pressures and business plans to pass along higher costs. “We have to take that into account.”

The Fed’s updated Summary of Economic Projections, or SEP, also released on Wednesday, reflects that view. The SEP includes quarterly forecasts from policymakers for inflation, growth, unemployment and interest rates. It also features a closely watched dot plot, a chart showing each official’s individual projection for where the federal-funds rate will end the year.

These projections aren’t policy promises but they do offer a window into the Fed’s collective thinking, and how much internal consensus exists.

The median forecast for core PCE inflation, the Fed’s preferred measure, rose to 3.1% in 2025, up from 2.8% in March. At the same time, officials expect economic growth to slow and the unemployment rate to rise slightly. The combination edges toward a stagflationary setup—where economic growth slows and prices increase. Powell pushed back against that framing, saying he wasn’t necessarily expecting an economic slowdown in the back half of the year.

The dot plot continues to show two cuts this year, but the internal distribution has shifted. More officials now expect just one cut or none at all, than in March. The median holds, but narrowly. Economists sometimes refer to this situation as a soft median, vulnerable to slipping lower with just one or two more hawkish dots.

Powell acknowledged that fragility on Wednesday afternoon. “No one holds these rate paths with a great deal of conviction,” he said. When asked how to interpret the SEP, he turned the question back on the reporter. “What would you write down?” he asked. “It’s not easy to do that with confidence.”

Analysts echoed Powell’s point. Seven of 19 Fed policymakers are forecasting no cuts at all this year, but “in the great scheme of things these forecasts are pretty meaningless as there is so much economic and political uncertainty and the outlook for policy could change very rapidly,” wrote economists at ING in a note Wednesday.

The Fed appears to be biding its time while balancing near-term inflation risks with the markets’ desire for more dovish policy. “A policy geared toward being all things to all people cannot endure for long,” wrote Joe Brusuelas, chief economist at RSM. “Either inflation via the trade channel proves transitory and the FOMC can cut rates, or the central bank will need to signal to market participants and the White House that rates are going to remain on hold, with the possibility of a rate hike.”

For now, the economy gives the Fed some room to wait and see. Unemployment remains low at 4.2%, real wages are rising, and recent data suggest consumer demand and business investment remain resilient. Powell called it a “solid economy,” and one that allows policymakers to absorb new information before making a move.

Inflation expectations are well-anchored for now, but Powell acknowledged that confidence isn’t synonymous with certainty. “We have to be humble,” he said, referring to forecasting the pass-through of tariffs. If inflation fails to materialize and the Fed continues holding on the basis of a forecast that never arrives, pressure to pivot more decisively could build quickly.

For now the Fed is standing still. The pause holds, but only just.

Read the full article HERE.

Central banks around the world continue to hold favourable expectations for gold, with most looking to add to their reserves over the coming months and even years, an annual survey by the World Gold Council (WGC) showed.

Central banks have been aggressively buying gold, accumulating over 1,000 tonnes in each of the past three years versus an average of 400-500 tonnes in the preceding decade.

These purchases coincided with a blistering gold rally during that period, which saw prices nearly doubling from around $1,800/oz. to the current $3,400 level. This year alone, gold has gained more than 26% and set multiple records, including a new high of $3,500 in mid-April.

Driving the acceleration in central bank purchases and soaring gold prices was an unstable geopolitical landscape — beginning with Russia’s invasion of Ukraine in 2022 — that clouded the overall economic outlook.

Geopolitics a recurring theme

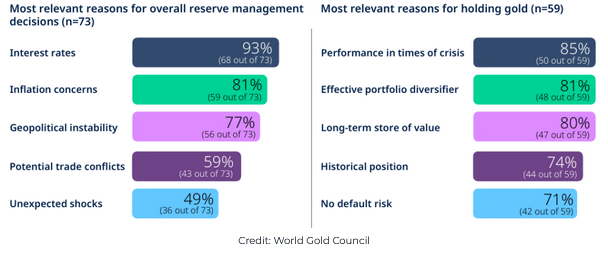

The new WGC survey sheds light on central banks’ decision-making process during turbulent times.

The 2025 edition of the Central Bank Gold Reserves (CBGR) survey drew a total of 73 respondents, the most since the Council began the survey eight years ago. The survey also saw a record-high number of respondents who actively manage their gold reserves at 44%.

According to the survey results, central banks continue to view economic and geopolitical uncertainty as a key factor influencing their decision to accumulate gold, just behind interest rate levels and inflation concerns. Also high on the banks’ list of considerations are tariffs and unexpected shocks.

