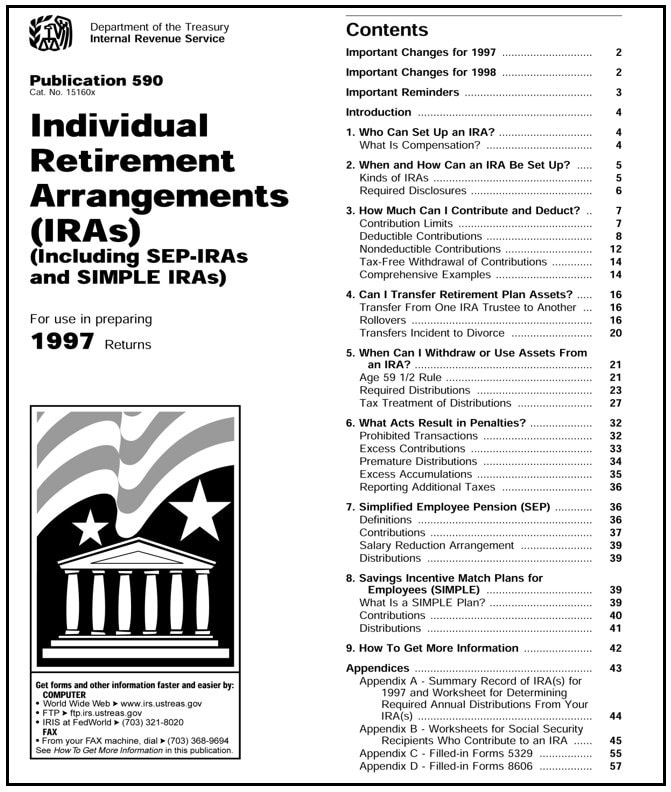

Diversifying with precious metals via an Individual Retirement Account wasn’t always an option in America. When the IRA was established back in 1974 by virtue of the Employee Retirement Income Security Act (ERISA), precious metals were not allowed. But in 1997, Congress passed the Taxpayer Relief Act which changed the rules of self-directed IRAs and in Title III: Savings and Investment Incentives, Section 304, it states: “Permits the investment of IRA assets in certain bullion.”1

The legislation specifically permits self-directed IRAs to hold certain precious metals including gold, silver, platinum, and palladium classified as investments as opposed to collectibles. The distinction between “investments” and “collectibles” is particularly important and constitutes an exception to existing Tax Code.

The accounting firm PKF Mueller describes the exception as follows:

“As a general rule, an IRA investment in any metal or coin counts as the acquisition of a collectible item … In effect, this general rule prohibits IRAs from investing in precious metals or coins made from precious metals. However, the Tax Code supplies an important statutory exception: IRAs can invest in 1) certain gold, silver, and platinum coins and 2) gold, silver, platinum, and palladium bullion that meets applicable purity standards. However, the coins or bullion must be held by the IRA trustee or custodian rather than by the IRA owner. These rules apply equally to traditional IRAs, Roth IRAs, SEP accounts and SIMPLE-IRAs.”2

So, what are the “purity standards” and “certain” coins that constitute the statuary exceptions referenced above? To be eligible for investment in an IRA — gold, platinum, and palladium must be 99.5% pure and silver must be 99.9% pure meaning that only the remaining .5% and .1% can be an alloy (or a combination of other metals).

Online financial educator LendEDU outlines the other minimum fineness requirements as follows3:

Coins:

- Proof coins must be encapsulated, in mint condition, and require a certificate of authenticity.

- Non-proof coins must be brilliant and uncirculated.

Bars and Rounds:

- Must be produced by an accredited/certified source or a national government mint and meet fineness requirements.

- Small bullion bars must be manufactured to exact weight specifications.