Most of the respondents cited the precious metal’s performance during times of crisis, alongside its role as a store of value, as the main reasons for adding more gold, the survey showed.

“Gold’s performance during times of crisis, portfolio diversification and inflation hedging are some key themes driving plans to accumulate more gold over the coming year,” the WGC stated.

More gold buying ahead

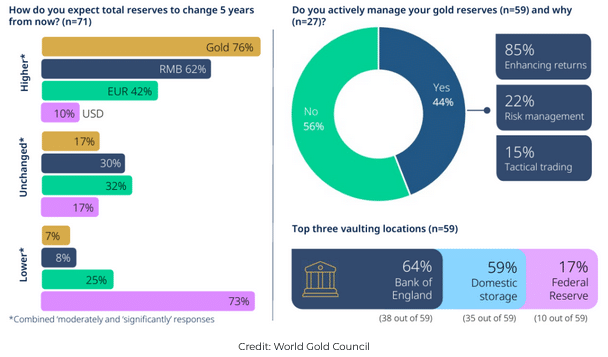

With that in mind, an overwhelming number of central banks (95%) said they see official gold reserves continuing to rise over the next 12 months, compared to 81% the last survey. Importantly, nearly half (43%) of them now believe their own gold reserves will also increase over the same period, more than any in previous surveys.

Over a longer horizon, about three-quarters of the banks (76%) expect their gold holdings to be higher in five years, an increase from 69% seen last year.

At the same time, about the same number of banks (73%) are prepared to see moderate or significantly lower US dollar holdings within their global reserves.

In terms of vaulting locations, the Bank of England remains the most popular amongst respondents (64%).

“The trends uncovered in our survey suggest that central banks continue to recognize the benefits of an allocation to gold, and indicate that their demand for gold will likely remain healthy for the foreseeable future,” the Council said.

Read the full article HERE.

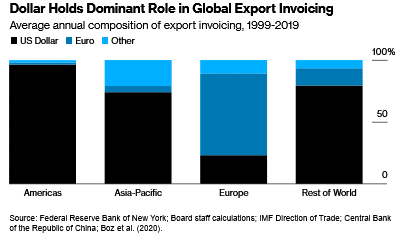

- US importers are increasingly being asked by their foreign counterparties to settle transactions in currencies other than the US dollar, such as euros, Chinese renminbi, Mexican pesos, and Canadian dollars.

- The dollar’s volatility, including an 8% decline this year against a basket of other currencies, is driving this trend, as foreign vendors seek to limit their exposure to further swings in the greenback.

- The shift away from the dollar could be seen in trade invoicing, particularly in regions like Latin America and Asia, where exporters may opt to denominate contracts in local currencies or other alternatives like the euro or yuan.

When Paula Comings, the head of currency sales for US Bancorp, talks to US importers, she increasingly hears the same message: Their foreign counterparties no longer want to be paid in dollars.

Instead, they ask for settlement in euros, Chinese renminbi, the Mexican peso and the Canadian dollar, looking to limit their exposure to further swings in the greenback.

“A lot of clients previously were reluctant because dollars were sacred in the eyes of the supplier,” Comings said. “Now the vibe from overseas vendors seems to be, ‘Just give us our currency.’”

While the dollar saw a brief boost amid the turmoil in the Middle East, the currency is still about 8% lower this year against a basket of other currencies. That followed a steep gain of 7% in the final quarter of 2024, according to a Bloomberg index. This volatility, which complicates pricing decisions and poses earnings risks, increasingly means the dollar is falling out of favor.

Some US Bank clients offer a glimpse into this trend. A lumber company from the Midwest now converts its US cash into euros before paying for hardwood imports from Europe — a change from its previous practice of simply sending dollars. The move was spurred in part by a 2% discount offered by its European supplier for making payments in the single currency.

Another client, a homeware retailer that imports from China, renegotiated its terms with suppliers and plans to settle its next bill in yuan. A third customer, a US food company sourcing equipment from Italy, agreed to pay its dues in the common currency, causing it to receive a more favorable rate on a purchase worth €400,000 ($463,120).

“The change is difficult to quantify in real time, but in markets from East Asia to Latin America, a growing number of exporters are opting to denominate contracts in euro, yuan, or even local currencies,” said Karl Schamotta, chief market strategist at cross-border payments firm Corpay in Toronto.

Trade invoices will be one area where the dollar’s dominance comes under pressure, Citigroup Inc. strategists including Dirk Willer and Adam Pickett wrote in a recent note. “We think it will take further ‘trade blocs’ across LatAm and Asia to emerge — possibly encouraged by the US trade war — to see larger shifts away from the dollar in trade invoicing.”

Across the Americas, the currency accounted for nearly all export invoices on average each year from 1999 to 2019, according to the latest data from the International Monetary Fund and the Federal Reserve Bank of New York. In the Asia Pacific region, that figure stood at about 75%. Europe, where intra-bloc trade prevails, saw a significantly smaller share of exports denominated in dollars.

While it remains to be seen if and when the shift manifests itself in official data, overseas vendors wanting to transact in local currencies “could speak to the dollar’s reputation,” US Bank’s Comings said.

Read the full article HERE.

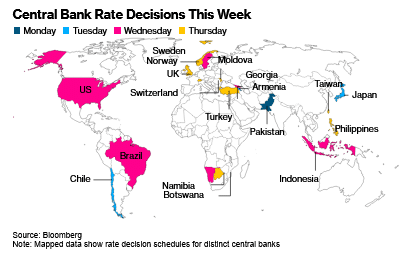

Policy makers from countries accounting for two-fifths of global economy set rates this week.

| Market Snapshot | ||

|---|---|---|

| Brent Crude | 73.81 | -0.57% |

| S&P 500 Futures | 6,060 | +0.47% |

| US 10-Year Treasury Yield | 4.424% | +0.026 |

| Gold | 3,417.15 | -0.44% |

| Bloomberg Dollar Spot Index | 1,200.65 | -0.15% |

Market data as of 06:35 am EST. Market data may be delayed depending on provider agreements.

Five things you need to know

- Crude prices erased an early surge as traders speculated the hostilities between Israel and Iran won’t ignite a wider conflict in the region. Brent was trading near $74 a barrel after giving up a 5.5% increase.

- President Donald Trump said it’s possible Israel and Iran could reach an agreement to end their conflict, though the two sides may need to “fight it out,” before they’re ready to broker a peace deal. Trump is in Canada for a Group of Seven summit of world leaders.

- Kering shares surged as the owner of the Gucci fashion house prepared to name the chief executive officer of Renault as its next CEO. Luca de Meo will be appointed to the job in the coming days, said people familiar with the matter. Renault shares fell as much as 8%.

- China posted 6.4% growth in retail sales in May, beating all estimates and notching the fastest pace since 2023. Still, a deepening housing market slump and deflationary forces suggest the consumer boom will prove temporary.

- Abu Dhabi National Oil made an $18.7 billion offer for Australian fossil fuel producer Santos. It’s one of the most audacious overseas moves yet by the Middle Eastern company seeking to expand production of liquefied natural gas.

Central bank action

Nations accounting for two-fifths of the global economy set interest rates this week, which may shift investors’ focus from the Middle East conflict.

The US, UK, Switzerland and Japan are among those jostling for attention, while peers in Brazil, Chile, Indonesia, Turkey and Sweden also meet.

Most, with the exception of Switzerland and Sweden, are set to keep rates on hold as officials await stronger insights into the path of inflation and just what effect the trade war will have on economic growth. The Israel-Iran conflict is now also clouding the outlook.

Here’s a rundown of the big meetings and the role markets will play in the decision-making:

The Federal Reserve: Chair Jerome Powell and colleagues meet on Wednesday. Even with rates set to stay unchanged, traders will scrutinize economic and interest-rate projections as well as Powell’s comments. Markets ended last week betting the central bank won’t lower borrowing costs until September at the earliest.

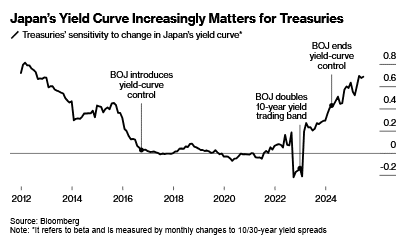

The Bank of Japan: A surge in Japanese bond yields is impacting debt markets elsewhere — as a Bloomberg analysis details here — a reversal from just a few years ago when the No. 3 economy was an anchor on global borrowing costs. Following the recent market turmoil, the BOJ is likely to consider slowing its pullback from the market after its holdings of Japanese government bonds fell ¥6.18 trillion ($43 billion) in the first quarter, the biggest-ever drop according to data going back to 1996. An announcement on this may come on Tuesday even if rates are left alone.