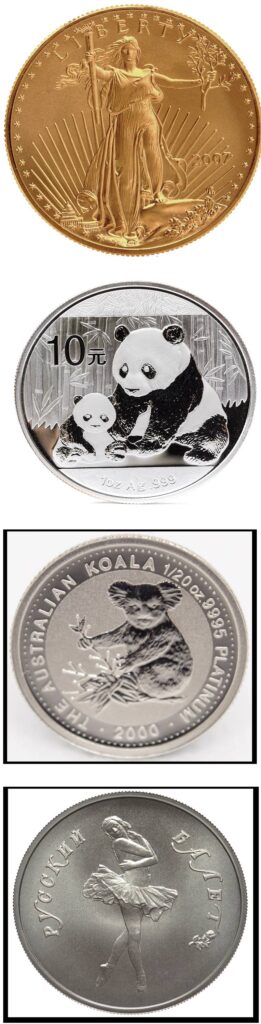

Here are some popular IRA-approved precious metals:

GOLD

- American Eagle Bullion and Proof Coins

- Canadian Maple Leaf Coins

- Chinese Panda Coins

- Credit Suisse Pamp Bars

- Austrian Philharmonic Bullion Coins

SILVER

- American Eagle Bullion and Proof Coins

- Canadian Maple Leaf Coins

- Chinese Panda Coins

- Australian Kookaburra Coins

- Mexican Libertad Bullion Coins

PLATINUM

- American Eagle Bullion and Proof Coins

- Australian Koala Bullion Coins

- Canadian Maple Leaf Coins

- Isle of Man Noble Bullion Coins

PALLADIUM

- American Eagle Bullion and Proof Coins

- Canadian Maple Leaf Coins

- Russian Ballerina Coins

- 1 ounce Palladium Bar

Three, Key Benefits of holding Gold and other Approved Metals in an IRA

Diversification – When held as part of a self-directed Individual Retirement Account, precious metals can help reduce portfolio volatility since they tend to be negatively correlated to paper assets like stocks and bonds. Negative correction means that precious metals tend to either increase in value or maintain their value when weakness or volatility strikes Wall Street, the bond market, and the U.S. dollar.

Tax Deferred Growth – Precious metals placed in a pre-tax IRA enjoy the same tax benefits as a standard IRA, meaning contributions are often tax deductible (in the year they are made) effectively reducing taxable income. In addition, precious metals IRAs appreciate tax deferred until the time of withdrawal. In the case of a qualified Roth Precious Metals IRA, gains are tax-free.

Store of Value – Gold has long been considered a store of value meaning it retains its value over the long term. Traditional assets held in an IRA tend to rise and fall over time, sometimes quite dramatically. Gold, however, has intrinsic value due to its rarity, supply and demand factors, its acquisition by central banks, and its longstanding historical significance.

At a recent US News Investment Experts Roundtable, financial consultant Julie Pinkerton, (CLU, ChFC, LUTCF), stated the following about gold’s appeal in particular:

“Many gold enthusiasts still remember the 1970s, a trifecta of recession, double-digit inflation and soaring oil prices. Long lines at the gas station are etched into their memories. As an investment, gold performs best when conditions are at their worst. Now, it’s easy to pick up any newspaper, watch any TV or hear one’s tech device chime with another notification of current turmoil – multiple global wars and instability, persistently elevated inflation, social unrest on college campuses and political upheaval in a contentious election year. For many, physical gold can be comforting. They can see it, touch it and have a general idea of how it will behave as an investment in these circumstances.” 4

Suffice to say whether you decide to put American Eagle gold bullion coins or pure palladium bars into a precious metals IRA, doing so will help reduce your portfolio risk, protect your retirement dollars, hedge against inflationary forces, and add a critical layer of safety to your accumulated wealth.

- https://www.congress.gov/bill/105th-congress/house-bill/2014 ↩︎

- https://www.pkfmueller.com/newsletters/tax-implications-of-holding-precious-metal-assets-in-your-ira ↩︎

- https://lendedu.com/blog/what-does-ira-eligible-gold-mean ↩︎

- https://money.usnews.com/investing/articles/is-gold-a-good-investment ↩︎