The Bank of England: Policymakers meet on Thursday under pressure to lower rates, but not expected to do so quite yet. A recent run of woeful data means market bets show the odds of a summer rate cut doubling this month, with two reductions by the end of the year now almost fully priced in.

Swiss National Bank: Officials will reduce borrowing costs by a quarter point on Thursday, according to a Bloomberg survey of economists. That would return the benchmark to the level it last crossed in September 2022, when seven years of negative rates ended. Policymakers are acting to stem a rise in the franc, which has gained more than 8% against the dollar since early April. —Craig Stirling and Simon Kennedy

On the move

- US Steel rises as much as 5% in early trading. Trump approved Nippon Steel’s $14.1 billion purchase of the company after giving significant concessions to the US government, including a “golden share” that allows Washington a say in major decisions.

- EchoStar soars 49% after Trump urged the company and the chairman of the Federal Communications Commission to resolve a dispute over the company’s valuable spectrum licenses.

- Sarepta Therapeutics tumbles 30%. The company said a second patient has died of acute liver failure after being treated with its gene therapy for a rare muscle disorder.

- Victoria’s Secret rises 2.8%. Barington Capital Group has built a stake in the lingerie retailer and plans to urge it to make changes to its board and strategy, according to a person familiar with the matter.

- With hostilities between Israel and Iran entering a fourth day, watch energy names Exxon Mobil, Chevron, ConocoPhillips and Occidental Petroleum, as well as defense stocks Lockheed Martin, Northrop Grumman, RTX, General Dynamics and airlines including Delta Air Lines, United Airlines, American Airlines. —Subrat Patnaik

Week ahead

Outside of the Middle East, policymaking takes the top spot this week with world leaders meeting, US lawmakers discussing tax cuts and a series of central bank meetings taking place from Japan to the US.

Monday: Group of Seven leaders continue talks in Canada, US Empire manufacturing data.

Tuesday: US senators debate a $3 trillion House tax bill. The Bank of Japan and Chile’s central bank both set interest rates. Germany’s ZEW survey. G-7 leaders complete their talks in Canada

Wednesday: The US, Brazil and Indonesia set rates. The euro-area and UK consumer price indexes are released as are US housing starts and initial jobless claims. Euro-area and Canadian central bankers speak in various locations.

Thursday: Norway, Switzerland, Turkey, the UK and Taiwan set rates. The US has a federal holiday. The US’s 75-day TikTok divest-or-band deadline is today.

Friday: China sets loan prime rates, Japanese CPI is released and the US sees the Conference Board leading index and Philadelphia Fed’s services data.

Oil options

Even with oil prices starting to retreat, some parts of the market are still reflecting jitters.

In options, several thousand lots of August calls with strike prices of more than $80 a barrel — which profit when prices rise — changed hands in the first few hours of Monday’s session. About 2,000 lots each of August Brent calls, with strikes of $100 and $101, also traded in a flurry of activity not normally seen during Asia hours.

Options don’t typically trade to this extent during the Asian portion of the day. It wasn’t immediately clear whether the options activity was part of a wider strategy.

The big fear in the market is still centered on the Strait of Hormuz, the narrow waterway through which Middle East producers ship about a fifth of the world’s output daily. Prices could soar if Tehran attempts to block the route.

For now, traders are betting Iran won’t take that step. Robert Rennie, head of commodity and carbon research at Westpac Banking, called the early jump an “over-reaction.” He sees Brent prices capped below $80. —Yongchang Chin

Word from Wall Street

“This has been a year where fading bad news paid off, and the FOMO theme has been growing louder.”

Max Gokhman

Deputy chief investment officer at Franklin Templeton Investment Solutions.

Check out the full story on why traders are opting to hold their breath rather than sell.

One number to start your day

- 20%The S&P 500 risks sinking 20% in one worst-case scenario modeled by RBC that would involve inflation spiking and higher oil prices.

Read the full article HERE.

Pound, gold and oil prices in focus: commodity and currency check, 13 June

Gold (GC=F)

Gold prices surged to their highest level in nearly two months on Friday, lifted by heightened geopolitical tensions following Israeli airstrikes on Iran. The escalation in the Middle East conflict spurred demand for traditional safe-haven assets, putting bullion on track for a weekly gain.

Gold futures gained nearly 1% to $3,435.20 per ounce at the time of writing, while the spot gold price advanced 2% to $3,414.79 per ounce.

“The geopolitical escalation adds another layer of uncertainty to already fragile sentiment,” said Charu Chanana, chief investment strategist at Saxo.

The Israeli government declared a state of emergency, warning of imminent missile and drone attacks from Iran. Meanwhile, the US military is reportedly preparing for a range of scenarios, including potential evacuations of American civilians from the region, a US official told Reuters.

“This latest spike in hostilities in the Middle East has taken the focus off trade negotiations for now, with investors making a play towards safe-haven assets in response,” said Tim Waterer, chief market analyst at KCM Trade.

“Gold surged past resistance around $3,400 on news of the airstrikes, and further upside could be in-store should the escalation continue,” he added.

The rally in gold has been further underpinned by growing expectations of monetary policy easing in the US. Recent data showing elevated jobless claims and muted producer price inflation have increased speculation that the Federal Reserve could cut interest rates, making non-yielding assets such as gold more attractive to investors.

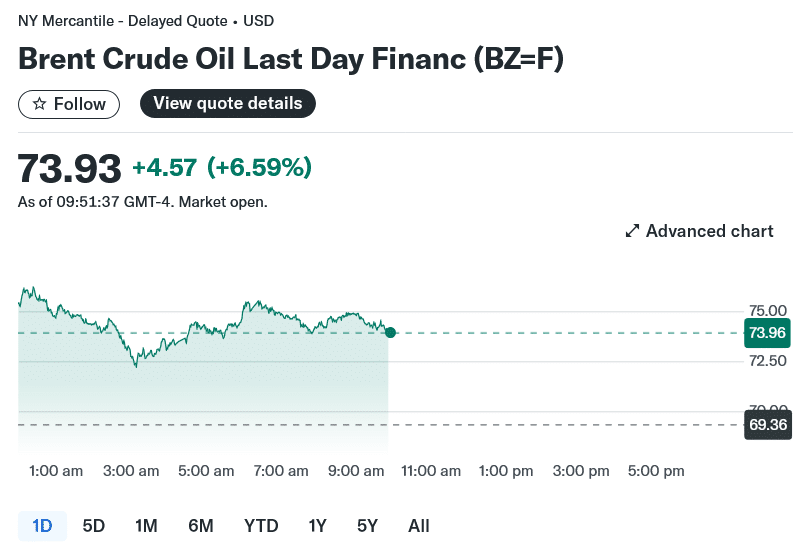

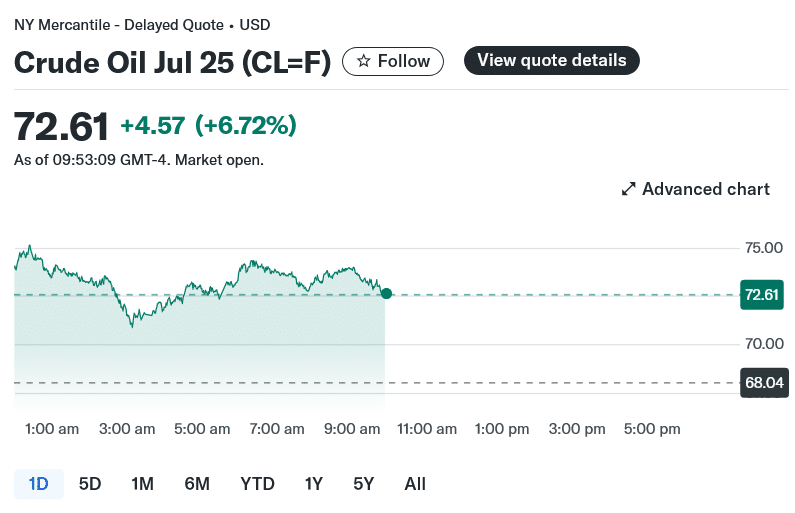

Oil (BZ=F, CL=F)

Oil prices rose at the fastest pace in over three years on Friday amid concerns that Israeli military strikes on Iran could trigger a wider conflict in the Middle East, threatening global energy supplies and stoking inflation.

Brent crude futures (BZ=F) climbed 5% to $71.92 a barrel, at the time of writing, while West Texas Intermediate futures (CL=F) rose by the same margin to $71.44 a barrel.

The market reaction reflects growing unease that a broader confrontation could disrupt flows through the Strait of Hormuz, a vital maritime chokepoint through which roughly a fifth of global oil supply is transported. While Iran exports around 1.6 million barrels of oil per day, any move to block or restrict traffic through the strait could have far-reaching consequences for global energy markets.

Warren Patterson, an analyst at ING (ING), said: “We are back in an environment of heightened geopolitical uncertainty, leaving the oil market on tenterhooks and requiring it to start pricing in a larger risk premium for any potential supply disruptions.”

Iran, one of the world’s leading oil producers, sells the majority of its crude to China, which consumes approximately 15% of global oil demand.

Priyanka Sachdeva, an analyst at Phillip Nova, said: “Iran has announced an emergency and is preparing to retaliate, which raises the risk of not just disruptions but of contagion in other neighbouring oil producing nations too.

“Although Trump has shown reluctance to participate, US involvement could further raise concerns.”

US secretary of State Marco Rubio on Thursday called Israel’s strikes against Iran a “unilateral action” and said Washington was not involved, while also urging Tehran not to target US interests or personnel in the region.

MST Marquee senior energy analyst Saul Kavonic said the conflict would need to escalate to the point of Iranian retaliation on oil infrastructure in the region before oil supply is materially impacted.

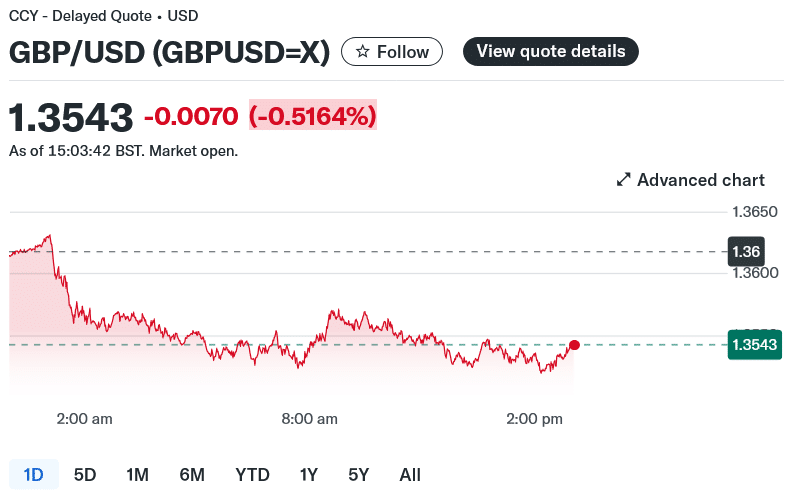

Pound (GBPUSD=X, GBPEUR=X)

The pound was lower against a stronger dollar, slipping 0.4% to $1.3558, amid a global selloff sparked by Israeli strikes on Iran.

The US dollar index (DX-Y.NYB), which measures the greenback against a basket of six currencies, rose 0.3% to $98.19, bolstered by safe-haven demand.

“Full-scale war in the Middle East moves another step closer,” says Tatha Ghose, an analyst at Commerzbank (CBK.DE). “Until the danger of further escalation has passed, safe assets are likely to remain in demand.”

In other currency moves, the pound was muted against the euro (GBPEUR=X), trading at €1.1744 at the time of writing.

More broadly, the FTSE 100 (^FTSE) was down, losing 0.6% to 8,834 points at the time writing. For more details, check our live coverage here.

Read the full article HERE

The dollar has sunk to its lowest in three years as rapidly changing U.S. trade policy unsettles markets and expectations build for Federal Reserve rate cuts, fuelling outflows from the world’s biggest economy.

With the dollar down almost 10% against a basket of major currencies this year, other countries around the globe are grappling with unanticipated FX moves that are having a knock-on impact on economic growth and inflation.

“There’s clearly solid dollar selling,” said Kit Juckes, chief FX strategist at Societe Generale.

Here’s a look at some of the biggest movers:

1/ CROWN JEWELS

Scandinavia’s currencies are the standout performers against the dollar so far in 2025. The Swedish crown is up 14%, its best performance at this point in the year against the U.S. currency in at least 50 years. Norway’s crown is up nearly 12%, its best run since 2008.

Highlighting just how much of this strength stems from dollar weakness, Sweden’s crown is up only 4% against the euro and Norway’s just 1.8%.

Sweden is expected to cut rates this month as inflation and its economy slow, yet its currency shows no signs of weakening. In Norway, lower oil prices often temper the crown, but that dynamic has also been upended by its relationship with the dollar.

2/ SAFE-HAVEN WOES

The euro, Swiss franc and Japanese yen are also among the biggest beneficiaries of the dollar’s fall from grace, up roughly 10% each so far this year.

But this comes at a price.

Swiss inflation turned negative in May, marking the first decline in consumer prices for more than four years. The surge in the franc reduces the price of imported goods, and piles pressure on the central bank to cut rates back below 0%.

European Central Bank rate setters will also have a wary eye on the single currency, which at around $1.1572 is at its highest since 2021.

“In my heart-of-hearts we are going to get to $1.20 but we shouldn’t get there too fast because it’s deflationary,” said SocGen’s Juckes.

Even after the recent surge, the yen remains down almost 30% from end-2020 levels, leaving Japan to try to balance the negatives of a stronger currency with the need to demonstrate in trade talks with Washington that it is not seeking an unfair advantage from its longer-term weakness.

3/ FACTORY ASIA

For years, Asian investors parked trillions of dollars in U.S. assets such as Treasuries. U.S. President Donald Trump’s April 2 “Liberation Day” fired the starting gun for that capital to start flowing back to the world’s manufacturing powerhouses, boosting their currencies.

Taiwan’s dollar surged 10% over two days in May and is up nearly 12% this year, while the Korean won has gained around 10%.

Singapore’s dollar, Malaysia’s ringgit and Thailand’s baht are all up 6% too, but China’s yuan – arguably the most exposed to tariffs – has only appreciated by about 2% offshore, hemmed in by the central bank’s guardrails around its onshore counterpart.

China wasn’t labelled a manipulator in the U.S. Treasury’s latest currency report, but the lag in the yuan will not have gone unnoticed in Washington.

4/ OUTLIER

Argentina’s peso is an outlier, down around 15% against the dollar and one of this year’s weakest performers.

The reasons are domestic with the introduction of a new exchange rate regime in April allowing the peso to float freely within a gradually expanding band that started between 1,000-1,400 pesos per dollar.

Still, the chaotic crash feared by some has been avoided and a recent $20 billion loan agreement with the IMF is positive.

In contrast, Mexico’s peso, which was under particular pressure at the start of the year from U.S. trade policy, has bounced back to near its strongest levels since August. While it could gain further if tariff spats are resolved, it is also sensitive to the U.S. economic outlook.

5/ STERLING

Softer data has raised the prospect of Bank of England rate cuts and capped sterling’s recent rally to more than three-year highs against the dollar.

The pound is up almost 9% this year and analysts say foreign buyers may be rushing to snap up UK Plc before any further dollar weakness makes future transactions more expensive.

More than $10 billion in bids for British companies were announced on Monday, this year’s busiest day, according to Dealogic data.

Analysts do, however, expect sterling to underperform other major currencies bar the dollar, given fiscal worries and weakening growth.

“Sterling is less appealing than others (currencies) and the macro risks are elevated,” said Lloyds FX strategist Nick Kennedy.

Read the full article HERE.

Record-high purchases and a blistering rally in prices has seen gold overtake the euro as the second-largest asset in the reserves of the world’s central banks.

The share of gold in global foreign reserves at market prices reached 20% at the end of 2024, surpassing the euro at 16%, the European Central Bank said in an annual assessment of the currency’s international standing. The US dollar extended a steady decline to reach 46% of global reserves.

Gold’s dizzying rise — prices have doubled since late 2022 — has been fueled in part by central bank purchases. Sovereign institutions have bought more than 1,000 tons a-year for the past three year, twice as fast as their average pace of purchases prior to 2022. Their holdings are now back at levels last seen in the late 1970s.

“Gold demand for monetary reserves surged sharply in the wake of Russia’s full-scale invasion of Ukraine in 2022 and has remained high,” the ECB wrote in the report.

The freezing of Russia’s foreign exchange reserves held in Group of Seven currencies after its invasion of Ukraine spurred some banks to reduce exposure to the Western financial system, as did the threat of inflation and speculation that the US would treat foreign creditors less favorably.

Gold prices and real yields have historically had a negative correlation, as higher returns tempt investors away from bullion, which doesn’t bear interest. This relationship broke down in 2022, as central banks began to buy the yellow metal as insulation from sanctions risk, in spite of interest rates rising globally, the ECB report added.

“Countries that are geopolitically close to China and Russia have seen more marked increases in the share of gold in their official foreign reserves since the last quarter of 2021,” the ECB economists wrote.

Read the full article HERE.

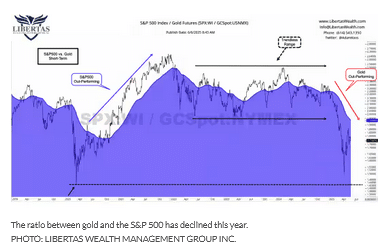

This year’s rise for both the metal and the stock index tells a story of ‘conflicting narratives’

The S&P 500 and gold are both within striking distance of all-time highs — a rare event that leaves investors wondering what exactly is going on.

After all, stocks at all-time highs indicate that investors are optimistic about the future and happy to pile into risky assets. Gold, meanwhile, is often viewed as a safe haven — a port in the storm during periods of uncertainty.

“It’s like watching someone eat salad and dessert at the same time,” said Adam Koos, president and senior financial adviser at Libertas Wealth Management Group. “Investors are trying to be ‘healthy’ but still hedging against what might come later.”

‘It’s like watching someone eat salad and dessert at the same time. Investors are trying to be “healthy” but still bill still hedging against what might come later.’

— Adam Koos, Libertas Wealth Management

It is possible for both the S&P 500 and gold to hit, and hold, record highs at the same time, but “it’s not exactly the norm,” he said. When it does happen, it’s usually “under a specific set of conditions that reflect a combination of optimism and anxiety in the markets.”

This year’s rise for both tells a story of “conflicting narratives,” Koos said. “The stock market is pricing in a soft landing with [artificial-intelligence] fueled earnings growth, while gold is pricing in longer-term structural concerns” such as runaway deficits, a weakening dollar or even central-bank demand from countries hedging U.S. exposure.

Traditionally, the S&P 500

SPX+0.08% and gold

GC00-0.29% are “somewhat inversely correlated,” he said. When they rise together, it often “points to a deeper undercurrent,” such as fear around inflation, a weakening dollar or expectations that the Federal Reserve might start easing interest rates.

Both gold and the S&P 500 have been moving higher so far this year, though the metal has far outpaced the rise for the index.

As of Monday, gold futures were up nearly 27% in the year to date and sitting just 2.1% below the record high set on April 21, according to Dow Jones Market Data. The S&P 500 is up only 2.1% this year but has roared back from the steep selloff that followed President Donald Trump’s unveiling of sweeping tariff measures on April 2. The S&P 500 as of Friday was just about 2.3% below its record finish, scored on Feb. 19.

“The rare positive correlation between gold and the index, which historically tend not to peak together, may have been fueled by dovish Fed expectations and fiscal as well as structural concerns,” said Dina Ting, head of global index portfolio management at Franklin Templeton.

The S&P 500 index and gold futures had reached respective record highs at the same time earlier this year, on Feb. 18, with the index marking a record close at the time of 6,129.58 and gold settling at $2,949.

Tandem move

Equities tend to respond to growth-related factors like earnings and interest rates, while gold prices tend to move on more fear-related factors like inflation expectations or debt levels, said Keith Weiner, chief executive officer of Monetary Metals.

Right now, we seem to be in a period where both sets of forces are “elevated,” he said. Optimism is driving equity markets higher, while underlying fears are supporting record demand for gold” and investors are “positioning for both potential outcomes by continuing to buy stocks for growth and gold for stability.”

To see the precious metal and the index move in tandem is a break from the norm, but it’s not surprising to see, said Harley Kaplan, an independent financial advisor in Plymouth, Mass.

“Investments can be emotion driven and presently, there is a lot of risk in the world,” he said. Gold has always provided security against turmoil, while investors in equities invest for tomorrow — “showing confidence in the future.”

Ratio ‘elevated but not extreme’

Meanwhile, the ratio between gold and S&P 500, which represents how many ounces of the metal are required to buy the index, appears to have rebounded since narrowing and is “elevated but not extreme,” said Franklin Templeton’s Ting.

“That suggests confidence in equities, but not an outright dismissal of gold,” she told MarketWatch. “The significance here is it’s signaling a reversion to more traditional dynamics.”

At roughly 1.76, the ratio currently favors gold, Koos said. It had fallen to around 1.5 back in April, according to a chart provided by Libertas Wealth Management.

When the ratio falls, gold is the relative outperformer, which likely means that investors are “shifting toward safety or bracing for volatility,” he said. When the ratio is moving up, the bulls — and momentum and strength — are in the hands of the S&P 500, he said.

That said, although it’s rare, the index and gold could reach record highs simultaneously again, said Koos.

For that to be sustainable, however, there would likely need to be a combination of falling real interest rates or dovish Fed policy, ongoing demand for hard assets — such as central banks buying gold — continued belief in long-term growth that would support equities and “enough macro uncertainty to keep fear trades alive,” he said.

“It’s a fragile dance,” Koos said, likening such a situation to watching “someone balancing two spinning plates.” It’s possible for a while, he said, but it “takes constant motion and the right conditions to keep both from falling.”